Embarking on your options trading journey in the dynamic world of Bank Nifty can be an exciting yet daunting experience. As a novice, it’s crucial to equip yourself with the fundamental knowledge and strategies to navigate this complex market effectively. This comprehensive guide will provide you with a solid foundation in Bank Nifty options trading, empowering you to make informed decisions and potentially unlock significant profit opportunities.

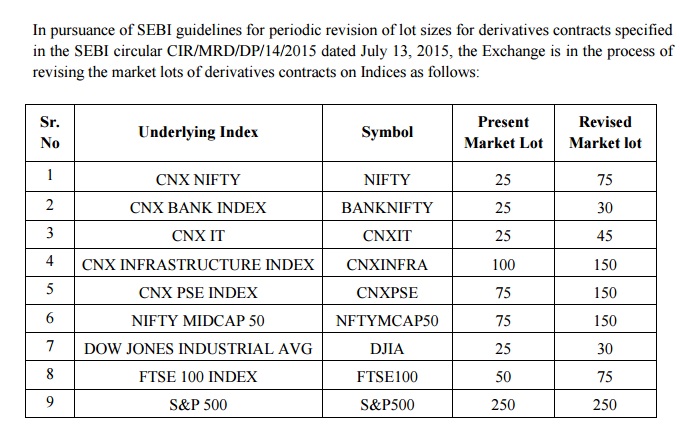

Image: eqogypacuc.web.fc2.com

Understanding Bank Nifty Options: A Gateway to Stock Market Gurus

Bank Nifty options represent financial contracts that grant you the right, but not the obligation, to buy or sell the underlying Bank Nifty index at a predetermined price on or before a specific expiration date. These instruments provide traders with the flexibility to speculate on the price movements of the Bank Nifty without the need to own the underlying assets. With careful analysis and execution, options trading can yield significant rewards and mitigate risks in both rising and falling markets.

Decoding Option Terminology: A Lexicon for Beginners

To master the art of options trading, it’s essential to familiarize yourself with key terminologies:

- Call Option: Grants you the right to buy the underlying asset at a predetermined strike price on or before the expiration date.

- Put Option: Gives you the right to sell the underlying asset at a predetermined strike price on or before the expiration date.

- Strike Price: The predetermined price at which you can buy/sell the underlying asset if you exercise the option.

- Expiration Date: The final day on which you can exercise the option.

- Premium: The price you pay to acquire the option contract, representing the value of the option’s rights.

Trading Bank Nifty Options: A Guide to Options Trading

1. Identify Trading Opportunities: Identify potential trading opportunities by analyzing the Bank Nifty index’s historical performance, market news, and economic indicators.

2. Choose the Right Option Strategy: Different option strategies suit different trading scenarios. Choose the strategy that aligns with your risk tolerance and profit objectives.

3. Execute Your Trade: Once you have identified the opportunity and selected the strategy, execute the trade by placing an order on the trading platform.

4. Manage Risk: Options trading involves inherent risk. Implement proper risk management strategies, such as stop-loss orders, to mitigate potential losses.

Image: learningthenifty.blogspot.com

Expert Advice for Successful Trading

1. **Understand the Market:** Thoroughly research Bank Nifty’s performance, seasonality, and market trends to gain an edge.

2. **Start Small:** Begin with small trades to gain experience and confidence in your trading decisions.

3. **Practice Patience:** Options trading requires patience and discipline. Allow your trades to play out before prematurely exiting.

Common FAQs about Bank Nifty Options

- What is the minimum capital required for Bank Nifty options trading? There is no specific minimum capital requirement, but brokers typically set minimum margin levels for each contract.

- What is the profit potential in Bank Nifty options trading? Profit potential is unlimited, but it depends on the strategy, market conditions, and level of risk taken.

- What is the risk involved in Bank Nifty options trading? The maximum loss is limited to the premium paid for the option contract.

Bank Nifty Options Trading For Beginners

Conclusion: Trading Success Within Reach

Embarking on Bank Nifty options trading can be a lucrative but challenging endeavor. By understanding the fundamentals of options contracts, employing effective trading strategies, and implementing proper risk management techniques, you can increase your chances of success in this dynamic market. Remember, patience, research, and a disciplined approach are the keys to unlocking consistent profitability. Are you ready to dive into the thrilling world of Bank Nifty options trading?