Ever dreamt of harnessing the power of market fluctuations to your advantage? Options trading, a complex yet rewarding avenue in the financial world, allows you to do just that. But with its intricacies and potential for both profits and losses, delving into options trading can feel daunting. Enter TD Ameritrade, a leading brokerage platform, offering a comprehensive toolkit to navigate the options landscape. This guide will equip you with the knowledge and resources to embark on your options trading journey with TD Ameritrade.

Image: forextradingdaysinayear.blogspot.com

Whether you’re a seasoned investor seeking to diversify your portfolio or a curious beginner eager to explore the world of options, this comprehensive resource provides everything you need to get started. We’ll delve into the fundamental concepts of options trading, explore the unique features and tools offered by TD Ameritrade, and equip you with the knowledge to make informed trading decisions. So, buckle up and prepare to unravel the fascinating world of options trading with TD Ameritrade.

Unveiling the World of Options Trading

Imagine a contract that gives you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. That, in essence, is an options contract. These contracts are traded on exchanges and represent a powerful tool for investors looking to:

- Control larger positions: Options allow you to control a significant amount of an underlying asset with a relatively small investment, unlike buying the asset outright.

- Limit potential losses: Options contracts offer the advantage of capping your potential losses, unlike traditional stock investments where losses can be unlimited.

- Maximize profits: Options can provide significant returns on your investment if the market moves in your favor.

- Gain exposure to various assets: Options can be traded on stocks, indices, currencies, and commodities, allowing you to diversify your portfolio and explore different markets.

Types of Options: A Deeper Dive

Options contracts come in two main categories:

1. Call Options:

A call option grants the holder the right to buy an underlying asset at a predetermined price (strike price) on or before a specific expiration date. Imagine the price of a stock is $100, and you buy a call option with a strike price of $105. If the stock price rises above $105 before expiration, you can exercise your option, buy the stock at $105, and sell it in the market at a profit. If the stock price stays below $105, you can let the option expire worthless and lose only the premium you paid for it.

Image: www.pinterest.com

2. Put Options:

A put option grants the holder the right to sell an underlying asset at a predetermined price (strike price) on or before a specific expiration date. Consider a scenario where the price of a stock is $100, and you buy a put option with a strike price of $95. If the stock price falls below $95 before expiration, you can exercise your option, sell the stock at $95, and make a profit. If the stock price stays above $95, you can let the option expire worthless and lose only the premium you paid.

Navigating the Options Market: Strategies and Tools

The world of options trading is filled with various strategies, each designed for different market situations and risk tolerances. TD Ameritrade equips you with an array of tools and resources to make informed trading decisions.

1. TD Ameritrade’s Options Trading Platform:

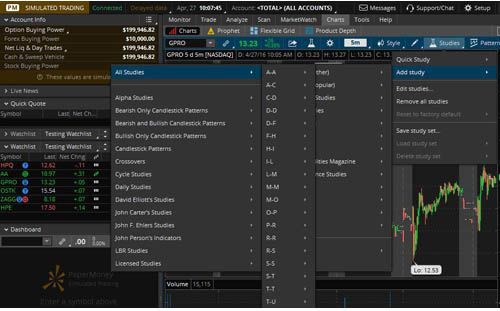

TD Ameritrade’s intuitive platform provides a comprehensive suite of tools for both beginners and experienced traders. Features like real-time quotes, advanced charting capabilities, and customizable watch lists allow you to monitor the market and make informed trades. Their intuitive interface and educational resources make it easy to find the information you need.

2. Educational Resources:

TD Ameritrade offers a wealth of educational resources to help you understand options trading and develop your skills. Their comprehensive guides, webinars, and video tutorials cover a wide range of topics, from basic options concepts to advanced trading strategies. These resources are accessible both online and through their mobile app.

3. Paper Trading:

Before risking real money, TD Ameritrade’s paper trading feature allows you to practice your options trading strategies in a simulated environment. This risk-free environment lets you experiment with different strategies, learn from mistakes, and gain confidence before entering the real market.

Common Options Trading Strategies

Whether you’re aiming to protect your portfolio from potential downside risks or seeking to capitalize on market volatility, various options strategies can assist you in meeting your objectives.

1. Covered Calls:

This strategy involves selling a call option on a stock you already own. It allows you to generate income but limits your potential upside. If the stock price rises above the strike price, the buyer of the call option can exercise it, forcing you to sell them the shares at the strike price, limiting your potential gains.

2. Cash-Secured Put:

This strategy involves selling a put option and holding enough cash to buy the underlying stock if the option is exercised. It generates income while providing you with the opportunity to purchase the stock at a discounted price if the option is exercised.

3. Protective Put:

This strategy involves buying a put option on a stock you own. This strategy protects your portfolio from potential losses if the stock price declines. If the stock price stays above the strike price, the put option expires worthless, and you lose only the premium you paid for it.

4. Bull Call Spread:

This strategy involves buying a call option and selling another call option with a higher strike price on the same underlying asset and expiration date. This strategy limits your potential losses to the net premium you paid, while your potential profits are limited to the difference between the strike prices.

Understanding Risks and Rewards

Options trading, while offering significant potential rewards, also carries inherent risks. It’s crucial to be aware of these risks and manage them effectively:

- Time Decay: Options lose value over time as they get closer to their expiration date. This is known as time decay.

- Limited Profit Potential: While options can offer significant profits, they also have limited profit potential compared to buying the underlying asset outright.

- Unlimited Loss Potential: Unlike buying a stock, where your maximum loss is the price you paid, options can lead to losses exceeding the premium paid.

- Volatility Risk: Options prices are highly sensitive to the volatility of the underlying asset. High volatility can significantly increase the value of options, but it also increases the risk of substantial losses.

TD Ameritrade’s Risk Management Tools

TD Ameritrade provides various tools to help manage risk and ensure responsible trading practices. These include:

- Order Types: TD Ameritrade offers various order types, including limit orders, stop-loss orders, and trailing stop orders, allowing you to control your risk exposure.

- Margin Requirements: TD Ameritrade enforces margin requirements for options trading, ensuring you have sufficient capital to cover potential losses.

- Account Monitoring Tools: TD Ameritrade’s account monitoring tools provide real-time updates on your positions, profit/loss, and margin utilization, empowering you to make informed decisions.

Options Trading Td Ameritrade

Conclusion

Embarking on the journey of options trading with TD Ameritrade equips you with the tools, knowledge, and resources to navigate the dynamic world of options. Remember, education, research, and a well-defined trading plan are crucial for success. Begin your options trading journey with confidence, leveraging the unique features and educational resources provided by TD Ameritrade, and embrace the potential rewards while managing risks effectively. Explore further resources, connect with financial advisors, and share your experience to enhance your learning and refine your trading strategy.