Introduction

For many investors, delving into the world of options trading can feel like navigating uncharted waters. However, with the right tools and knowledge, this powerful strategy can unlock boundless opportunities. Our guide, in collaboration with TD Ameritrade, will equip you with the fundamental understanding you need to confidently navigate the options trading landscape.

Image: slickbucks.com

Understanding Options: The Basics

Options contracts are financial instruments that grant the holder the right, but not the obligation, to buy or sell a specific asset at a predetermined price within a specified timeframe. This flexibility offers investors the potential to capitalize on market fluctuations and hedge against potential risks.

There are two main types of options: calls and puts. Call options grant the holder the right to buy an asset, while put options grant the holder the right to sell an asset. These options can be exercised at any time before the expiration date or can simply be held until expiry.

Benefits and Risks of Options Trading

Options trading presents numerous advantages, including:

- Enhanced returns: Options contracts with well-calculated strategies have the potential to yield substantial returns.

- Risk management: Options can be used to hedge against downside risks, providing valuable protection to investment portfolios.

- Flexibility: Options contracts offer investors the flexibility to customize risk-reward profiles based on their objectives.

However, it’s crucial to acknowledge the inherent risks involved:

- Potential for losses: Options can lead to significant financial losses if not traded strategically.

- Complexity: Options trading requires an understanding of market dynamics and risk management techniques.

- Time decay: Option contracts have a limited lifespan, and their value gradually declines as the expiration date approaches.

Getting Started with TD Ameritrade

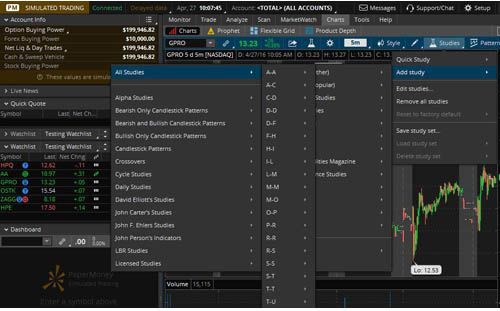

TD Ameritrade offers a comprehensive platform for options trading, catering to both novice and seasoned investors. Their services include:

- Intuitive trading platform: TD Ameritrade’s user-friendly platform makes options trading accessible and efficient.

- Educational resources: Extensive educational content is available to help beginners navigate the complexities of options trading.

- Customer support: Dedicated support channels ensure that traders have access to expert assistance when needed.

Image: www.forex.academy

Types of Options Strategies

Options trading involves employing various strategies to achieve different investment goals. Some popular strategies include:

- Covered calls: Generate income by selling call options against an owned stock.

- Put selling: Generate income by selling put options on stocks with high conviction of continued price stability.

- Bull call spread: Leverage a positive outlook on an underlying asset with limited risk exposure.

- Bear put spread: Hedge against potential downside risks or capitalize on price declines.

Options Trading 101 Td Ameritrade

Image: forextradingdaysinayear.blogspot.com

Conclusion

Options trading can be a powerful tool for investors seeking enhanced returns and risk management. By understanding the basics, assessing the risks, and leveraging TD Ameritrade’s platform, you can navigate this exciting investment arena with confidence. Remember, as with any investment, thorough research and strategic decision-making are key to unlocking the potential of options trading.