Introduction

In the labyrinthine world of finance, where stocks, bonds, and currencies dance in intricate patterns, there lies a captivating realm known as options trading. Options trading, like a skilled surgeon’s scalpel, offers investors and traders an unparalleled level of precision and flexibility in managing their financial destinies. But what are options, and how do they wield such transformative power in the stock market? In this comprehensive guide, we embark on a journey into the enigmatic realm of options trading, exploring its foundations, applications, and the potential rewards and risks that come with it.

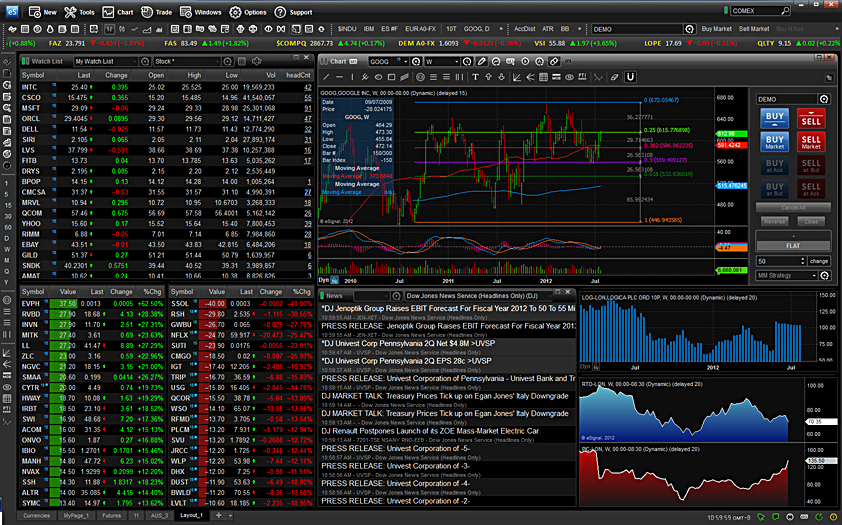

Image: www.pinterest.fr

Options, in their simplest form, are financial contracts that bestow upon the holder a specific right, but not an obligation, to either buy (call option) or sell (put option) an underlying asset, such as a stock, at a predetermined price (strike price) within a set period (expiration date). This unique characteristic grants options traders the ability to speculate on the future price movements of underlying assets, hedge against potential losses, or create tailored investment strategies that align with their unique financial goals.

Understanding the Basic Concepts

At the heart of options trading lies a fundamental concept known as the premium. When an investor purchases an option, they pay a premium to acquire this contractual right, which represents the price paid for the option’s potential benefits. The premium’s value fluctuates based on various factors, including the underlying asset’s volatility, the time remaining until expiration, and the strike price’s relationship to the current market price.

Once an option is purchased, the holder has a designated expiration date by which they must decide whether to exercise their right to buy or sell the underlying asset at the strike price. If the option is in-the-money, meaning the strike price is favorable compared to the current market price, the holder can exercise the option and potentially reap profits. However, if the option is out-of-the-money, meaning the strike price is less favorable, the option expires worthless and the premium paid is lost.

Call Options: A Speculator’s Weapon

Call options empower traders with the right to purchase an underlying asset at a specific strike price on or before the expiration date. These options are often employed by investors who believe the underlying asset’s price will rise above the strike price, allowing them to purchase the asset at a discounted rate. If the market sentiment sways in their favor, call options offer the potential for substantial gains. However, it’s important to remember that these gains are capped at the difference between the market price and the strike price, minus the premium paid.

Put Options: A Defensive Shield

In contrast to call options, put options provide the holder with the right to sell an underlying asset at a specified strike price before the expiration date. These options are favored by investors seeking to protect themselves against potential declines in the asset’s price. By purchasing a put option, an investor effectively sets a minimum selling price for the underlying asset, ensuring a degree of financial security in case the market turns sour. If the market indeed falls, the put option’s value increases, potentially offsetting losses incurred on the actual asset. However, if the market remains stable or rises, put options lose value and the premium paid is forfeited.

Image: niyudideh.web.fc2.com

Risking It All for a Calculated Gain

Options trading inherently carries significant risk, making it imperative for traders to tread carefully. While the potential rewards can be tempting, it’s essential to approach options trading with a clear understanding of the risks involved. Unlike traditional stock trading, where losses are limited to the initial investment made, options trading can result in the loss of not only the premium paid but also additional capital. The speculative nature of options trading demands a comprehensive trading strategy, effective risk management techniques, and a tolerance for potential setbacks.

What Is Options Trading In Stock Market

Conclusion

Options trading offers a versatile and potent tool for investors and traders seeking to navigate the complexities of the stock market. By grasping the nuances of options, such as their unique features and risk-reward dynamics, individuals can leverage these financial instruments to enhance their investment strategies, bolster their portfolios against market volatility, and unlock new avenues for financial growth. However, it’s crucial to remember that options trading is not a guaranteed path to riches and that successful participation requires a thorough understanding of financial markets, a disciplined approach, and a healthy dose of caution.