In the dynamic world of finance, options trading has emerged as a sophisticated tool that empowers investors to navigate market risks and seize opportunities. As a bustling platform connecting investors with the financial realm, Robinhood has become a top choice for those seeking to venture into options trading. In this article, we’ll embark on a comprehensive journey into the intricacies of enabling options trading on Robinhood, empowering you to unlock the potential of this financial instrument.

Image: www.youtube.com

Navigating Robinhood’s Options Activation Process

To activate options trading on Robinhood, you’ll need to navigate a straightforward process that ensures you meet certain eligibility criteria. This entails:

- Account Age: Your Robinhood account must be at least six months old.

- Investing Experience: You’ll need to demonstrate a minimum level of investing experience by passing a series of knowledge-based questions.

- Risk Tolerance: Understanding your risk tolerance is crucial, as options trading involves significant potential risks. You’ll need to complete a questionnaire to assess your risk tolerance profile.

- Trading Experience: If you possess a brokerage account where you’ve actively traded options, you may be able to qualify for options trading on Robinhood more quickly.

Delving into the World of Options Trading

Options trading is a unique financial instrument that offers a wide spectrum of opportunities and risks. Understanding the basics is paramount:

Definition and Meaning

An option is a contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified date. Options come in two main flavors: calls and puts.

- Call Option: Grants the buyer the right to buy an underlying asset at a strike price on or before the expiration date.

- Put Option: Grants the buyer the right to sell an underlying asset at a strike price on or before the expiration date.

Image: www.youtube.com

Key Features and Concepts

To fully grasp options trading, several key concepts come into play:

- Strike Price: The predetermined price at which the buyer can buy or sell the underlying asset.

- Expiration Date: The specified date by which the option contract expires and becomes worthless.

- Premium: The price the buyer pays to acquire the option contract.

- Intrinsic Value: The difference between the strike price and the current market price of the underlying asset.

- Time Value: The value of the option that decays over time as the expiration date approaches.

Latest Trends and Developments in Options Trading

The world of options trading is constantly evolving, with emerging trends and developments shaping the landscape:

- Increased Retail Participation: Online platforms like Robinhood have democratized options trading, making it accessible to a wider range of investors.

- Technology Advancements: AI-powered trading algorithms are optimizing options strategies, enhancing execution efficiency.

- Regulatory Changes: Regulatory bodies are actively monitoring options trading activities to protect investors and ensure market integrity.

Tips and Expert Advice for Novice Options Traders

踏入 options trading 的世界,掌握一些专业建议至关重要:

- Start Small: Begin with modest trades and gradually increase your position sizes as you gain experience.

- Understand Risk: Fully grasp the risks associated with options trading before committing any funds.

- Define Your Objectives: Clearly outline your goals and stick to a trading plan.

- Seek Continuous Education: Stay updated on market trends and enhance your knowledge through webinars, books, and online resources.

- Test Strategies: Utilize paper trading or demo accounts to refine your strategies without risking real capital.

Frequently Asked Questions about Options Trading

To clarify common queries, let’s address some frequently asked questions:

- Can I lose more than I invest in options trading? Yes, options trading carries significant risk, and losses can exceed the initial investment.

- What types of assets can I trade options on? Options can be traded on a wide array of underlying assets, including stocks, indices, and commodities.

- How do I determine which options strategy to use? The choice of strategy depends on your trading objectives, risk tolerance, and market conditions.

- What are some additional risks to consider in options trading? Market volatility, liquidity risks, and margin requirements are all factors to be taken into account.

- Is options trading suitable for all investors? No, options trading may not be appropriate for all investors due to its inherent risks.

