Introduction

Image: www.linkedin.com

Imagine stepping onto the battlefield of the financial markets, armed with the knowledge to predict market movements like a seasoned strategist. In the realm of option trading, accurate market forecasts hold the key to unlocking significant gains and mitigating potential losses. This guide empowers you with the tools and techniques to decipher market trends, forecast future price movements, and make informed trading decisions.

Understanding Market Outlook Forecasting

Market outlook forecasting is an art that involves analyzing various factors to predict the future direction of market prices. By assessing current market conditions, historical data, and economic indicators, traders can gain valuable insights into potential market movements. While it requires a keen eye and thorough preparation, mastering this skill can elevate your trading endeavors to new heights.

Historical Analysis and Technical Indicators

Technical indicators are statistical tools that analyze historical price data to identify trends and patterns. Candlestick charts, moving averages, and support and resistance levels provide valuable insights into price action and market sentiment. By studying these indicators, traders can deduce patterns that may indicate future price movements. However, it’s important to remember that historical performance does not guarantee future results.

Economic Indicators and News Events

Economic indicators, such as GDP growth, inflation reports, and interest rate announcements, have a significant impact on market outlook. By monitoring economic releases and staying abreast of macroeconomic news, traders can anticipate potential market shifts and adjust their trading strategies accordingly. News events, such as political developments and natural disasters, can also have a sudden and significant impact on market prices.

Fundamental Analysis

Fundamental analysis delves into the intrinsic value of a stock, bond, or other underlying asset. This involves assessing factors such as financial performance, industry outlook, and management strategy. By understanding the fundamental strengths and weaknesses of an underlying asset, traders can make informed judgments about its potential price movements within the broader market context.

Expert Insights and Chart Patterns

Consulting experienced traders, analysts, and market gurus can provide valuable insights into market outlook. By listening to diverse perspectives and studying successful trading strategies, you can gain an edge in deciphering market movements. Additionally, identifying chart patterns, such as head-and-shoulders formations or cup-and-handle patterns, can offer clues about potential price reversals or continuations.

Scenario Planning and Risk Management

Once you have a forecast, it’s crucial to develop trading strategies that anticipate multiple scenarios. Consider both bullish and bearish outcomes and adjust your trades accordingly. Effective risk management practices, such as setting stop-loss orders and position sizing, are essential to mitigate potential losses and protect your trading capital.

Conclusion

Forecasting market outlook for option trading is a multifaceted endeavor that requires a combination of analytical skills, market knowledge, and experience. By implementing the techniques outlined in this guide, you can develop a deeper understanding of market dynamics and enhance your ability to make informed trading decisions. Remember, the financial markets are constantly evolving, so continuous learning and adaptability are key to long-term success. Embrace the challenges and leverage the insights provided in this article to forecast market outlook with confidence and navigate the ever-changing trading landscape.

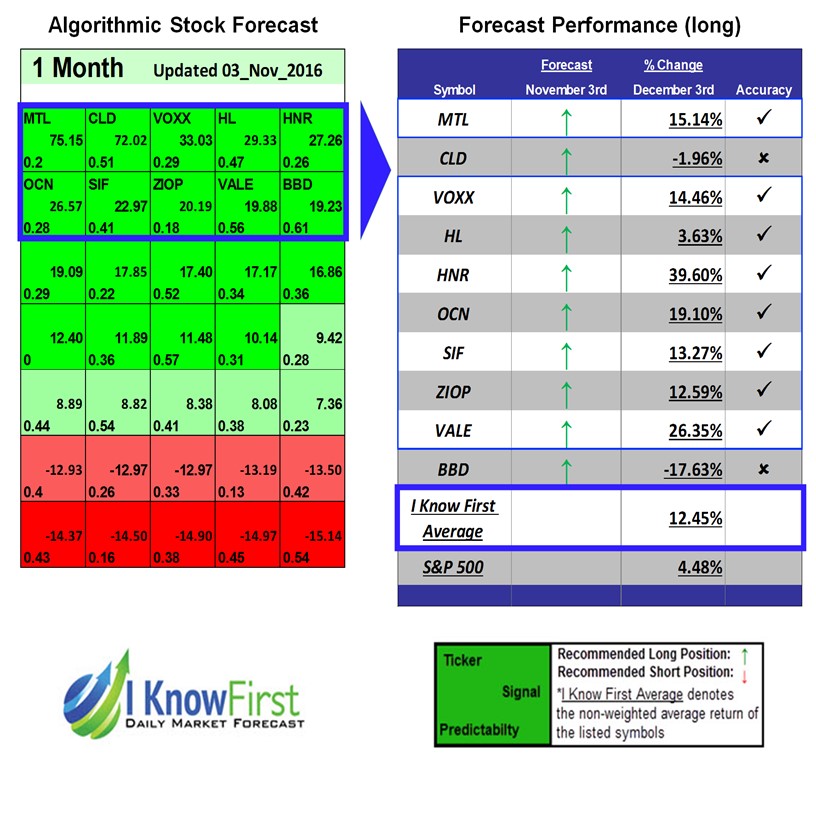

Image: iknowfirst.com

Hiw To Forecast Market Outlook For Option Trading

Image: www.youtube.com