An Introduction to CDX Options Trading

In the realm of finance, understanding complex financial instruments like Credit Default Swaps (CDSs) is crucial for investors seeking high-yield returns. CDSs, akin to insurance contracts, serve as a protective shield against the risk of default by a reference entity, typically a company or sovereign nation. Enter CDX options trading, a sophisticated strategy that allows investors to speculate on the future direction of CDS spreads. This article delves into the intricacies of CDX options trading, providing a comprehensive overview for beginner investors.

Image: medium.com

What Are CDX Options?

CDX options are financial derivatives that convey the right, but not the obligation, to buy or sell Credit Default Swap (CDS) contracts at a predetermined price on a future date. These options provide investors with the flexibility to bet on the movement of CDS spreads, either anticipating a widening (increase) or narrowing (decrease) in the spread.

How Does CDX Options Trading Work?

Trading CDX options involves two primary strategies: buying and selling. By buying a call option, an investor acquires the right to purchase a CDS contract at a specific price in the future. If the CDS spread widens, the call option gains value, allowing the investor to profit from the increase. Conversely, an investor who sells a call option is obligated to deliver a CDS contract if the spread widens and the call option is exercised by the buyer.

Understanding the Benefits and Risks of CDX Options Trading

CDX options trading offers investors potential rewards, including leverage (amplified returns), diversification, and the ability to hedge against credit risk. However, it also carries substantial risks that must be carefully considered, such as the complexity of the underlying CDS contracts, market volatility, and the potential for loss exceeding the investor’s initial investment.

Image: www.researchgate.net

Tips and Expert Advice for CDX Options Traders

Navigating the complex terrain of CDX options trading requires a well-rounded understanding and strategic execution. Here are some tips and expert advice to guide beginner investors:

-

Thoroughly educate yourself about CDSs and CDX options before trading.

-

Only allocate capital that you are prepared to lose.

-

Monitor market news and CDS spread movements closely.

-

Consult with financial professionals for personalized advice and risk management strategies.

-

Consider trading through reputable and experienced brokers.

Frequently Asked Questions (FAQs) on CDX Options Trading

Q1. What is the underlying asset in CDX options trading?

A1. CDS contracts.

Q2. What is the difference between a call option and a put option?

A2. A call option conveys the right to buy, while a put option conveys the right to sell CDS contracts.

Q3. How do I determine the profitability of a CDX options trade?

A3. By comparing the option premium (price paid for the option) to the change in CDS spread.

Q4. Are CDX options suitable for all investors?

A4. No, they are recommended for experienced investors who understand the risks involved.

Cdx Options Trading

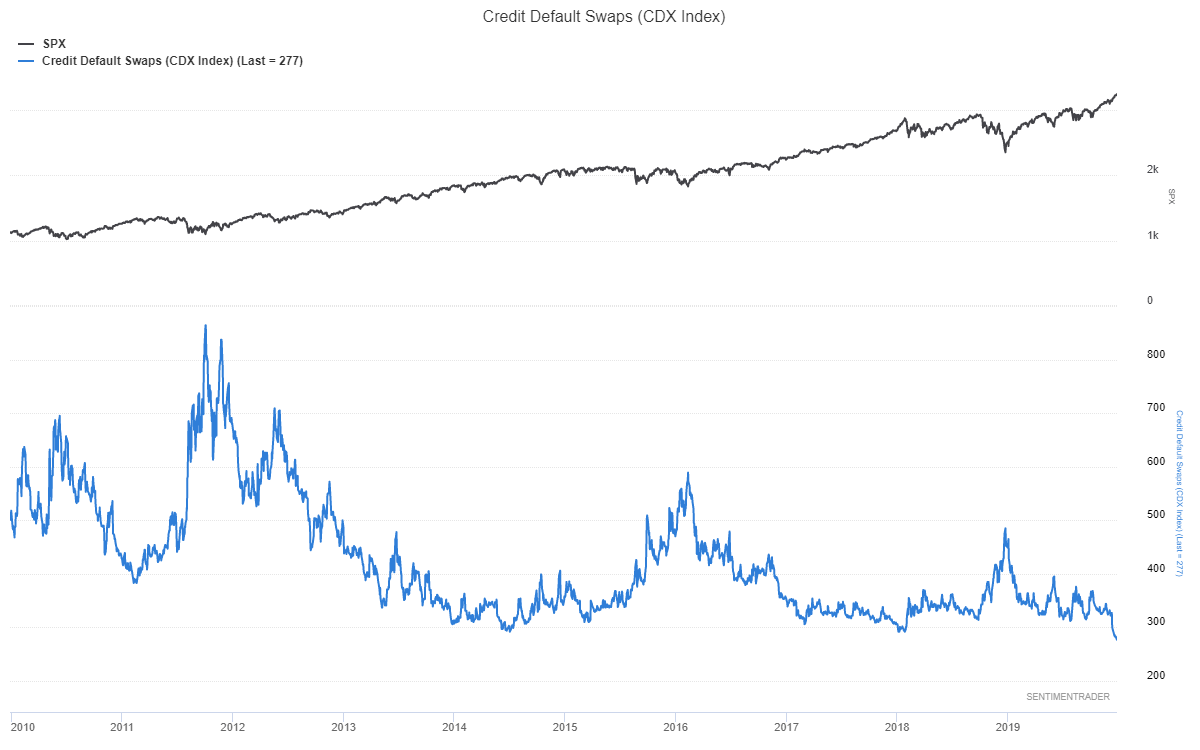

Image: seekingalpha.com

Conclusion

CDX options trading presents both potential rewards and risks for investors. By understanding the mechanics, strategies, and associated risks, beginners can navigate this complex financial landscape with greater clarity and confidence. Remember, knowledge is the key to successful investing.

Thank you for reading. If you found this article informative, please share it and let us know your thoughts in the comments below. We would love to hear if you are interested in learning more about CDX options trading or related topics.