In the ever-evolving financial landscape, options trading offers traders an opportunity to capitalize on market movements while managing risk. Among them, T3 options present unique opportunities, but navigating them successfully requires a deep understanding of their intricacies. This article aims to demystify T3 options trading, providing you with a thorough overview of this strategy’s history, advantages, and implications. Whether you’re a seasoned trader or new to the world of options, this comprehensive guide will empower you with the knowledge and insights necessary to make informed decisions.

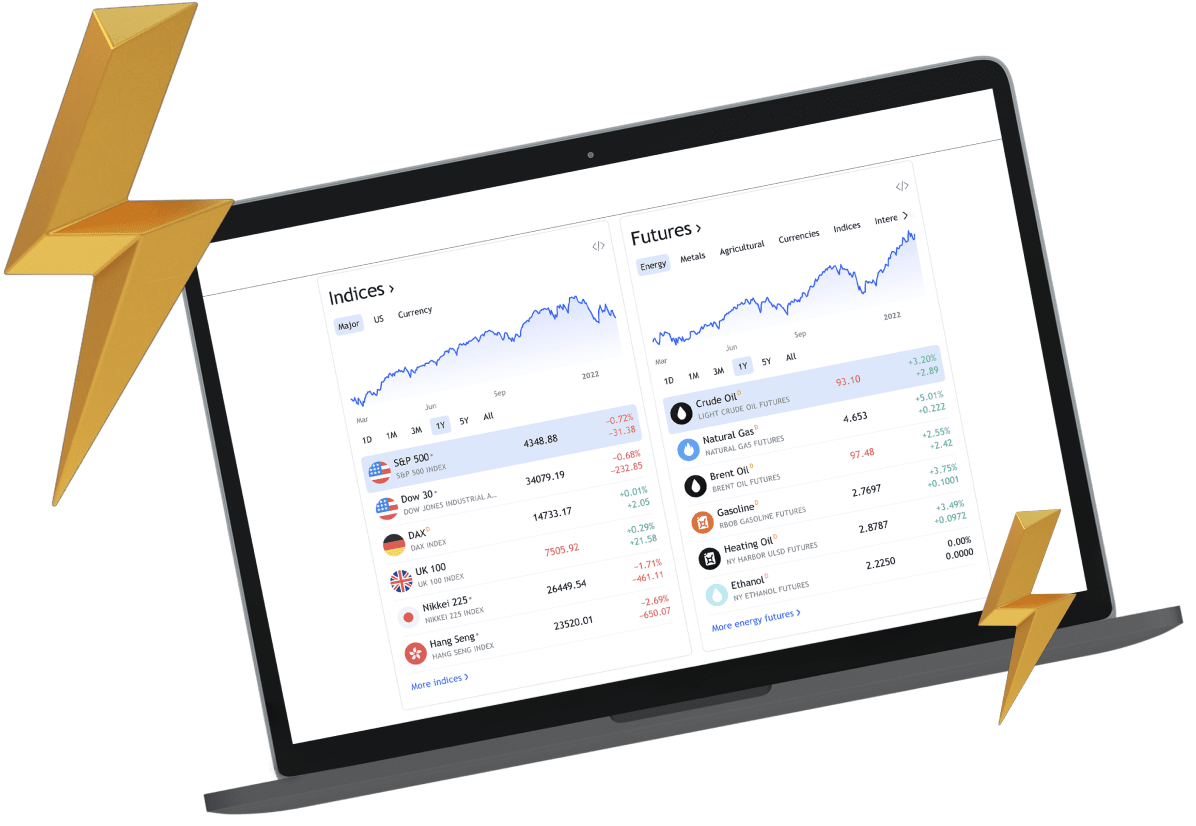

Image: www.t4trade.com

What is T3 Options Trading?

