Are you new to the world of financial trading and curious about options? Amidst the labyrinth of investment opportunities, option web trading stands as a powerful tool that can help you explore the financial realm. With its immense flexibility and potential for exponential returns, options have become an essential element in the arsenal of many seasoned investors. But before you dive headfirst into this exciting arena, it’s crucial to equip yourself with the necessary knowledge to navigate its complexities.

Image: aapleincome.blogspot.com

In this comprehensive guide, we will embark on an enlightening journey into the world of option web trading. We’ll demystify the basics, delve into the intricacies of various trading strategies, and equip you with the insights and tools needed to make informed decisions in the financial markets. Along the way, we’ll draw upon the wisdom of industry experts, unravel real-life examples, and provide practical guidance to help you maximize your trading potential. Get ready to unlock the transformative power of options and empower yourself as a confident and successful trader.

Unveiling the Essence of Options Trading: What Are Options Contracts?

To grasp the fundamentals of option web trading, it’s imperative to understand the nature of an options contract. Essentially, an option contract grants the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame. This unique characteristic distinguishes options from conventional stocks or bonds, where ownership and the associated obligations are inseparable.

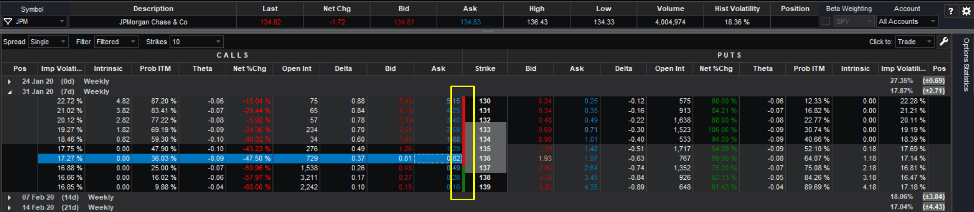

Options contracts come in two primary forms: calls and puts. Call options confer upon the holder the right to purchase the underlying asset, while put options provide the right to sell it. This distinction empowers traders with immense versatility, allowing them to tailor their trading strategies to suit their market outlook and risk tolerance. Whether you anticipate rising or falling prices, options provide a flexible framework to capitalize on market movements while mitigating potential losses.

Navigating the Option Market: Calls vs. Puts and Understanding Option Terminology

Now that we’ve established the foundational concepts, let’s delve deeper into the intricacies of call and put options and unravel the terminology associated with option web trading.

Call Options:

-

Call options are bullish instruments, meaning they convey the right to purchase the underlying asset.

-

When an investor purchases a call option, they are effectively betting on the price of the underlying asset to increase.

-

If the asset price rises above the strike price (the predetermined price at which the option can be exercised), the call option holder can exercise their right to purchase the asset at a favorable price, potentially profiting from the price appreciation.

Put Options:

-

Put options, on the other hand, are bearish instruments, granting the right to sell the underlying asset.

-

Investors who purchase put options anticipate a decline in the underlying asset’s price.

-

If the asset price falls below the strike price, the put option holder can exercise their right to sell the asset at a higher price than its current market value, potentially profiting from the price depreciation.

Option Terminology:

-

Strike Price: This is the predetermined price at which the option can be exercised.

-

Expiration Date: This is the date on which the option contract expires, rendering it worthless if unexercised.

-

Premium: This is the price paid upfront to acquire an option contract.

Image: programminginsider.com

Option Web Trading

Image: www.tradestation.io

Key Considerations When Engaging in Option Web Trading: Evaluating Risks and Rewards

Like any form of investment, option web trading carries both risks and rewards. Understanding these risks and aligning your trading strategies with your risk tolerance is paramount to successful and sustainable trading.

Potential Rewards:

-

Leverage: Options offer the potential for significant returns even with a relatively small initial investment. This leverage can amplify your profit potential.

-

Flexibility: Options provide a versatile trading instrument that can adapt to changing market conditions and accommodate a wide range of trading strategies.

Potential Risks:

-

Time Decay: The value of an option contract decays over time, which means that even if the underlying asset moves in your favor, you could still lose money if you hold the option too long.

-

Unlimited Loss Potential: Unlike traditional stock investments, where your losses are limited to the amount invested, the potential losses in option trading can be substantial, especially for certain strategies involving selling options.

-

Complexity: Options trading involves a higher level of complexity compared to other investment vehicles. It’s essential to thoroughly understand the intricacies of options before engaging in active trading.