Imagine a world where you can bet on the future price of an asset, with the potential to reap significant rewards or potentially lose everything. This is the fascinating world of options and futures trading.

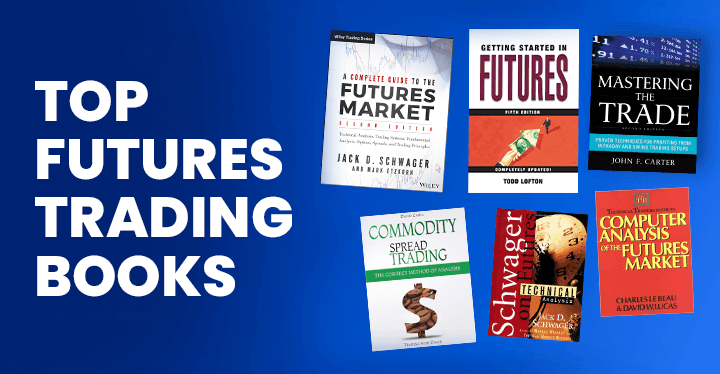

Image: howtotrade.com

The financial markets offer a plethora of instruments to speculate on the price movements of underlying assets. Options and futures are two such powerful tools that enable traders to express their views and manage risks.

What is Option Trading?

Definition:

Options are contracts that give the buyer the right but not the obligation to buy or sell an underlying asset at a specified price on or before a certain date. This flexibility allows traders to speculate on the future direction of the asset’s price without committing to an immediate transaction.

Meaning:

Options provide a two-fold advantage for traders. They offer the potential for substantial profit if the underlying asset price moves in the anticipated direction, while also limiting the risk to the premium paid for the option.

Image: brokerchooser.com

What is Future Trading?

Definition:

Futures are standardized contracts that obligate the buyer to buy or the seller to sell a specific quantity and quality of an underlying asset at a predetermined price on a specified date. Unlike options, futures carry a legal obligation to fulfill the contract.

Meaning:

Futures provide a way for traders to lock in a price for future delivery of an asset. This can be advantageous for producers and consumers seeking to mitigate price risk, as well as speculators seeking to capitalize on price fluctuations.

Latest Trends and Developments

The options and futures markets are constantly evolving. Recent advancements include:

- Increased availability of exchange-traded funds (ETFs) and options on ETFs, expanding trading opportunities.

- Growing popularity of binary options, which offer a simplified form of option trading with a fixed payout structure.

- Technological advancements in trading platforms, providing faster execution and sophisticated analytical tools.

Tips and Expert Advice

To enhance your option and future trading, consider these tips:

- Understand the risks: Options and futures trading involve substantial risks. Ensure you fully comprehend the potential losses before participating.

- Set realistic expectations: While these markets offer the potential for high returns, it’s essential to approach them with realistic expectations and a clear trading plan.

- Manage your risk: Spread your trades across multiple assets and employ proper risk management techniques, such as stop-loss orders and position sizing.

- Continuously educate yourself: The markets are constantly changing, so stay up-to-date on market trends and trading strategies.

FAQs

- Q: What is the difference between a call option and a put option?

A: A call option gives the buyer the right to buy the underlying asset, while a put option gives the right to sell.

- Q: What is futures expiration?

A: Futures contracts have a fixed expiration date, after which they are settled by delivery or cash.

- Q: Is options trading suitable for beginners?

A: While options offer potential opportunities, they also come with higher risks. Beginners should consider thoroughly educating themselves before trading.

- Q: What are the benefits of futures trading?

A: Futures provide price locking capabilities, allow for flexible trading strategies, and offer opportunities for both speculation and hedging.

What Is Option And Future Trading

Image: www.5paisa.com

Conclusion

The world of options and future trading is captivating and complex. With proper education, risk management, and a clear understanding of the markets, traders can harness these powerful tools to pursue their financial goals. Nevertheless, it is imperative to approach these markets with caution and a realistic mindset.

Are you ready to explore the exciting and challenging realm of options and futures trading? Seize the opportunity to expand your investment horizons and potentially reap the rewards of financial success.