As a seasoned investor, I recall my initial foray into the realm of options trading with a mix of excitement and trepidation. The intricacies of options strategies had always intrigued me, but the perceived complexity held me back. However, when I partnered with TD Ameritrade, everything changed. Their user-friendly platform and unparalleled educational resources empowered me to navigate the options market with confidence.

Image: www.hoteldacanoa.com.br

That’s why I’m thrilled to share my insights on TD Ameritrade options trading in this comprehensive guide. Whether you’re a seasoned pro or a novice seeking to unravel the potential of options, join me as we delve into the intricacies of this dynamic trading arena.

TD Ameritrade: The Premier Gateway to Options Trading

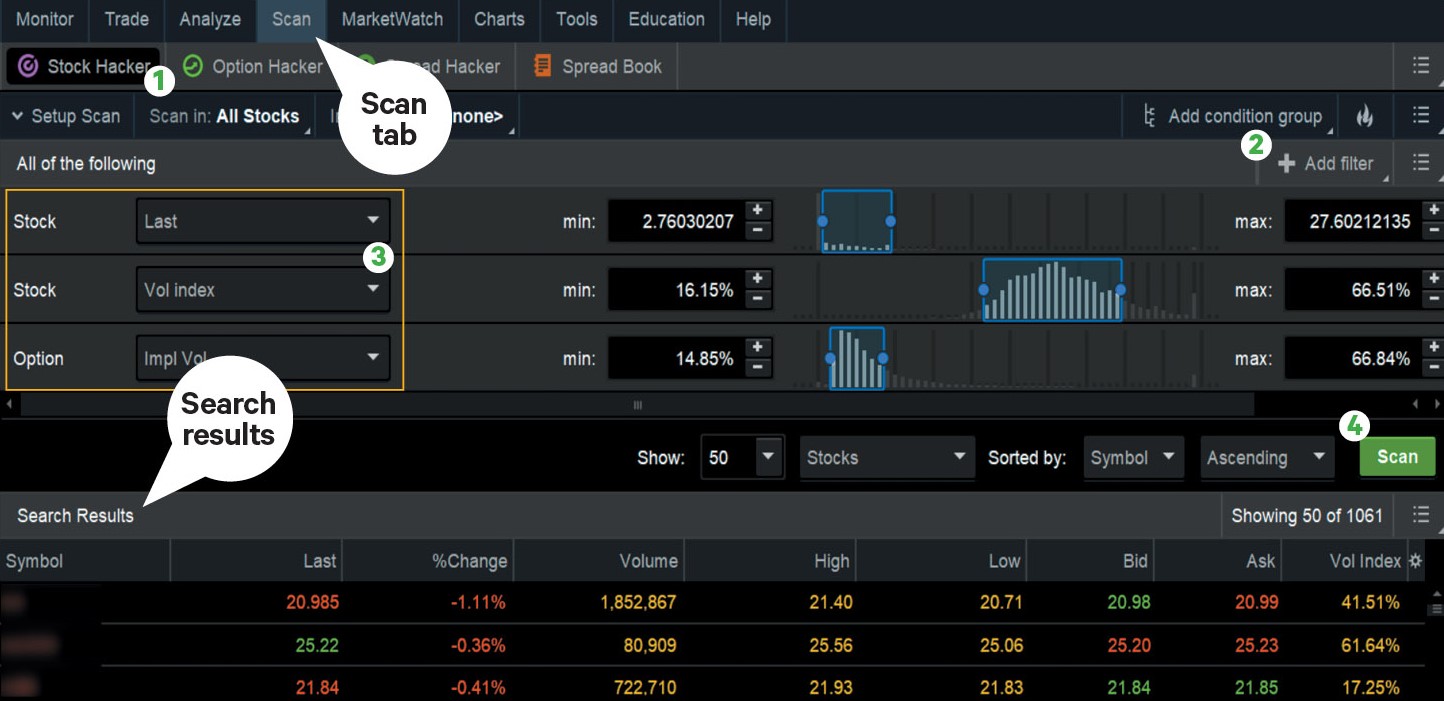

TD Ameritrade stands as an industry leader in options trading, offering a suite of innovative tools and educational materials tailored for traders of all levels. Their Thinkorswim platform, an industry-renowned platform, seamlessly combines cutting-edge charting capabilities with sophisticated analysis tools, putting the power of informed decision-making at your fingertips.

Furthermore, TD Ameritrade’s extensive educational library, webinars, and virtual workshops empower traders to enhance their knowledge and refine their strategies. Their dedicated team of options experts is always on hand to provide guidance and support, ensuring a smooth and successful trading experience.

Options Trading: A Comprehensive Overview

Options, in the financial world, are contracts that bestow upon the buyer the right, not the obligation, to buy or sell an underlying asset at a specified price within a predefined timeframe. These instruments provide investors with a versatile tool to potentially enhance returns, hedge risks, and generate income.

Options trading encompasses a diverse range of strategies, each meticulously crafted to adapt to distinct market conditions and risk appetites. From simple strategies like covered calls and protective puts to complex multi-leg combinations, the options arena offers traders an unparalleled level of flexibility and customization.

Navigating the Latest Trends and Developments

The options market is a constantly evolving landscape, with new strategies and trends emerging regularly. Staying abreast of these developments is crucial for traders seeking to stay ahead of the curve and seize lucrative opportunities.

By tapping into industry news sources, engaging in discussions on forums and social media platforms, and attending industry conferences, traders can gain invaluable insights on the latest market trends and adjust their strategies accordingly. This proactive approach to market research empowers traders to make informed decisions and maximize their trading potential.

Image: thewaverlyfl.com

Tips for Success in Options Trading

As you embark on your options trading journey with TD Ameritrade, consider these invaluable tips from seasoned experts:

- Start small and gradually increase your risk exposure: Begin with a modest portfolio and gradually increase your investment as you gain experience and confidence.

- Understand the risks involved: Options trading carries inherent risks. It’s crucial to thoroughly grasp the potential losses before risking any capital.

- Use limit orders to control risk: Limit orders allow you to predetermine the maximum price you’re willing to pay or receive for an option, mitigating potential losses.

li>Research and due diligence: Before executing any trade, dedicate ample time to researching the underlying asset, industry trends, and potential market catalysts.

Remember, patience and discipline are key to long-term success in options trading. Avoid emotional decision-making and always approach the market with a well-defined strategy.

Frequently Asked Questions about TD Ameritrade Options Trading

- Q: What types of options can I trade with TD Ameritrade?

A: TD Ameritrade offers a wide range of options products, including single-leg options, multi-leg strategies, and complex option spreads.

- Q: How do I access Thinkorswim?

A: Thinkorswim is available as a downloadable platform or through the TD Ameritrade website.

- Q: Can I paper trade before risking real capital?

A: Yes, TD Ameritrade’s paper trading feature allows you to simulate trades without risking real money, providing a valuable opportunity to practice and refine your strategies.

Tdameritrade Options Trading

Conclusion

Options trading with TD Ameritrade empowers investors with a versatile tool to potentially enhance returns, manage risks, and generate income. By leveraging their user-friendly platform, comprehensive educational resources, and expert support, you can confidently navigate the options market and unlock its full potential. Embrace the principles of risk management, and you’ll be well-positioned to explore the limitless possibilities of options trading.

So, are you ready to embark on this captivating adventure in options trading with TD Ameritrade? Their unparalleled suite of tools and resources awaits your exploration. Join the ranks of successful traders and seize the opportunities the options market has to offer.