The stock market’s recent downturn has left many investors feeling uneasy. Bear markets, characterized by prolonged declines in stock prices, can erode portfolios and test the mettle of even the most seasoned traders. However, bear markets also present opportunities for savvy investors willing to navigate the volatility.

Image: www.quantifiedstrategies.com

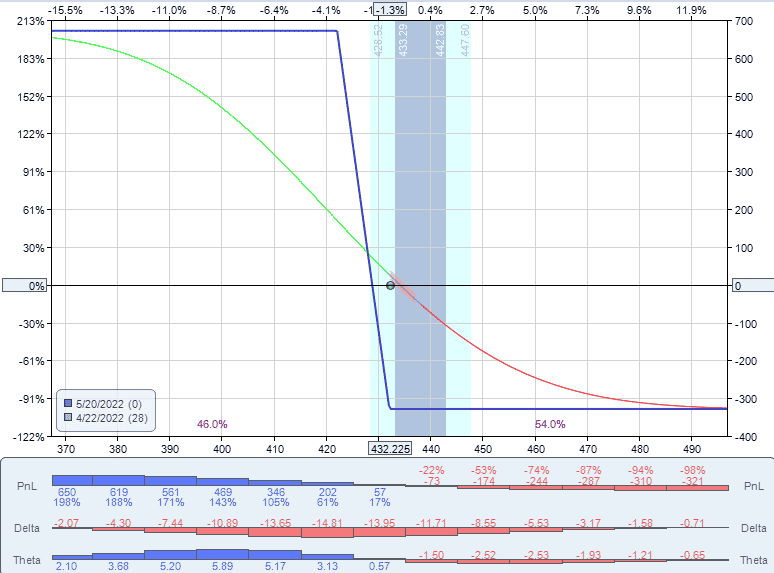

One such strategy is option trading. Options are contracts that give the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset, such as a stock, index, or currency, at a predetermined price (strike price) on or before a specified date (expiration date). By understanding the nuances of option trading, investors can potentially mitigate risks, enhance returns, and even capitalize on market downturns.

Understanding the Mechanics of Options

-

Call options: Grant the holder the right to buy an underlying asset at a specified strike price on or before a predetermined expiration date.

-

Put options: Grant the holder the right to sell an underlying asset at a specified strike price on or before a predetermined expiration date.

-

Strike price: The price at which the holder can buy (call option) or sell (put option) the underlying asset.

-

Expiration date: The date on which the option contract expires. If the option is not exercised before this date, it becomes worthless.

-

Premium: The cost to purchase an option contract. This premium represents the market’s estimate of the likelihood that the underlying asset will reach the strike price by the expiration date.

Options in a Bear Market

In a bear market, put options can be a valuable tool. By purchasing a put option, investors can hedge against further declines in the underlying asset’s price. If the market continues to decline, the value of the put option will increase, potentially offsetting the losses on their underlying investment.

For example, if an investor owns 100 shares of XYZ Corp. trading at $50 per share and is concerned about a potential market downturn, they could purchase a one-month put option with a strike price of $45. If XYZ Corp.’s stock falls to $40 per share, the put option will gain in value, mitigating the investor’s losses on their stock position.

Expert Insights

“Options provide investors with an array of tools to manage risk and generate returns in all market conditions,” explains John Carter, a veteran options trader and author. “In a bear market, put options can be an effective way to hedge against downside losses while maintaining the potential for upside gains.”

According to Katherine Duffy, a financial planner specializing in options strategies, “Options offer a unique level of flexibility and customization, allowing investors to tailor their investment strategy to their individual risk tolerance and financial goals.”

Image: optionstradingiq.com

Actionable Tips for Using Options in a Bear Market

-

Identify suitable underlying assets: Focus on assets with high volatility and clear downtrends.

-

Choose an appropriate strike price: The strike price should be below the current market price for put options and above the current market price for call options.

-

Manage risk carefully: Limit option purchases to a small percentage of your overall portfolio and avoid overleveraging.

-

Consider expiration dates: Short-term options (monthly or weekly) can provide quick returns or losses, while long-term options offer more time for the underlying asset to recover.

-

Monitor market conditions: Monitor the performance of the underlying asset and the value of the option contract regularly. Adjust your strategy as needed based on changing market dynamics.

Option Trading In Bear Market

https://youtube.com/watch?v=UFYAGO7Nfs8

Embracing Volatility in a Bear Market

Bear markets present challenges, but they also offer opportunities for skillful investors. By understanding the principles of option trading and applying sound risk management practices, investors can harness the power of options to navigate market volatility, preserve capital, and potentially generate profits even in the face of market downturns. Remember, as renowned investor Warren Buffett once said, “Volatility is the friend of the intelligent investor.”