Introduction

In the labyrinthine world of financial markets, the term “options” often elicits a sense of mystery and intrigue. Amidst this realm of complex instruments lies a lesser-known gem: botattrelli trading options. These options, named after the enigmatic figure who pioneered them, offer a unique and potentially lucrative approach to profiting from market movements.

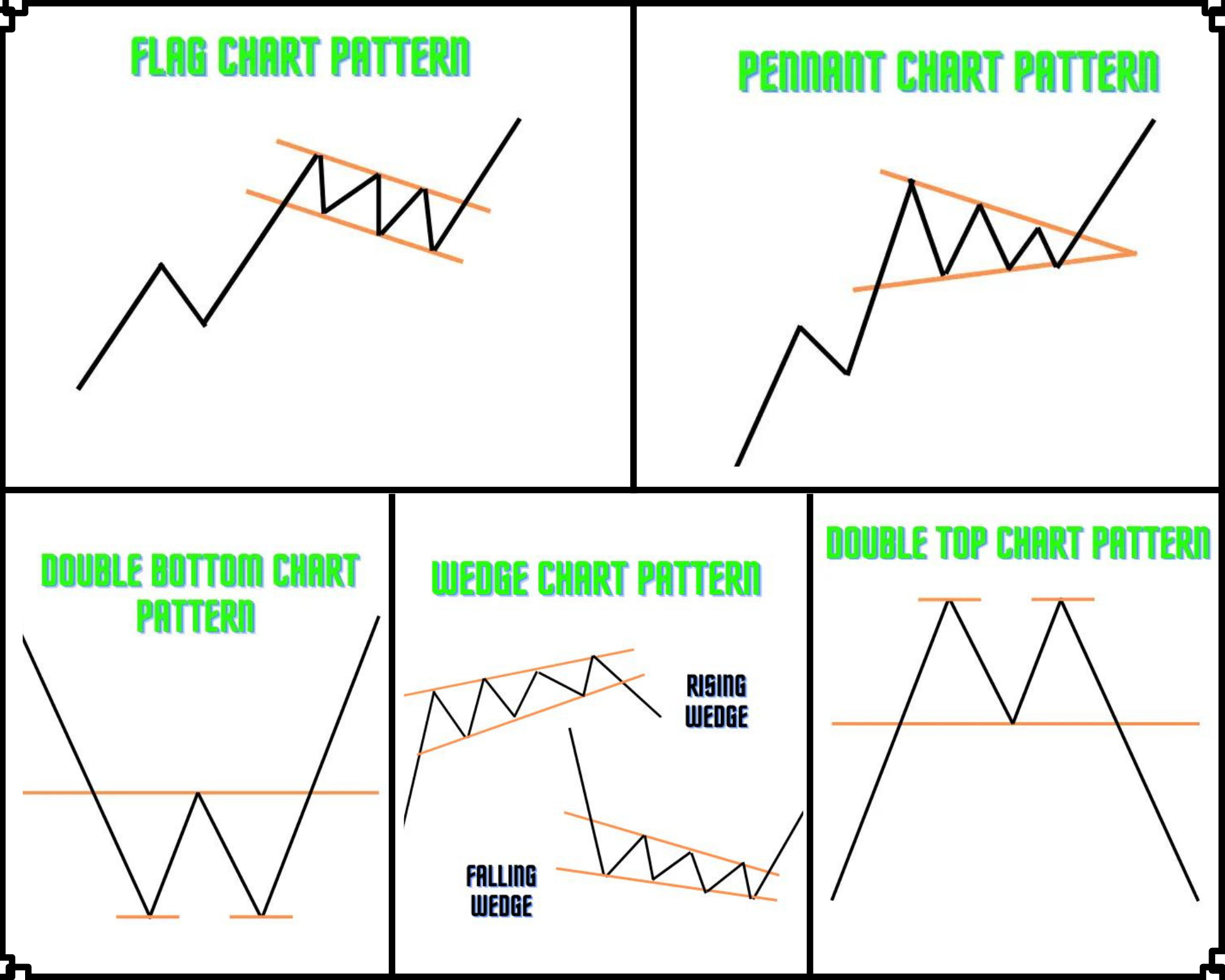

Image: bullsarenatrading.com

Botattrelli trading options, also known as capped call options, are a type of financial contract that grants the holder the right, but not the obligation, to sell a specific asset at a predetermined price within a specified timeframe. Unlike conventional call options, which have unlimited profit potential, botattrelli options come with a built-in “cap” on the maximum profit that can be realized.

Understanding the Basics

The mechanics of botattrelli trading options are relatively straightforward. When purchasing a botattrelli option, the buyer pays a premium to the seller in exchange for the right to sell the underlying asset at the strike price. If the market price of the asset rises above the strike price prior to the option’s expiration date, the buyer can exercise their right to sell it at that price, pocketing the difference as a profit.

The key distinction of botattrelli options lies in their capped nature. If the market price of the underlying asset skyrockets, the holder of the botattrelli option will still only realize the maximum profit outlined in the contract. This feature provides downside protection against extreme market volatility, making botattrelli options a more conservative alternative to conventional call options.

Applications and Use Cases

Botattrelli trading options are versatile instruments that can be used in a variety of market environments and trading strategies. They are particularly well-suited for investors seeking to generate income while mitigating risk.

- Income generation: Botattrelli options can provide a steady stream of income by repeatedly selling them at a premium. The premium received can be retained as profit, regardless of whether the underlying asset’s price fluctuates.

- Conservative trading: As mentioned earlier, the capped nature of botattrelli options makes them a more conservative investment compared to conventional call options. Investors who are apprehensive about excessive market volatility may prefer the limited downside risk associated with these instruments.

- Hedging: Botattrelli trading options can be used to hedge against the risk of an underlying asset’s price declining. By selling a botattrelli option, an investor can effectively create a synthetic put option, ensuring that they can still profit if the asset’s price falls.

Market Trends and Advancements

Over the past decade, the botattrelli trading options market has witnessed several notable trends and advancements:

- Increased liquidity: The market for botattrelli options has become increasingly liquid in recent years, making it easier for investors to buy and sell these instruments at competitive prices.

- New product offerings: Financial institutions have introduced various new botattrelli trading options products, including fixed-expiration and inter-commodity options. This has expanded the range of opportunities available to investors.

- Technology advancements: Trading platforms and analytical tools have evolved to facilitate the analysis and execution of botattrelli trading options strategies. Automated execution capabilities and real-time market data have further enhanced the efficiency of these instruments.

Image: erainnovator.com

Botattrelli Trading Options

Image: www.pinterest.com

Conclusion

Botattrelli trading options are a powerful and versatile tool for investors seeking to navigate the often-unpredictable financial markets. Their unique capped nature provides a balance between profit potential and risk management, making them a suitable choice for both experienced traders and those new to options trading.

The market for botattrelli options is constantly evolving, with new trends and advancements emerging. By staying informed about these developments and conducting thorough research into the underlying assets, investors can harness the full potential of these instruments to build a more resilient and profitable portfolio. Exploring reputable resources and seeking the guidance of financial professionals can further enhance your understanding and trading success.