In the captivating world of finance, option trading stands out as an exhilarating realm where opportunities abound. Within this realm, short-term options have emerged as a formidable force, offering savvy investors the potential for substantial gains in a matter of days or even hours. In this comprehensive guide, we’ll delve into the intricacies of short-term option trading, empowering you with the knowledge and strategies necessary to navigate this dynamic investment landscape.

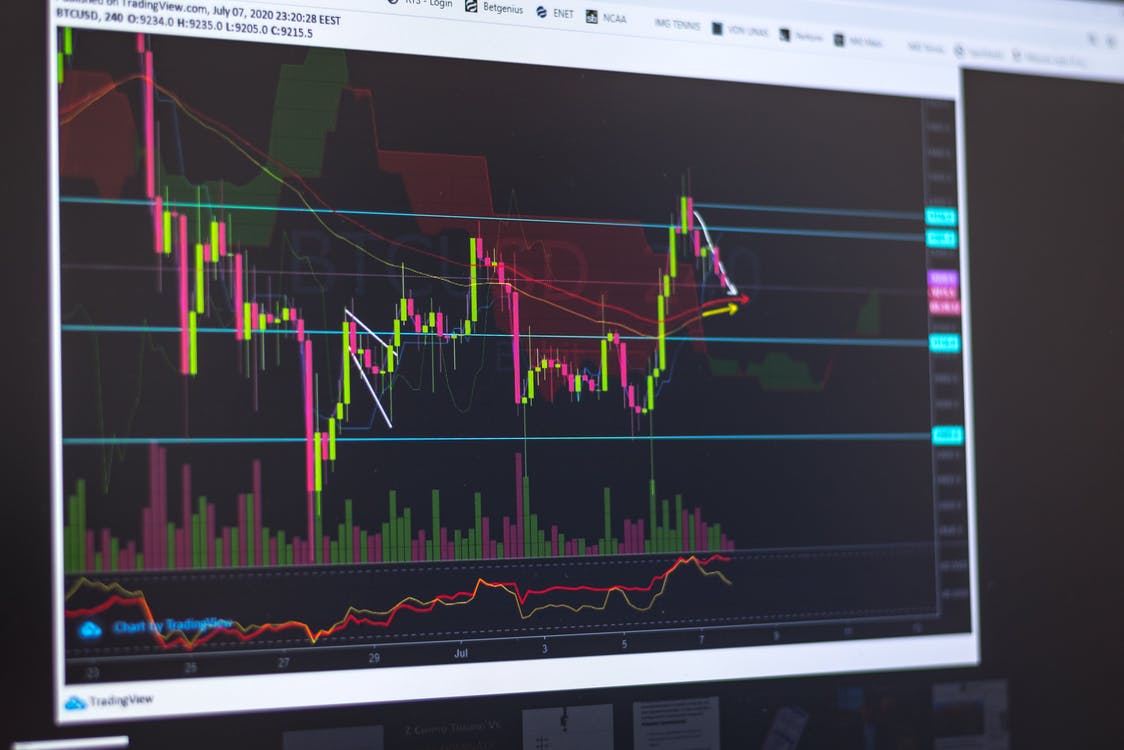

Image: www.daytrading.com

At its core, an option is a contract that grants the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame. Short-term options, as the name suggests, have relatively短いexpirations, often ranging from a few days to a few months. This unique feature makes them particularly attractive to traders seeking quick returns and flexible investment strategies.

To successfully engage in short-term option trading, it’s crucial to possess a solid understanding of its fundamental concepts and strategies. One key aspect is volatility, which measures the rate at which the underlying asset’s price changes. Volatility is a double-edged sword: while it can amplify potential profits, it can also magnify losses. Therefore, traders must carefully assess their risk tolerance and align their trading strategies accordingly.

Another important consideration is time decay. Unlike stocks, options have a limited lifespan, and their value erodes over time, even if the underlying asset’s price remains unchanged. This phenomenon, known as theta, underscores the importance of timely execution and close monitoring of option positions.

While the potential rewards of short-term option trading are alluring, it’s essential to approach this market with a healthy respect for its inherent risks. Options are complex instruments and can be subject to significant price fluctuations. Therefore, traders should exercise caution, conduct thorough research, and establish clear risk management strategies before venturing into this exhilarating yet potentially perilous realm.

Before embarking on your short-term option trading journey, it’s prudent to seek guidance from experts in the field. Seasoned traders and financial advisors can provide invaluable insights into market trends, trading strategies, and risk management techniques. Their wisdom can help you navigate the complexities of this market and enhance your chances of success.

To further augment your knowledge and refine your trading acumen, consider exploring reputable online resources and attending industry webinars and seminars. By continuously expanding your understanding of option trading, you’ll be better equipped to make informed decisions and capitalize on emerging opportunities.

Finally, remember that success in short-term option trading requires discipline, patience, and a deep understanding of market dynamics. Avoid emotional trading and adhere to a well-defined strategy. Continuous self-evaluation and adaptation are also crucial; the market is constantly evolving, and so should your approach.

In closing, short-term option trading presents both remarkable opportunities and significant risks. By mastering the intricacies of this dynamic market, managing risks effectively, and learning from the insights of seasoned traders, you can increase your odds of harnessing the potential of this exhilarating investment domain. May your trading endeavors be marked by informed decisions, calculated risks, and the realization of your financial aspirations.

Image: forextraininggroup.com

How To Look At Short Term Option Trading

Image: racingtraders.co.uk