Introduction

In the ever-evolving landscape of financial markets, futures trading has emerged as a formidable force, offering a unique opportunity for risk-tolerant investors to harness the potential of price fluctuations. Among the various futures contracts available, low-cost options have gained immense popularity, providing a cost-effective way to speculate on market movements. This comprehensive guide will equip you with the essential knowledge and strategies to navigate the world of futures options trading, enabling you to maximize your potential for success in this dynamic and rewarding arena.

Image: www.fxcracked.com

Understanding Futures Options

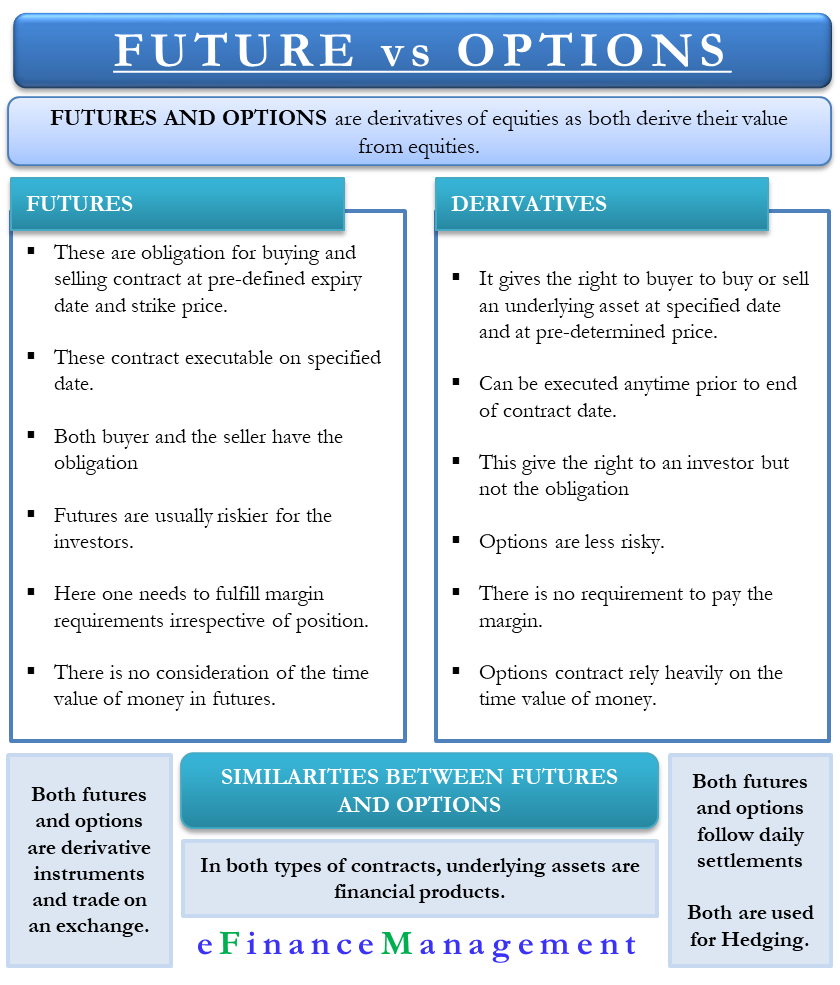

Futures options are derivative financial instruments that grant the holder the right, but not the obligation, to buy or sell an underlying futures contract at a predetermined price, known as the strike price, on a specific date, known as the expiration date. Essentially, they offer the holder the flexibility to speculate on the direction of the market without committing to a physical purchase or sale of the underlying asset.

Types of Futures Options

Futures options come in two primary types: call options and put options. Call options convey the right to purchase the underlying futures contract at the strike price, while put options confer the right to sell the underlying futures contract at the strike price. The holder of a call option profits when the market price of the underlying futures exceeds the strike price, and the holder of a put option profits when the market price of the underlying futures falls below the strike price.

Trading Futures Low-Cost Options

Low-cost options are a cost-effective way to enter the futures options market. They are typically characterized by lower premiums compared to their higher-priced counterparts. This makes them particularly suitable for traders with smaller capital or those looking to minimize their upfront investment.

Image: efinancemanagement.com

Choosing the Right Futures Option

Selecting the right futures option contract involves careful consideration of several factors. These include the underlying futures market, the strike price, the expiration date, and the available premiums. Traders should conduct thorough research and analysis to identify options contracts that align with their risk tolerance, market outlook, and trading objectives.

Managing Futures Options Positions

Futures options trading requires a proactive approach to position management. Traders should continuously monitor market conditions, adjust positions as necessary, and employ appropriate risk management techniques to protect their capital. Effective position management strategies include setting stop-loss orders, taking profits, and adjusting positions in response to changing market trends.

Strategies for Futures Low-Cost Options

Numerous strategies can be implemented when trading futures low-cost options. Some common approaches include buying calls, selling puts, buying puts, and selling calls. Each strategy offers unique risk and reward profiles, and traders should carefully evaluate their suitability based on their individual circumstances and market outlook.

Advantages and Disadvantages of Futures Options Low Cost

Trading futures low-cost options offers several advantages, including the potential for high returns, limited risk compared to the underlying futures contract, and flexibility in trading strategies. However, it is essential to be aware of the potential disadvantages, such as limited profit potential compared to standard options, higher volatility, and the potential for losses.

How To Start Trading Futures Low Cost Options

Image: www.pinterest.com

Conclusion

Venturing into the world of futures options trading with low-cost options can be a rewarding endeavor for those seeking to expand their investment horizons. By understanding the foundational concepts, selecting the right contracts, and employing effective position management strategies, traders can harness the opportunities presented by futures markets while mitigating potential risks. Thorough research, careful planning, and a disciplined approach are key ingredients for success in this dynamic and challenging arena.