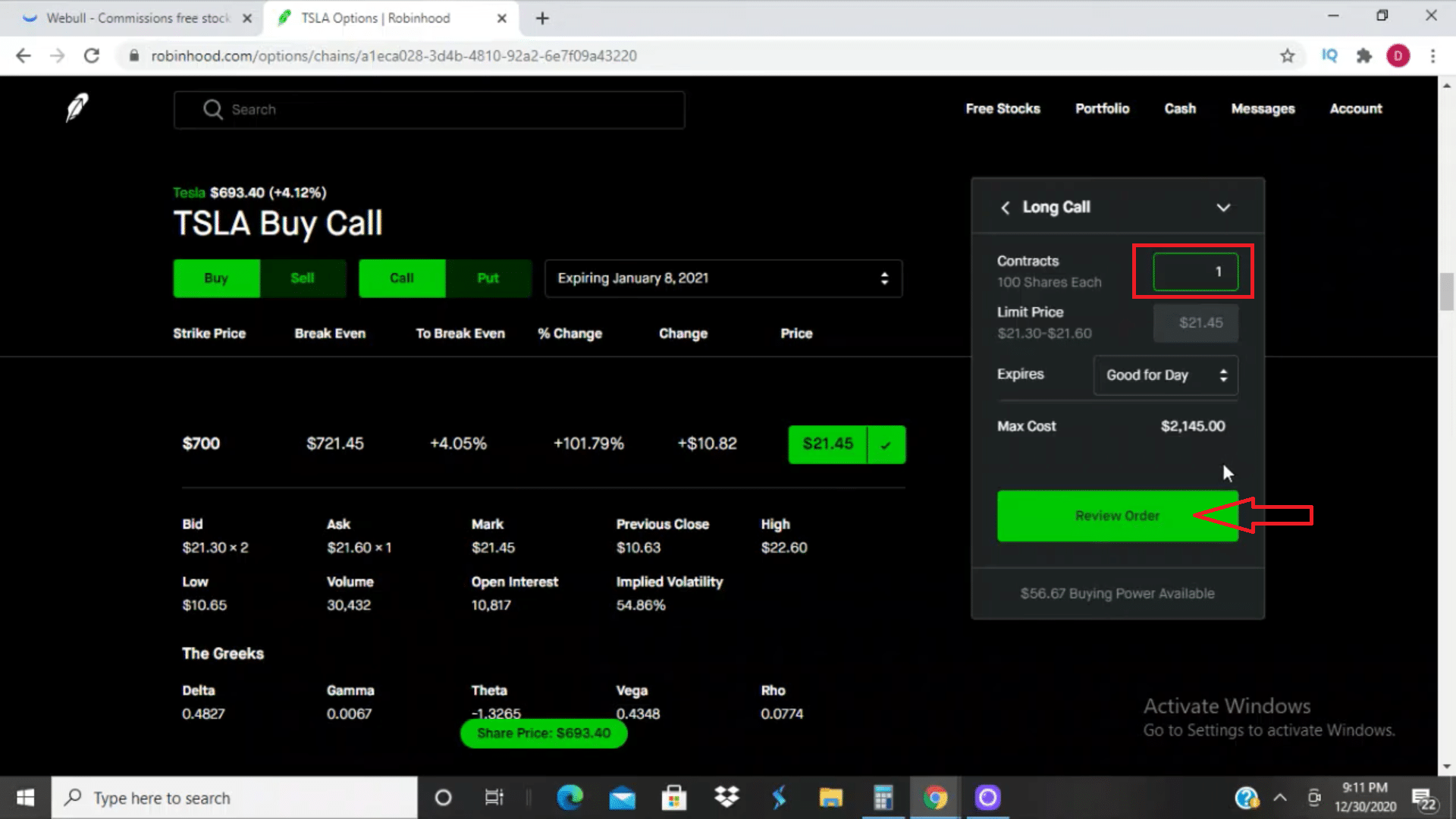

Turning On Options Trading Robinhood

Image: marketxls.com

Conclusion

Options trading on Robinhood offers a powerful tool for experienced investors to navigate market risks and capture potential opportunities. By meeting eligibility criteria, understanding the complexities, and heeding expert advice, you can harness the potential of options trading. Remember, education and risk management are crucial in this realm.

Are you eager to delve deeper into the world of options trading? Share your thoughts and questions, and let’s continue the exploration.