Navigating the Investment Landscape:

Embarking on the investment journey can be both exciting and daunting. With countless options available, navigating the landscape can feel overwhelming. Two prevalent investment vehicles that have sparked debates and drawn comparisons are options trading and real estate. This article will delve into the complexities and nuances of both investment avenues, highlighting their distinct characteristics, potential returns, and risks involved. By examining their historical performance, recent trends, and expert insights, we aim to equip you with the knowledge and understanding necessary to make informed investment decisions.

Image: www.thepinnaclelist.com

Understanding Options Trading

Options trading involves contracts that grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific period. These contracts derive their value from the underlying asset’s price movements, allowing investors to speculate on future market fluctuations. Options trading provides a high degree of leverage, enabling traders to control a large number of shares with relatively small capital. However, this leverage also amplifies both potential gains and losses.

Insights into Real Estate

Real estate encompasses land, buildings, and other physical property. Investing in real estate typically involves purchasing property with the intent of holding it for appreciation in value or generating rental income. Real estate investments can be classified into various categories, including residential, commercial, and industrial properties, each with its own unique risks and potential returns. While real estate has historically offered stable returns over the long term, it also requires substantial capital investment and involves ongoing expenses such as maintenance, property taxes, and insurance.

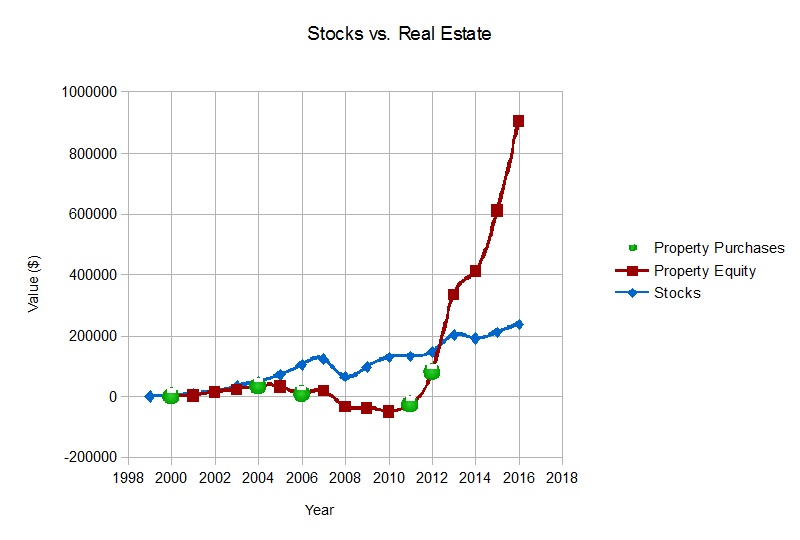

Comparing Options Trading and Real Estate:

-

Liquidity: Options trading offers a high degree of liquidity, as contracts can be bought and sold throughout the trading day, providing investors with the flexibility to enter and exit positions quickly. Real estate, on the other hand, is inherently less liquid due to the time and effort involved in buying, selling, or renting properties.

-

Volatility: Options trading is generally considered more volatile than real estate. The price of options contracts can fluctuate rapidly in response to even minor changes in the underlying asset’s price or market conditions. Real estate values tend to be more stable over shorter time frames, although they can be subject to market fluctuations and economic downturns over the long term.

-

Returns: The potential returns from options trading can be substantial, but they come with a correspondingly high level of risk. Real estate, on the other hand, typically offers lower but more consistent returns over the long term, making it a more suitable investment for those seeking stability.

-

Leverage: Options trading provides investors with significant leverage, allowing them to control a large number of shares with a relatively small investment. Real estate investments typically require a larger upfront capital investment, resulting in lower leverage.

-

Risk: Options trading involves a high degree of risk, as the value of contracts can fluctuate rapidly and lead to substantial losses. Real estate investments are generally considered less risky than options trading, but they are not immune to market downturns and other unforeseen events that can affect property values.

Image: www.graana.com

Expert Advice for Navigating Investment Opportunities

-

Research and Due Diligence: Thoroughly research both options trading and real estate before making any investment decisions. Understand the risks and potential returns associated with each investment vehicle and determine which aligns best with your financial goals.

-

Start Small and Gradually Increase Investment: Avoid investing more than you can afford to lose. Start with a small investment and gradually increase your exposure as you gain knowledge and experience.

-

Diversify Your Portfolio: Diversifying your investments across different asset classes, such as stocks, bonds, real estate, and options trading, can help spread risk and potentially improve overall returns.

-

Consider Your Risk Tolerance: Determine your risk tolerance and invest accordingly. Options trading is suitable for those who are comfortable with higher levels of risk and potential volatility, while real estate may be a better choice for those seeking stability and long-term appreciation.

-

Seek Professional Advice: Consult with a financial advisor or real estate professional to gain expert insights and guidance tailored to your individual circumstances and financial goals.

FAQs on Options Trading vs. Real Estate:

Q: Which investment is better, options trading or real estate?

A: There is no one-size-fits-all answer. The most suitable investment depends on your financial goals, risk tolerance, and investment horizon.

Q: How much money do I need to start trading options?

A: The amount of capital required to start trading options varies depending on the type of options and the trading strategy employed. It is generally recommended to start with a small investment that you are comfortable losing.

Q: What are the risks of real estate investments?

A: Real estate investments are not immune to risks. Some common risks include fluctuations in property values, economic downturns, vacancies, and maintenance expenses.

Q: Can I make a lot of money quickly through options trading?

A: While it is possible to make substantial profits from options trading, it is important to remember that it carries a high degree of risk. Rapid profits are not guaranteed and losses can occur just as quickly.

Options Trading Vs Real Estate

Image: www.moneyheals.com

Conclusion

Choosing between options trading and real estate for investment purposes requires a careful evaluation of each option’s characteristics, risks, and potential returns. Both investment vehicles offer unique advantages and drawbacks, and the most suitable choice depends on your individual circumstances and financial goals. Thorough research, expert advice, and a well-diversified portfolio are key elements of a successful investment strategy. Whether you are a seasoned investor or just starting your investment journey, ongoing learning and adapting to evolving market conditions are essential for maximizing your chances of success in the ever-changing world of finance.