Navigating the complex world of option trading can be daunting, but understanding the tax implications is essential for maximizing returns. I found myself in hot water with the taxman after a profitable option trading year, leaving me wondering what I had missed. This article will delve into the intricacies of tax regulations surrounding option trading, helping aspiring traders steer clear of similar pitfalls and optimize their financial strategies.

Image: probizadvisor.com

Taxation Basics of Option Trading

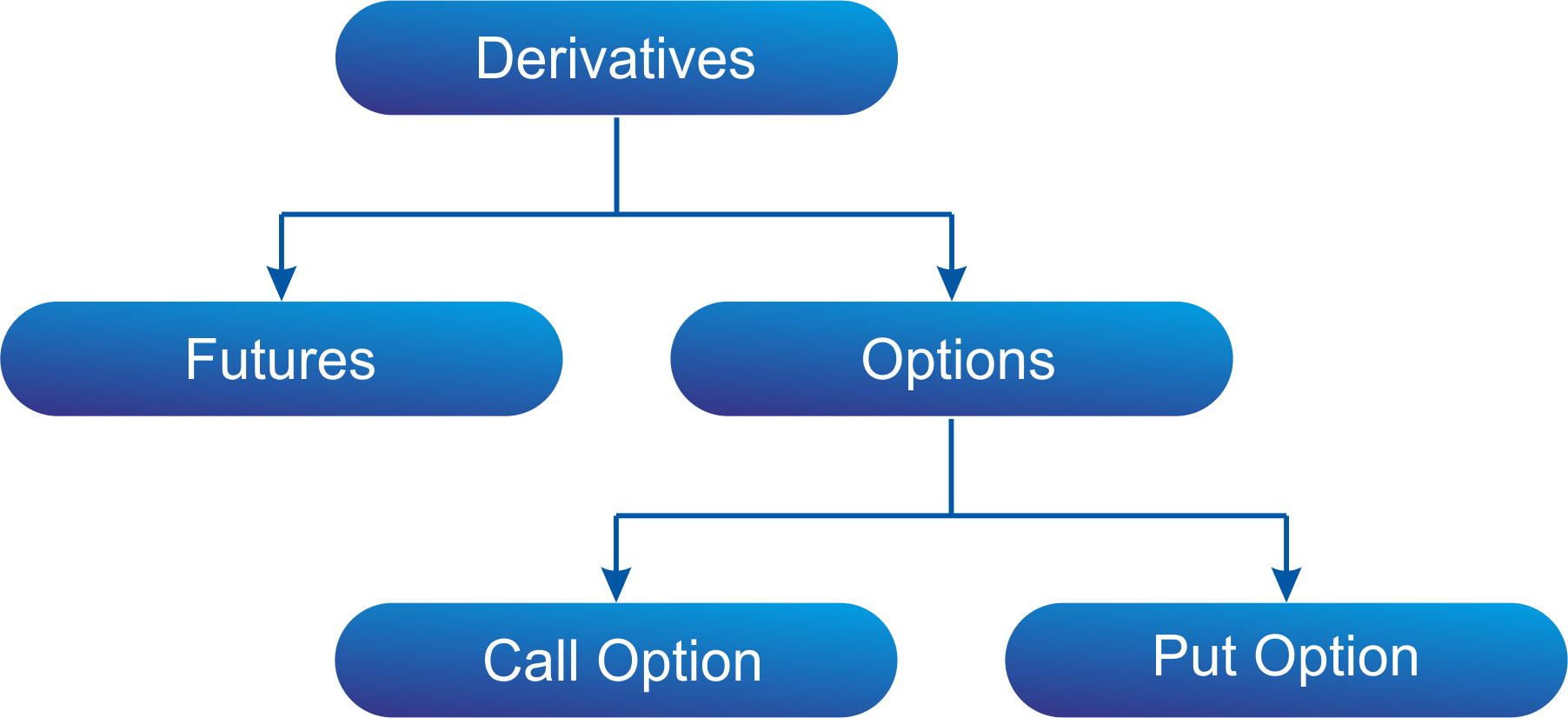

Defining Options

Options are financial contracts that grant buyers the right, but not the obligation, to buy or sell an underlying asset at a predetermined price. They come in two flavors: calls and puts. A call option gives the buyer the right to purchase an asset, while a put option allows them to sell. These options typically expire after a specific period.

Trading Options

When options are traded, the premiums paid or received are subject to taxation. The premium represents the price of the option contract. Premiums received from selling options are considered income and taxed as such. Conversely, premiums paid to acquire options are typically treated as capital gains or losses, depending on the outcome of the trade.

The Wash Sale Rule

The wash sale rule is a critical concept to understand when trading options. If an investor sells an option for a loss to claim a tax deduction and then repurchases a “substantially identical” option within 30 days before or after the sale, the tax loss is disallowed. It would help if you waited 31 days to re-enter the position.

Image: www.youtube.com

Short-Term vs. Long-Term

The holding period of an option determines whether it is taxed as a short-term or long-term gain or loss. Options held for one year or less are subject to ordinary income tax rates, while those held for more than a year benefit from preferential long-term capital gains rates.

Straddle and Spread Transactions

Straddles and spreads are complex option trading strategies that involve buying and selling multiple options with different strike prices and expiration dates. The tax treatment of these transactions can be complicated, so it’s recommended to consult with a tax professional for guidance.

Latest Trends and Developments

Mark-to-Market Taxation

In recent years, the Internal Revenue Service (IRS) has implemented mark-to-market taxation for option traders who meet certain criteria. This means that unrealized gains and losses on open option positions are recognized for tax purposes each year, regardless of whether the positions are closed.

Insider Trading and Options

Insiders with access to material nonpublic information (MNPI) are prohibited from trading options on stocks of their companies. If an insider is found to have traded options while in possession of MNPI, they may face significant tax penalties and other consequences.

Tips and Expert Advice

**Keep Accurate Records**

Maintaining meticulous records of all option trades is crucial for accurate tax reporting. This includes the date of each trade, the type of option traded, the strike price, the expiration date, and the premium paid or received.

**Consult with a Tax Professional**

The complexities of option trading taxation can be overwhelming. Consulting with a tax professional can help ensure compliance and maximize tax efficiency. A qualified accountant or tax attorney can provide personalized guidance based on your specific trading strategies and financial situation.

FAQ

Q: What are the tax rates for option trading gains?

A: Short-term gains (held for one year or less) are taxed at ordinary income tax rates, while long-term gains (held for more than a year) are taxed at preferential capital gains rates.

Q: Is the wash sale rule applicable to options?

A: Yes, the wash sale rule applies to options, disallowing tax losses if an “substantially identical” option is repurchased within 30 days of a sale.

Q: How do I account for mark-to-market taxation?

A: Unrealized gains and losses on open option positions are recognized for tax purposes each year, regardless of whether the positions are closed.

Q: Can I use options to reduce my tax liability?

A: Options can be used for tax-efficient strategies such as tax-loss harvesting or income deferral. However, it’s crucial to consult with a tax professional to optimize your strategy.

Tax In Option Trading

Conclusion

Navigating the tax implications of option trading requires meticulous record-keeping, a deep understanding of the rules and regulations, and, when necessary, guidance from a qualified tax professional. By following the principles outlined in this article, traders can minimize tax liabilities and maximize their returns. Are you interested in discovering more about the intricacies of option trading taxation? Share your thoughts and queries in the comments section below.