Take control of your financial destiny and embark on a journey of trading options using indexes. This comprehensive guide will equip you with the knowledge and strategies to navigate the world of options like a pro. From the basics to advanced techniques, we’ll guide you through every step, empowering you to make informed decisions and unlock the potential of this exciting investment tool.

Image: www.youtube.com

Demystifying Options and Indexes

An option contract grants you the right, but not the obligation, to buy (call) or sell (put) an underlying asset at a predetermined price on or before a specific expiry date. Index options, in particular, track the performance of a market index, such as the S&P 500 or the Nasdaq Composite, providing a convenient way to invest in a broad basket of stocks.

Benefits of Trading Index Options

The allure of trading index options lies in its inherent advantages:

-

Diversification: Gain exposure to a wide range of underlying assets, reducing overall portfolio risk.

-

Leverage: Amplify potential returns without putting up the full cost of the underlying index.

-

Flexibility: Execute various trading strategies to tailor your investments to your risk and return objectives.

-

Hedging: Utilize options to protect existing portfolios from market downturns.

Understanding the Mechanics

Mastering options trading begins with understanding the key terms and concepts:

-

Strike Price: The predetermined price at which you can buy or sell the underlying index.

-

Premium: The price you pay for the option contract, which represents its value.

-

Expiration Date: The date by which you must exercise or close your option position.

Image: www.pinterest.com

Types and Uses of Options Strategies

The world of options unfolds a wide array of strategies, each designed to address specific investment goals:

-

Covered Call: Sell a call option against an underlying index you own to generate income.

-

Protective Put: Buy a put option to protect your portfolio from a decline in the index’s value.

-

Spread Trading: Combine multiple options positions with different strike prices to manage risk and enhance potential returns.

-

Iron Condor: Deploy a combination of call and put options to profit from a specific volatility range.

Trading Insights from Industry Experts

For a deeper dive into options trading, we sought advice from esteemed experts in the field:

-

David S. Goldman, President of Doppler Trading: “Options provide the sophistication and flexibility to tailor strategies to your unique risk tolerance and return expectations.”

-

Stephanie Link, Chief Investment Strategist at Hightower Advisors: “Embrace a ‘mentorship mindset’ and learn from the experiences of seasoned traders in the options market.”

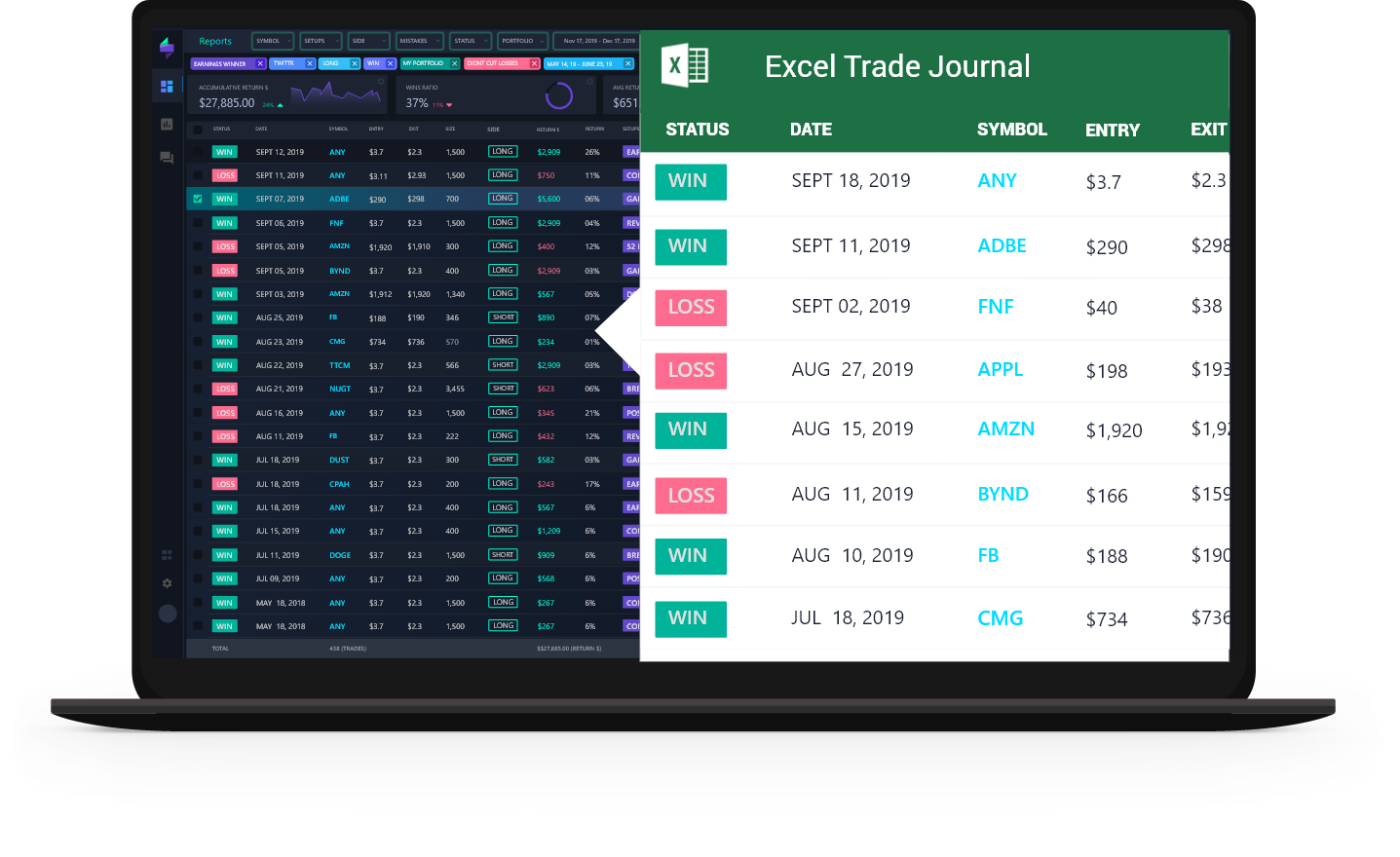

Trading Options Using Index

Image: tradersync.com

Essence of Option Trading

Trading options using indexes is an empowering tool that can elevate your investment strategy. Remember, success lies in understanding the underlying mechanics, employing effective trading strategies, and seeking guidance from experienced professionals. Embrace the journey, manage your risks judiciously, and unlock the full potential of this dynamic market.