Have you ever dreamed of making massive profits without investing significant capital? If so, options trading on TD Ameritrade might be the key to unlocking your financial freedom.

![TD Ameritrade Review [2024] - Top Choice For US Traders](https://www.compareforexbrokers.com/wp-content/uploads/2020/09/TD-Ameritrade-Futures-Trading.png)

Image: www.compareforexbrokers.com

As an experienced investor, I’ve witnessed the transformative power of options trading firsthand. It has enabled me to supplement my income and achieve my financial goals with remarkable ease. Whether you’re a seasoned trader or just starting out, this article will provide a comprehensive guide to options trading on TD Ameritrade, empowering you to harness its potential.

What is Options Trading?

Options trading involves the buying and selling of contracts that give you the right but not the obligation to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) on or before a certain date (expiration date).

The beauty of options trading is that it allows you to control a substantial number of shares with a small investment, known as a premium. This provides you with the opportunity to amplify your profits without assuming the full risk associated with the underlying asset.

Why Trade Options on TD Ameritrade?

TD Ameritrade is one of the most reputable and established brokers in the industry and offers a wide range of benefits for options traders:

- User-friendly trading platform with advanced charting tools and real-time data

- Comprehensive education resources and trading alerts

- Dedicated customer support team for guidance and assistance

- Low trading commissions and margin rates, allowing you to maximize your profits

- Thriving community of traders for networking and support

Understanding Options Terminology and Strategies

To succeed in options trading, it’s crucial to familiarize yourself with essential terminology and strategies:

- Call option: Gives you the right to buy the underlying asset at the strike price.

- Put option: Gives you the right to sell the underlying asset at the strike price.

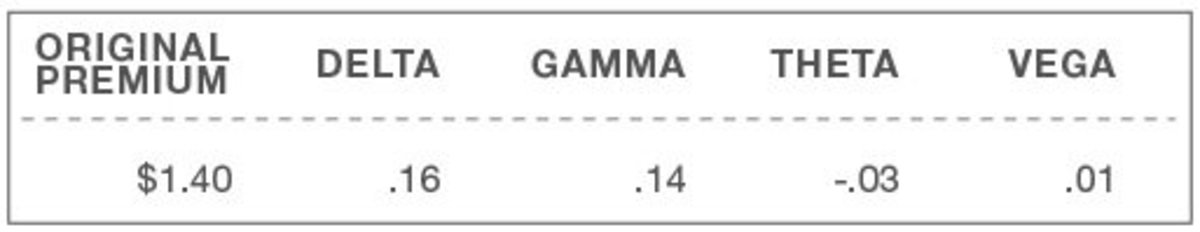

- Premium: The price paid upfront for purchasing an option contract.

- In the money: When the strike price is favorable for the option holder (above the underlying asset price for a call or below for a put).

- Out of the money: When the strike price is unfavorable for the option holder.

- Long option: When you buy an option, giving you the right to exercise it.

- Short option: When you sell an option, obligating you to fulfill the contract if exercised.

Image: toughnickel.com

Latest Trends and Developments in Options Trading

The world of options trading is constantly evolving, so it’s essential to stay abreast of the latest trends and developments:

- Growth in retail investor participation: More individual investors are embracing options trading as a means to generate income and enhance their portfolios.

- Technological advancements: Advanced trading platforms and mobile apps provide real-time data and facilitate faster execution of trades.

- Rise of volatility: The recent market volatility has created opportunities for options traders to generate significant profits.

- Increased regulatory oversight: Regulatory bodies are implementing stricter measures to ensure fairness and transparency in options trading.

Expert Tips and Advice for Successful Options Trading

To help you navigate the complex world of options trading, consider the following expert advice:

- Educate yourself: Thoroughly research options trading before investing. Attend webinars, read books, and immerse yourself in industry news.

- Start with small trades: Test the waters with small trades until you gain confidence and understanding.

- Manage your risk: Only trade with capital you can afford to lose. Utilize stop-loss orders to limit potential losses.

- Stay informed: Keep yourself updated on market trends and news events that can impact your trades.

- Be patient: Options trading can be a challenging but rewarding endeavor. Stay persistent and don’t get discouraged by setbacks.

Trading Options On Td

Image: www.youtube.com

Frequently Asked Questions About Options Trading

- Q: Is options trading suitable for beginners?

A: While options trading offers significant potential, it’s not recommended for complete beginners. It requires a thorough understanding of the market and prudent risk management.

- Q: How much money do I need to start options trading?

A: You can start with any amount, but it’s advisable to have a minimum of $500-$1,000 to invest in premium.

- Q: What is the best strategy for options trading?

A: The best strategy depends on your risk tolerance and investment horizon. However, covered calls, bull put spreads, and bear put spreads are commonly used strategies.

- Q: Can I become a millionaire with options trading?

A: While options trading can generate substantial profits, becoming a millionaire is not a guarantee. It requires skill, patience, and a significant amount of capital.