As I embarked on my journey into the captivating world of option trading, I couldn’t help but marvel at its potential for both immense gain and inherent risk. Little did I know that amidst the thrill-seeking and meticulous analysis lay a labyrinth of tax implications, ready to shape my trading decisions in profound ways.

Image: moneymunch.com

Understanding the Basics of Option Taxation

Options, financial instruments granting the buyer the right but not the obligation to buy or sell an underlying asset at a predetermined price, come with unique tax ramifications. These instruments can be classified as either short-term (held for a year or less) or long-term (held for more than a year).

Short-term options, upon their sale or expiration, are taxed as ordinary income, similar to wages or business income. In contrast, long-term options enjoy preferential treatment, with profits taxed at the lower capital gains rate. This distinction highlights the significance of holding period in shaping the tax burden.

Practical Considerations for Tax-Advantaged Option Trading

Armed with an understanding of the tax implications, savvy option traders can devise strategies to minimize their liabilities and maximize returns.

One such strategy involves selling covered calls. When you own the underlying stock and sell a call option against it, you lock in a minimum selling price for the stock. If the stock rises above the strike price, you’ll reap the profits up to that limit. Notably, this strategy generates long-term capital gains, offering substantial tax savings.

Another option is to hold options to expiration. Although riskier, this approach can yield significant tax advantages. If the option expires worthless, you can claim it as a loss, potentially offsetting other capital gains. Moreover, any profit from exercised options will qualify for long-term capital gains treatment if held for more than a year.

Leveraging Expert Advice for Informed Decision-Making

Navigating the tax complexities of option trading requires a deep understanding of both financial and tax principles. Consulting with a qualified tax professional can provide invaluable guidance tailored to your individual circumstances.

Investment advisors specializing in options can offer insights into tax-efficient trading strategies, helping you minimize your tax burden while maximizing your returns. Seeking expert advice empowers you to make informed decisions that optimize your financial outcome.

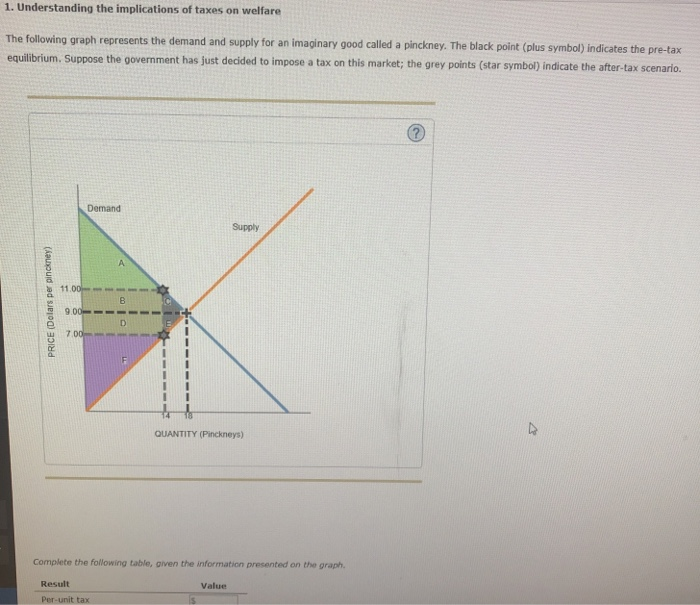

Image: www.chegg.com

FAQs on Option Trading Taxation

- Q: Is all option trading income taxed as ordinary income?

- A: No, only short-term options (held for a year or less) incur ordinary income tax.

- Q: Can I deduct losses from worthless options?

- A: Yes, losses from worthless options can offset capital gains or up to $3,000 of ordinary income.

- Q: How can I reduce my tax liability through options trading?

- A: Consider selling covered calls or holding options to expiration, both of which can yield long-term capital gains.

Tax Implications Of Option Trading

Image: www.pinterest.com

Conclusion

Delving into the intricacies of option trading taxation unveils a landscape of potential tax liabilities and opportunities. By comprehending the tax implications and employing strategic approaches, traders can navigate this complex terrain, unlocking greater financial rewards while minimizing their tax burden. Are you ready to embark on the journey of tax-savvy option trading?