Unlock the Power of Visual Learning

Embark on an educational journey as we delve into the captivating world of option trading strategies. Through the lens of engaging visuals, we’ll unveil the complexities of this dynamic market, enabling you to make informed decisions and maximize your trading potential.

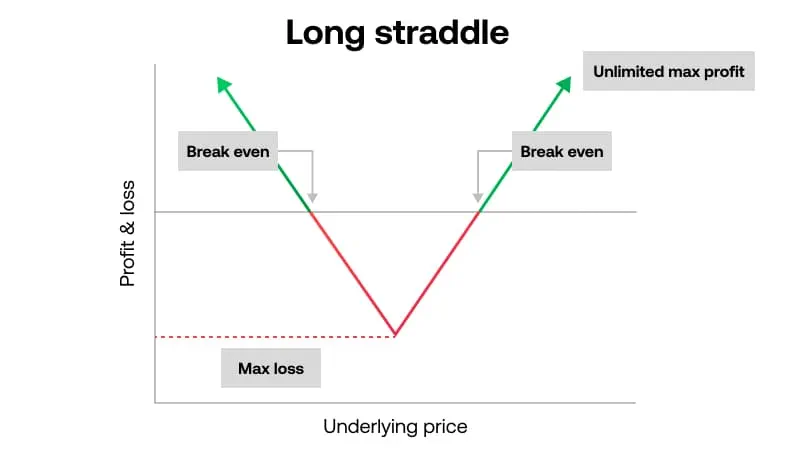

Image: www.cityindex.com

Dissecting Complex Strategies

Option trading offers a myriad of strategies that can be overwhelming to grasp. This article aims to simplify the learning process by presenting a visual representation of these strategies. With clear diagrams and charts, we’ll break down complex concepts into bite-sized pieces, making them accessible even to beginners.

Exploring the Fundamentals

- Definition: Options are financial instruments that grant the buyer the right (but not the obligation) to buy (in the case of call options) or sell (put options) an underlying asset at a specified price on or before a specific date.

- History: Option trading has its origins in the 18th century, with the first known transaction taking place in Amsterdam in 1708. Since then, options have evolved into a versatile tool used by traders, investors, and hedgers.

- Meaning: Options play a crucial role in managing risk and enhancing returns. They can be used to speculate on the future price of an asset, create income or protect existing investments.

Mastering Option Strategies

- Covered Call: A strategy that involves selling an OTM (out-of-the-money) call option against an underlying stock you already own. This generates income but limits your potential upside if the stock price rises.

- Protective Put: A strategy that entails purchasing an OTM put option to protect against a potential decline in the price of an underlying asset. This limits your losses, but it incurs a premium that reduces your potential gains.

- Bull Call Spread: A strategy involving buying a lower-strike call option and selling a higher-strike call option on the same underlying asset. This generates income and provides moderate profit potential while reducing risk.

- Iron Condor: A neutral strategy that involves selling a call option and a put option at higher strike prices and buying a call option and a put option at lower strike prices on the same underlying asset. This strategy generates income with limited risk but also has limited profit potential.

- Collar: A strategy that involves purchasing a protective put option and selling an OTM call option against the same underlying asset. This limits both your potential gains and losses.

Image: www.asktraders.com

Stay Ahead of the Curve

The option trading landscape is constantly evolving. To remain competitive, it’s essential to stay abreast of the latest trends and developments:

- Rise of ETFs: The popularity of ETFs (exchange-traded funds) has opened up new possibilities for option trading, such as ETFs tracking indices, commodities, and bonds.

- Automated Trading: Sophisticated algorithms and trading platforms enable execution of complex option strategies with lightning speed and precision, enhancing efficiency and reducing human error.

- Trading Psychology: Mastering the psychological aspects of option trading is crucial, as emotional biases can influence decision-making and lead to losses.

Empowering Your Trading

- Due Diligence: Conduct thorough research and identify profitable option trading strategies that align with your risk tolerance and financial goals.

- Discipline: Adhere to your trading plan and avoid making impulsive decisions that could compromise your performance.

- Continual Education: Dedicate time to ongoing learning to stay updated on market trends, new strategies, and trading tools.

Frequently Asked Questions

- Q: What is the difference between a call option and a put option?

A: A call option gives you the right to buy an asset, while a put option gives you the right to sell it. - Q: How do I determine the profitability of an option strategy?

A: Consider the premium paid, the strike price, and the underlying asset’s price movement. - Q: Is option trading suitable for beginners?

A: While it can be complex, beginners can gradually gain knowledge and experience through careful study and risk management.

Option Trading Strategies Ppt

Conclusion

Navigating the complexities of option trading can be daunting, but with the power of visual learning and a deep understanding of strategies, you can transform yourself into a confident and successful options trader. Remember, the journey to mastering option trading requires patience, discipline, and a relentless pursuit of knowledge. Embrace the learning process and unlock the boundless opportunities that await you.

Are you eager to delve deeper into the world of option trading? Let us know in the comments below!