In the realm of option trading, where time and decay dance in harmony, the elusive Theta holds the key to unlocking hidden opportunities. As an experienced trader, I’ve witnessed firsthand the transformative power of Theta, transforming paper losses into substantial gains.

Image: luckboxmagazine.com

Before we delve into the depths of Theta, let’s set the stage with a captivating anecdote. Imagine a seasoned trader meticulously selecting an option contract with the unwavering belief that it possessed an exceptional Theta. Days turned into weeks, and still, the contract languished, its value eroding with the relentless passage of time. It was a lesson that left an enduring mark: not all Theta is created equal, and discerning the true hidden gems requires a discerning eye.

Defining Theta

Understanding Theta Decay

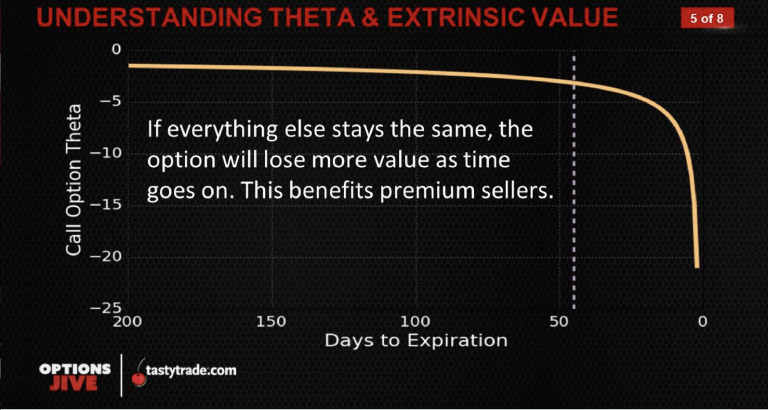

Theta measures the sensitivity of an option’s price to the passage of time. As time ticks away, the value of an option will steadily decline, a phenomenon known as Theta decay. This is particularly true for short-term options, which lose value at an accelerated pace as their expiration dates draw near.

Identifying Best Theta: A Comprehensive Strategy

Image: blog.naver.com

Analyzing Implied Volatility

Implied volatility (IV) represents the market’s expectations for future price fluctuations of an underlying asset. Options with higher IV will generally experience greater Theta decay, as elevated volatility is often associated with uncertainty and a higher probability of significant price movements. By scrutinizing IV, traders can select options with moderate or low IV to mitigate excessive Theta loss.

Determining Time-to-Expiration

Time-to-expiration is a crucial factor in Theta decay. Options with longer time-to-expiration experience slower Theta decay compared to their short-term counterparts. This is because there is more time for price fluctuations to occur, potentially offsetting the impact of Theta loss.

Assessing Price Changes

Rapid price movements in the underlying asset can exacerbate Theta decay. When the underlying asset moves significantly against the option’s position (e.g., a rise for call options and a decline for put options), Theta decay accelerates. Traders can mitigate this risk by choosing options with a well-defined strike price that aligns with their market outlook.

Consider Delta Neutral Strategies

Delta-neutral strategies involve simultaneously buying and selling options with different strike prices but equal and opposite Delta values. This can partially offset Theta decay, as gains in one option are typically offset by losses in the other. While Delta-neutral strategies can reduce Theta impact, they require sophisticated trading knowledge and constant monitoring.

Expert Insights and Proven Tips

Recognizing Volatility Contraction

Savvy traders can capitalize on periods of volatility contraction. When IV subsides, Theta decay slows down, creating opportunities for profit. By monitoring IV trends, traders can identify optimal entry and exit points to maximize Theta gains.

Trading Long-Dated Options

Long-dated options with extended time-to-expiration typically experience less Theta decay. This allows traders to hold positions longer while letting time work in their favor. However, it’s important to judiciously select strike prices and understand potential risks associated with holding options for extended periods.

Frequently Asked Questions

Q: When is Theta decay most significant?

Theta decay is most pronounced in the final weeks leading up to expiration, especially for short-term options.

Q: Can Theta be used to generate profits?

Yes, traders can capitalize on Theta decay by selling options with higher IV or shorter time-to-expiration. However, it’s crucial to manage risk effectively.

Q: What is the relationship between Delta and Theta?

Delta measures the rate of change in an option’s price relative to a change in the underlying asset’s price. Higher Delta options tend to experience faster Theta decay.

Best Theta To Find On Option Trading

Image: www.youtube.com

Conclusion

Mastering Theta is an invaluable skill for option traders seeking to optimize their returns. By embracing the aforementioned strategies, understanding Theta’s complexities, and leveraging expert advice, traders can uncover the hidden gems that hold the potential for substantial profits. May your trading endeavors be guided by the illuminating power of Theta!

As you journey through this article, dear reader, I invite you to reflect on your own experiences in option trading. Have you encountered the elusive Theta? If so, how did you navigate its complexities? Your insights will undoubtedly enrich the collective knowledge of our trading community.