T3 options trading is a specialized strategy that involves the simultaneous purchase of three different options contracts: two calls and one put. The goal is to create a predefined risk and reward profile that aligns with the trader’s market expectations. This intricate strategy is designed for advanced traders who have a solid understanding of options pricing and volatility dynamics.

Unveiling the History and Fundamentals of T3 Options Trading

The origins of T3 options trading can be traced back to the 1980s when traders began experimenting with customized combinations to enhance their trading strategies. Over the years, this strategy has proven effective in various market conditions, leading to its widespread adoption by both institutional and retail traders.

At its core, T3 options trading aims to capitalize on market volatility while limiting the downside risk associated with traditional options positions. By combining long and short options contracts, traders can fine-tune their risk tolerance and seek opportunities within a specific range of market movements.

Breaking Down the Components of a T3 Options Trade

A typical T3 options trade consists of the following three contracts:

-

Long Call Option: This contract gives the trader the right, but not the obligation, to buy an underlying asset at a predefined strike price on the contract’s expiration date.

-

Short Call Option: This contract represents an obligation to sell an underlying asset at a specific strike price above the long call’s strike price on the expiration date.

-

Long Put Option: This contract gives the trader the right, but not the obligation, to sell an underlying asset at a specific strike price below the short call’s strike price on the expiration date.

Image: www.forexfactory.com

Understanding the Risks and Rewards of T3 Options Trading

Like any trading strategy, T3 options trading carries both potential risks and rewards. It’s crucial to approach this strategy with a thorough understanding of its implications to make informed decisions.

Advantages of T3 Options Trading:

-

Flexibility and Customization: The ability to combine multiple options contracts allows traders to tailor their risk and reward profile to align with market expectations.

-

Limited Downside Risk: The long put option acts as a protective hedge, mitigating potential losses in scenarios where the underlying asset’s price falls below anticipated levels.

-

Profit Potential: The combined leverage provided by the long and short call options offers the potential for significant profit if the underlying asset’s price fluctuates within a narrow range.

Risks of T3 Options Trading:

-

Complexity and Sophistication: This trading strategy is intricate and requires advanced knowledge of options trading and market dynamics. Inexperienced traders may struggle to navigate its complexities effectively.

-

Time Decay: Option premiums decay over time, which can erode profits, especially if the underlying asset’s price does not move as anticipated.

-

Market Volatility: While T3 options are designed to benefit from market volatility, extreme market swings can increase the risk of losses beyond the initial investment.

Expert Insights: Unlocking the Secrets of Successful T3 Options Trading

To help you navigate the complexities of T3 options trading, here are valuable insights from seasoned experts:

-

“Thoroughly research and analyze the underlying asset to develop a clear understanding of its historical price movements and future prospects.” – Sarah Wilson, Financial Analyst

-

“Monitor market volatility closely and adjust your trading strategy accordingly.” – Michael Jones, Options Trading Consultant

-

“Manage your emotions and stick to a disciplined approach, avoiding impulsive decisions that could lead to significant losses.” – David Smith, Investment Advisor

Navigating the Practical Aspects of T3 Options Trading

To put your understanding into practice, consider these practical tips for T3 options trading:

-

Start by experimenting with small trades until you become comfortable with the strategy’s intricacies.

-

Utilize historical charting and technical analysis to identify potential trading opportunities.

-

Monitor your trades actively and adjust them as market conditions evolve.

-

Seek opportunities where volatility premiums are elevated to maximize profit potential.

-

Be prepared to accept losses as an inevitable part of trading and avoid chasing after unrealistic profits.

T3 Options Trading

Conclusion: Empowering You to Make Informed Trading Decisions

T3 options trading is a sophisticated strategy that can provide opportunities for experienced traders to enhance their market exposure while mitigating risk. By understanding the foundational concepts, risks, and rewards associated with this strategy, you can make informed trading decisions. Remember to approach T3 options trading with patience, discipline, and a willingness to learn and adapt as you navigate the ever-changing financial landscape.