Have you ever wondered what lies beneath the surface of an option contract’s seemingly complex price? You’re not alone. Option trading can appear intimidating, but understanding its core concepts, like delta, can unlock a deeper level of comprehension and control. This article delves into the world of delta, revealing its significance and how it empowers traders to navigate the unpredictable waters of volatility.

Image: callputoption.ir

Imagine yourself holding an option contract. It grants you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price. Delta, in essence, measures how much your option contract’s price will change for every dollar fluctuation in the underlying asset’s price. It acts like a compass, guiding you through the potential gains and losses of your option position.

Decoding Delta: The Sensitivity to Price Change

What exactly is Delta?

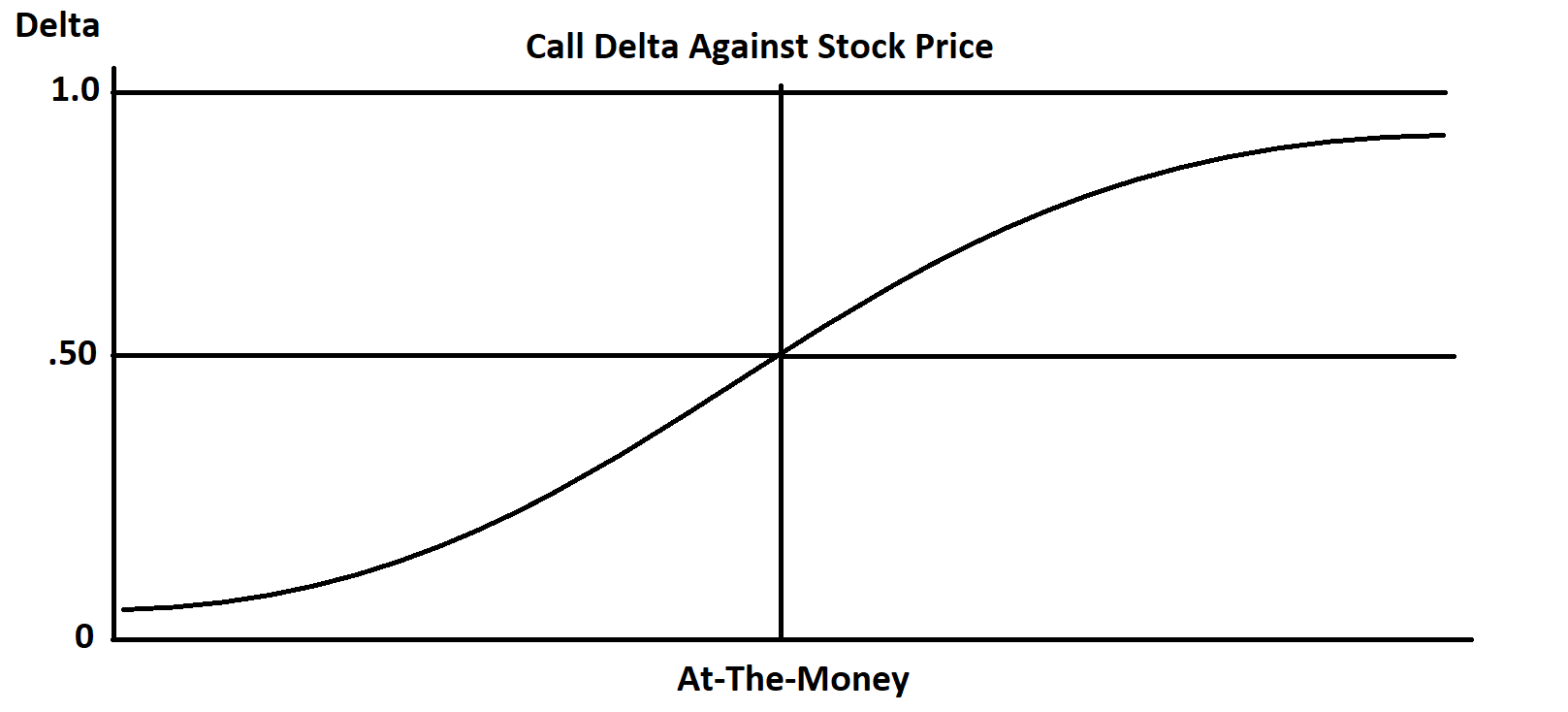

Delta is a key factor when evaluating options. Simply put, delta represents the rate of change in an option’s price relative to the underlying asset’s price movement. Delta values range from 0 to 1 for call options and -1 to 0 for put options.

