Image: www.adigitalblogger.com

Introduction:

In the ever-changing landscape of financial markets, uncovering strategies that can augment income and mitigate risk is paramount. Enter covered call options trading – a strategy that allows savvy investors to potentially harness the power of both stock appreciation and options premiums. Join us as we embark on an educational journey to unlock the secrets of this versatile strategy.

Demystifying Covered Call Options:

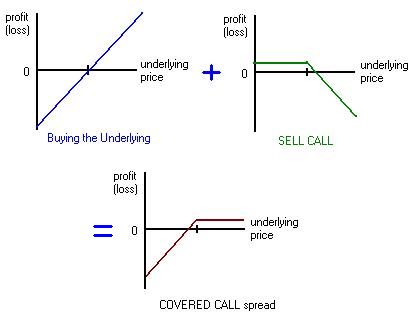

Covered call options trading involves selling (or writing) a covered call option against a stock you own. This call option grants the buyer the right, but not the obligation, to buy the stock from you at a predetermined price (strike price) on or before a specific date (expiration date). In return for selling this option, you receive a premium, providing an immediate cash inflow.

Mechanics of Covered Call Options Trading:

- Determine the Underlying Stock: Select a stock that exhibits solid fundamentals, aligns with your investment strategy, and has ample liquidity.

- Select the Strike Price: The strike price should be higher than the current stock price, allowing for potential appreciation while still limiting downside risk.

- Choose the Expiration Date: The expiration date should align with your investment horizon and market expectations regarding stock price movements.

- Manage the Position: Monitor the stock price and the option premium closely. Adjust your strategy as needed based on market fluctuations and your risk tolerance.

Understanding the Risks and Rewards:

Covered call options trading, like any investment strategy, carries both risks and rewards.

Risks:

- Limited Upside Potential: The sold call option caps your potential profit on stock appreciation at the strike price.

- Potential Loss on Assignment: If the stock price rises above the strike price at expiration, you may be obligated to sell your shares at a price lower than their current market value.

Rewards:

- Immediate Income Generation: The premium received upon selling the call option provides an immediate cash inflow.

- Reduced Downside Risk: Covered call options trading effectively lowers your downside risk compared to holding only the underlying stock.

- Enhanced Yield: Combining stock appreciation and option premiums can potentially enhance the overall yield on your investment portfolio.

Expert Insights and Actionable Tips:

- Warren Buffett: “It is far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” This principle applies equally to selecting underlying stocks for covered call options trading.

- Monitor Underlying Stock Performance: Keep a close eye on the stock price and adjust the strike price or expiration date as needed based on market conditions.

- Be Patient and Disciplined: Covered call options trading requires patience and discipline. Avoid chasing short-term profits and instead focus on a long-term, risk-managed approach.

Conclusion:

Covered call options trading strategy empowers investors with the potential to increase their income, reduce risk, and enhance their overall investment portfolio performance. By embracing this strategy and adhering to the principles outlined in this guide, you can unlock a world of financial opportunities and become an empowered trader. Remember, education and vigilance are the keystones to success in any financial endeavor.

Image: urisofod.web.fc2.com

Covered Call Options Trading Strategy

Image: ylugudivalul.web.fc2.com