Introduction

Image: www.chegg.com

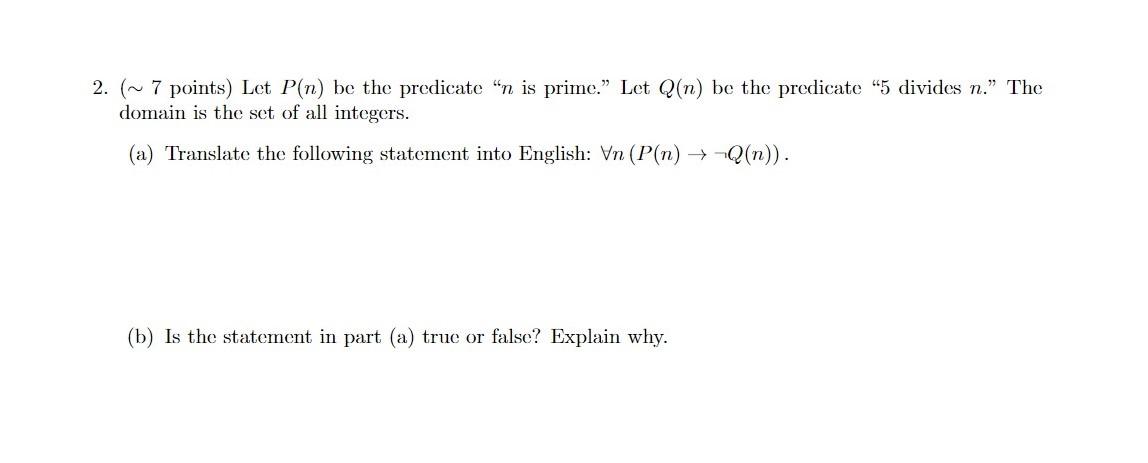

Navigating the realm of options trading can be a lucrative endeavor, but understanding how to accurately declare profit and loss (P&L) is crucial for tax purposes. Options contracts, with their complex nature and distinct regulations, require a specific approach when reporting their financial impact. This comprehensive guide will delve into the complexities of options P&L declaration, providing traders with a clear roadmap to ensure compliance and minimize tax liabilities.

Understanding Options and Their Taxation

Options trading involves agreements between two parties to buy or sell an underlying asset at a pre-determined price and date. The two primary types of options are calls, which grant the buyer the right to buy the underlying asset, and puts, which grant the buyer the right to sell. When an option is exercised, the buyer or seller incurs a gain or loss based on the difference between the strike price, the agreed-upon price, and the market price of the underlying asset.

The taxation of options P&L depends on the holding period. Short-term gains or losses, resulting from options held for less than one year, are taxed as ordinary income, subject to the applicable ordinary income tax rates. Long-term gains or losses, stemming from options held for more than one year, qualify for capital gains tax treatment, which typically offers more favorable tax rates.

Calculating Options P&L

Determining the P&L of options trading involves accounting for both the premium paid or received and the gain or loss on the underlying asset. The premium represents the price of the option contract itself and is an upfront cost for the buyer or a gain for the seller. The gain or loss on the underlying asset arises when the option is exercised and results in the difference between the strike price and the market price.

Declaring P&L on Tax Forms

In the United States, options P&L short-term gains or losses are reported on the Schedule D, Form 1040, under the section for short-term capital gains and losses. Long-term gains or losses are also reported on Schedule D, in the dedicated section for long-term capital gains and losses.

Forms for Reporting Options P&L

- Schedule D, Form 1040: Used to report capital gains and losses, including those from options trading.

- Form 1099-B: Issued by brokerages to report proceeds from the sale or exchange of stocks, bonds, and other financial instruments, including options contracts. It provides details on the cost basis and sales proceeds of the options traded.

Additional Considerations

- Wash Sale Rule: This rule prevents artificial short-term losses from being realized by disallowing the tax deduction for losses on options if substantially identical options are acquired within 30 days of the sale.

- Mark-to-Market (MTM) Election: Traders can make the MTM election to value their options contracts and have unrealized gains or losses taxed annually, regardless of their holding period.

- Options on Futures and Swaps: These contracts are taxed differently from standard options contracts and typically follow the same tax treatment as the underlying futures or swaps.

Conclusion

Understanding how to accurately declare P&L around options trading is paramount for compliance with tax regulations and avoiding potential penalties. By grasping the intricacies of options taxation, calculating P&L with precision, and utilizing the appropriate tax forms, traders can ensure transparent and accurate reporting. This comprehensive guide serves as a valuable resource for options traders, empowering them to navigate the complexities of tax compliance and maximize their financial returns.

Image: www.chegg.com

How Does One Declare P&L Around Trading Options

Image: www.chegg.com