Options trading has emerged as a transformative tool in the financial landscape, offering investors the potential to enhance returns and manage risk. In the UK, online options trading platforms have opened up new opportunities for individuals seeking to navigate the complexities of this dynamic market. This comprehensive guide will delve into the world of options trading in the UK, providing an overview of core concepts, strategies, and the benefits it offers.

Image: www.transparenttraders.me

What is Options Trading?

Options are financial contracts that grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) on or before a particular date (expiration date). Options provide investors with the flexibility to mitigate risk, speculate on price movements, and generate income from market volatility.

Types of Options Trading

In the UK, there are primarily two types of options available:

- Equity Options: These options represent the right to buy or sell individual company stocks.

- Index Options: These options give investors the right to trade the underlying index, such as the FTSE 100 or the FTSE 250.

Benefits of Options Trading Online

UK-based online options trading platforms offer numerous advantages:

- Accessibility: Online platforms allow traders to participate in the market from anywhere with internet access.

- Convenience: These platforms provide user-friendly interfaces and automated order processing, streamlining the trading experience.

- Cost-effectiveness: Online brokers often charge lower fees compared to traditional brokerage firms.

- Real-time Data: Traders have access to live quotes, charts, and market updates, enabling them to make informed decisions.

Image: www.entrepreneurshipsecret.com

Understanding Options Terminology

Essential terms to know in options trading include:

- Strike Price: The price at which the underlying asset can be bought or sold.

- Expiration Date: The date on which the option contract expires.

- Premium: The amount paid to acquire the option contract.

- Intrinsic Value: The difference between the current asset price and the strike price when the option is in the money (meaning profitable).

Common Options Trading Strategies

- Covered Call: Selling a call option when owning the underlying asset.

- Naked Call: Selling a call option without having sufficient funds to cover a possible obligation to buy the asset.

- Protective Put: Buying a put option as a hedge against losses in an existing investment.

Risk Management in Options Trading

Options trading involves inherent risks. Essential risk management practices include:

- Limit Losses: Establish clear stop-loss levels to minimize potential losses.

- Diversify Portfolio: Spread investments across multiple options and underlying assets.

- Understand Volatility: Consider the impact of market volatility on option premiums.

Selecting an Online Options Trading Platform

When choosing an online options trading platform in the UK, consider the following factors:

- Regulation and Reputation: Ensure the platform is authorized by the Financial Conduct Authority (FCA).

- Fees and Commissions: Compare platform fees and commission structures to select the most cost-effective option.

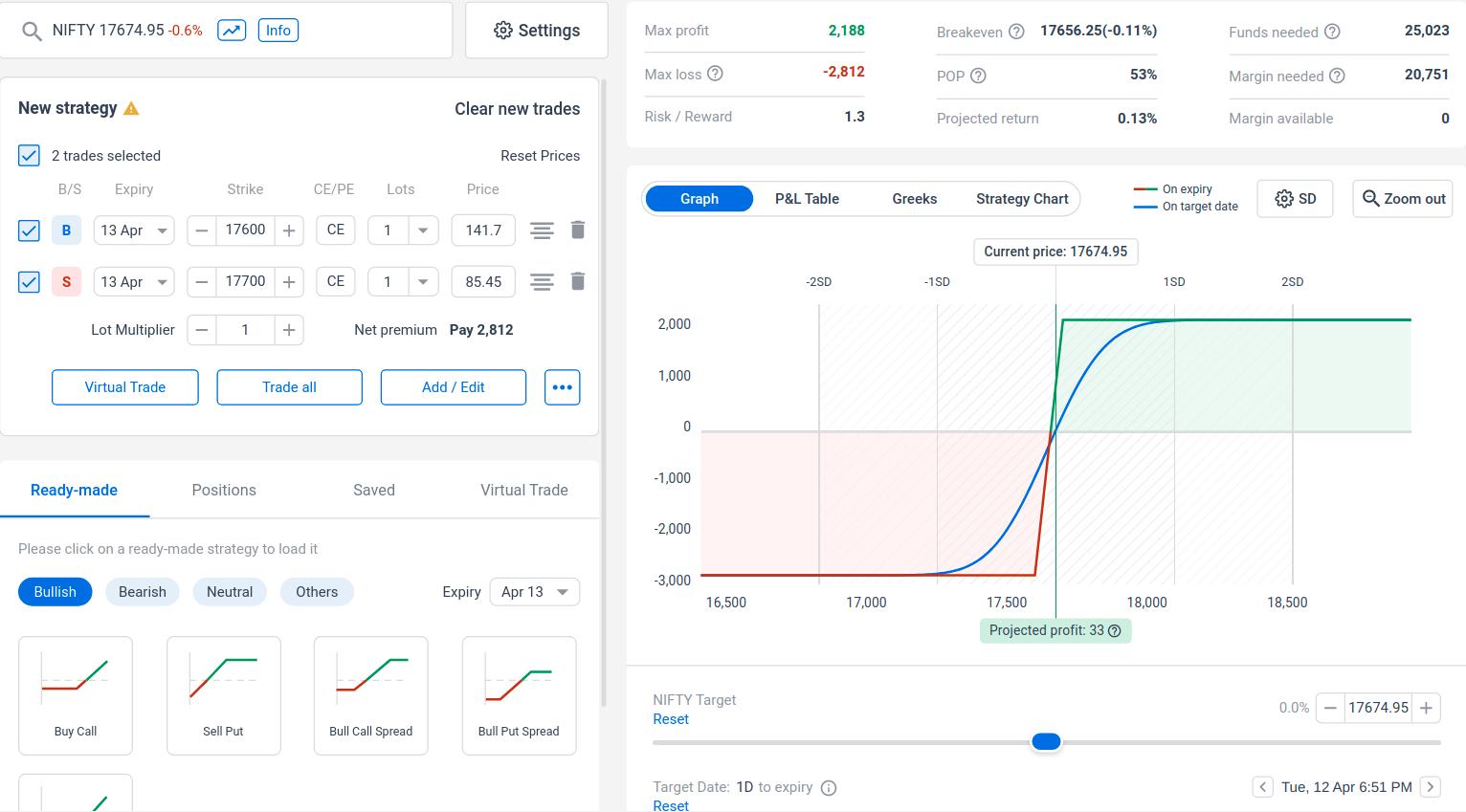

- Trading Tools and Features: Evaluate the platform’s trading tools, including real-time charting, technical indicators, and trade execution speed.

- Security: Opt for platforms employing robust security measures to protect user data and funds.

Options Trading Online Uk

Image: stewdiostix.blogspot.com

Conclusion

Options trading online in the UK can empower investors with the tools to enhance their financial strategies. By understanding the fundamental concepts, utilizing appropriate risk management techniques, and selecting a reliable trading platform, individuals can harness the potential of this dynamic market. Whether seeking to generate income or hedge against risks, options trading offers a valuable opportunity to navigate the complexities of financial markets and achieve investment goals.