- Call Options: A delta of 0.50 signifies that for every $1 rise in the underlying asset’s price, the call option’s value will increase by $0.50. A delta of 1.0 suggests that the option moves in perfect tandem with the underlying asset.

- Put Options: A delta of -0.50 indicates that for every $1 rise in the underlying asset’s price, the put option’s value drops by $0.50. A delta of -1.0 implies that the option’s value declines by the same amount as the increase in the underlying asset price.

The Practical Implications of Delta

Delta is a crucial component of option trading strategy, especially when considering risk management and profit potential.

- Risk Management: Delta helps traders assess the potential for loss on their option positions. A higher delta signifies greater sensitivity to the underlying asset’s price changes, potentially resulting in larger losses if the market moves against the trader’s position.

- Profit Potential: Delta can be used to estimate potential profit or loss depending on the expected direction of the underlying asset’s price. Higher delta positions offer greater profit potential but also carry increased risk, while lower delta options provide limited gains but offer some protection against losses.

Image: www.newtraderu.com

Understanding Delta’s Dynamic Nature

Delta isn’t static; it fluctuates. It’s influenced by factors like the option’s price, time to expiration, and the volatility of the underlying asset.

- Time Decay: As an option approaches its expiration date, its delta tends to decrease. This is because the time value of the option diminishes, and the price becomes more reliant on the underlying asset.

- Volatility: Elevated volatility leads to larger delta values. This is because the option’s value becomes more sensitive to fluctuations in the underlying asset.

Leveraging Delta for Strategic Trading

Delta Hedging: Managing Risk and Maximizing Gains

Delta hedging is a popular strategy that involves using combinations of options and underlying assets to neutralize the impact of price changes. This technique aims to minimize risk by offsetting the delta exposure of a particular position.

For example, if a trader holds a long position in 100 shares of stock with a delta of 1.0, they might sell 100 call options with a delta of 0.50 to offset the risk. This would result in a net delta of 0.50, reducing the overall risk associated with the stock position.

Delta Neutral Strategies: Riding the Wave of Volatility

Delta-neutral strategies are designed to profit from price changes in the underlying asset without being affected by the direction of these changes.

Suppose, for instance, a trader believes that the price of a stock will experience significant volatility but uncertainties about the direction of the movement. They could construct a delta-neutral strategy by selling a call option and buying a put option with equal deltas but opposite directions. This combination ensures that the losses on one side of the strategy are offset by gains on the other, effectively neutralizing the impact of price changes.

The Importance of Delta for Option Traders

Delta is an essential concept for traders of all levels. Understanding its impact on option pricing, risk management, and profit potential empowers traders to make informed decisions and create strategies that align with their investment goals.

By grasping the dynamics of delta, traders can fine-tune their option positions, manage risk effectively, and potentially generate substantial returns. Delta serves as a powerful tool to navigate the world of option trading, providing a clearer picture of the implications of market price fluctuations on their trades.

Beyond the Basics: A Deeper Dive into Delta

The world of options is vast, and delta is just one of many important factors to consider. Understanding the interplay between delta and other option Greeks, such as gamma, theta, and vega, further enhances your ability to make informed trading decisions.

Gamma, for instance, signifies how delta itself changes with every move in the underlying asset’s price. This factor is particularly significant when managing options positions in volatile markets.

Theta, or time decay, reflects the rate of value loss in an option as it approaches its expiration date. Understanding theta can help traders decide when to buy or sell options based on their time value and potential returns.

Vega measures how an option’s price responds to changes in volatility. Higher vega options are more sensitive to volatility fluctuations, potentially resulting in significant price increases or decreases depending on the market’s behavior.

By mastering these Greeks, traders can develop sophisticated strategies, understand the nuances of option pricing, and navigate the intricate world of options trading with greater confidence and control.

Delta In Option Trading

Embrace the Challenge: Unlocking Delta’s Power

While mastering delta may seem daunting at first, the benefits it provides are substantial. By dissecting the components of delta, understanding its dynamic nature, and exploring its applications, traders can elevate their understanding of options, refine their risk management tactics, and potentially unlock greater profit potential.

The journey of option trading is one of continual learning and adaptation. So, embark on this adventure, explore the intricacies of delta, and witness its transformative impact on your options strategies. The world of options is waiting to be conquered, one delta calculation at a time.