In the ever-evolving landscape of financial markets, options trading has emerged as a powerful tool for risk management and profit generation. By understanding the principles of options contracts and employing high probability strategies, traders can significantly increase their chances of success in this dynamic environment. This article offers a comprehensive guide to high probability options trading strategies, providing valuable insights into effective trading techniques and practical application.

Image: www.youtube.com

Understanding Options Contracts: The Foundation of Options Trading

Options contracts are financial agreements that provide the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. These contracts come in two primary forms: calls and puts. Call options give the buyer the right to purchase the underlying asset, while put options grant the right to sell. The underlying asset can be a stock, ETF, index, or other tradable instruments. By understanding the nature of options contracts, traders can unlock the potential of high probability strategies.

High Probability Options Trading Strategies: Empowering Traders

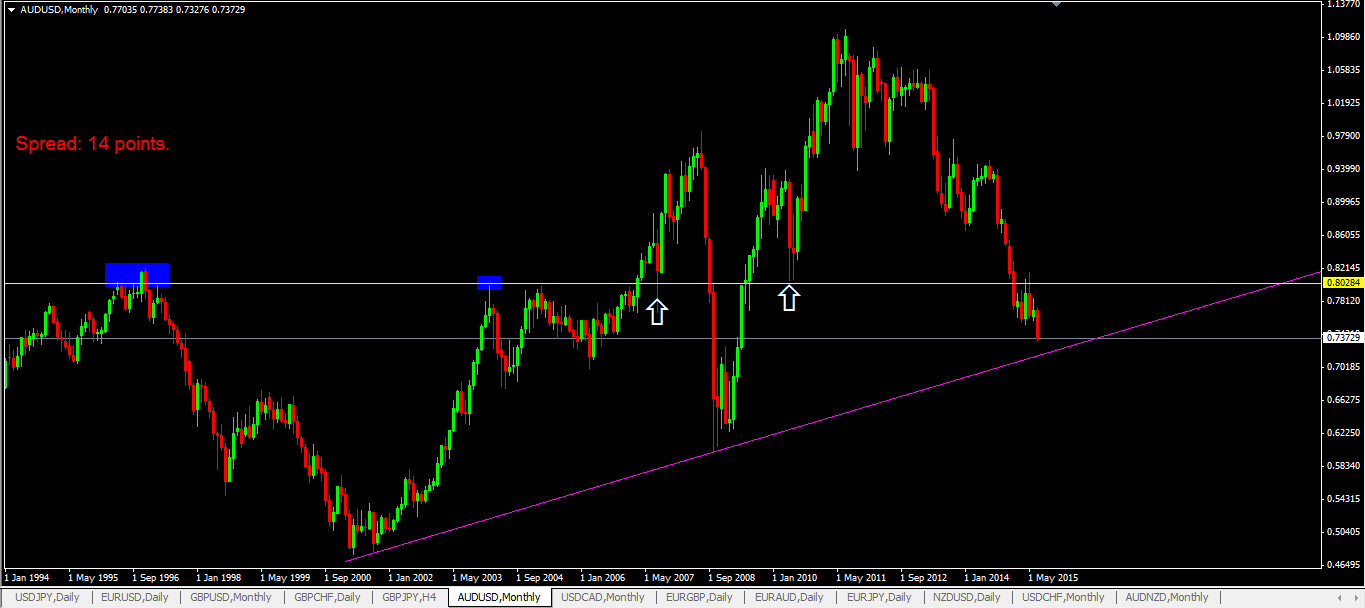

High probability options trading strategies are designed to identify opportunities with a greater likelihood of success. These strategies utilize technical analysis, fundamental analysis, and risk management techniques to increase the odds of profitable trades. One fundamental approach is the use of support and resistance levels, which are price points where the underlying asset has historically bounced off. By identifying these levels, traders can predict the potential direction of the market, allowing them to implement options strategies accordingly.

Iron Condor Strategy: Managing Risk and Generating Income

The Iron Condor strategy is a neutral strategy that aims to profit from a low-volatility environment. It involves selling two call options at slightly out-of-the-money strike prices and two put options at slightly in-the-money strike prices. The strategy generates a net premium from selling the options and profits when the underlying asset remains within a specific range. The Iron Condor is a conservative approach designed to manage risk and capture income in calmer markets, but it comes with limited profit potential and can suffer losses if the market becomes volatile.

Image: swing-trading-strategies.com

Bull Call Spread Strategy: Exploiting Directional Bias

The Bull Call Spread strategy is a bullish strategy that seeks to profit from an anticipated rise in the underlying asset’s price. The trader buys one call option at a lower strike price and sells another call option at a higher strike price. The strategy has limited risk, defined as the difference between the strike prices plus the net premium paid. Potential profit is limited to the premium received at the sale of the higher-priced call option. This strategy is suitable for situations where the trader believes the underlying asset will continue to appreciate but prefers a capped risk profile.

Strangle Strategy: Embracing Market Volatility

The Strangle strategy is a type of neutral strategy that aims to capture profits from significant price fluctuations without making any directional predictions. It involves buying both a call option and a put option at different strike prices, typically above and below the current market price. The trader profits if the underlying asset becomes more volatile, causing the price of both options to appreciate. However, the strategy can suffer losses if the asset moves within a tight range. The Strangle strategy is often employed when traders wish to express a neutral outlook on the market while positioning for potential volatility.

High Probability Options Trading Strategies Pdf

Conclusion: The Power of Knowledge in Options Trading

High probability options trading strategies empower traders to make informed decisions and increase their chances of success in the ever-changing market landscape. By understanding the principles of options contracts, employing proven strategies, and implementing effective risk management techniques, traders can navigate this dynamic and rewarding environment with greater confidence. The strategies discussed in this article provide a solid foundation for exploring the full potential of options trading, opening up opportunities for profit generation and financial growth. As you continue to explore this topic, it is crucial to conduct your own research and seek guidance from reputable sources to further enhance your knowledge and skills in high probability options trading.