In the ever-changing landscape of the financial markets, investors are constantly seeking strategies to mitigate risk and capitalize on market fluctuations. One such strategy is bear option trading, a powerful tool that enables traders to profit from declining asset prices.

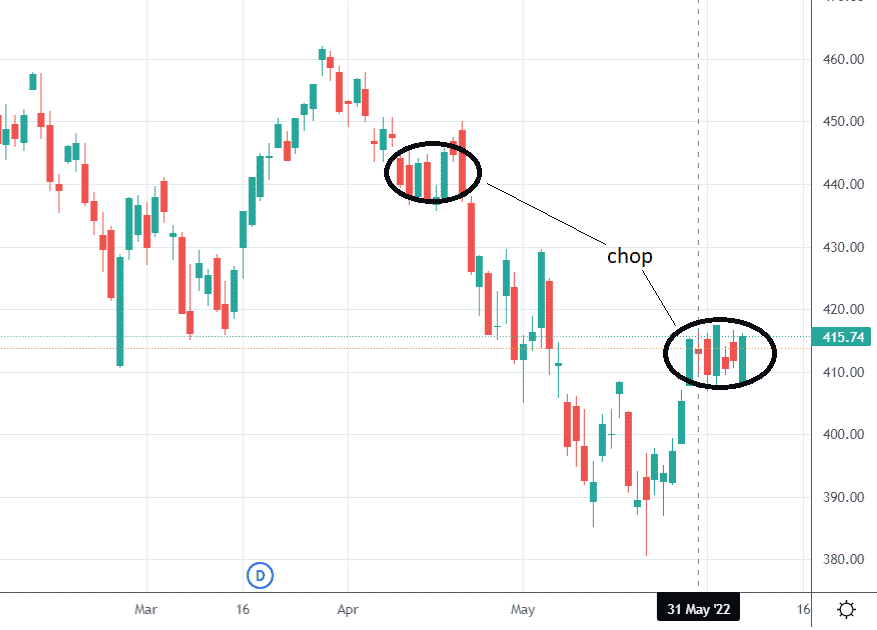

Image: tradingstrategy.ai

Understanding Bear Option Trading

Option trading involves the buying or selling of an option contract, a derivative that grants the holder the right but not the obligation to buy (call option) or sell (put option) the underlying asset at a specified price (strike price) on or before a specified date (expiration date).

Bear option trading specifically focuses on put options, which become valuable when the underlying asset’s price falls. When an investor anticipates a market downturn, they can purchase a put option, betting that the asset’s price will continue to decline.

Types of Bear Option Strategies

– Naked Put Selling: Selling a put option without owning the underlying asset, aiming to collect the premium paid by the option buyer. However, this strategy carries unlimited risk if the asset’s price rises.

– **Put Buying:** Purchasing a put option to gain the right to sell the underlying asset at the strike price. This strategy offers limited downside risk but requires the payment of the option premium.

– **Put Spread:** Buying and selling put options with different strike prices and expiration dates to create a defined risk and reward profile.

Executing Bear Option Trades

To execute a bear option trade, traders need to:

- Identify a suitable underlying asset likely to experience a price decline.

- Choose the appropriate put option contract (strike price, expiration date, and premium).

- Execute the trade by either buying or selling the option.

Image: optionstradingiq.com

Monitoring and Adjusting Bear Option Trades

Once a bear option trade is executed, ongoing monitoring is essential to manage risk and adjust the strategy as needed.

Traders should use technical analysis, news events, and other market indicators to track the performance of the underlying asset.

Adjustments to the trade may be necessary, such as rolling the option to a later expiration date or adjusting the strike price.

Tips for Successful Bear Option Trading

– Understand Risk: Bear option trading carries substantial risks. Always determine the potential losses before entering any trade.

– Proper Research: Thoroughly research the underlying asset, market conditions, and option contract details.

– Manage Risk: Use stop-loss orders or other risk management tools to limit potential losses.

Bear Option Trading Strategy

https://youtube.com/watch?v=STJzGGF6vrM

Conclusion

Bear option trading is a valuable strategy for investors seeking to profit from falling asset prices. By carefully assessing market conditions and employing appropriate trading techniques, traders can harness the power of put options to navigate market downturns and enhance their overall portfolio performance.

If you are intrigued by the potential of bear option trading, we encourage you to explore this strategy further. Consult with a financial advisor, conduct thorough research, and practice responsible risk management to maximize your chances of success in this dynamic and potentially lucrative market.