Introduction:

Image: www.economagic.com

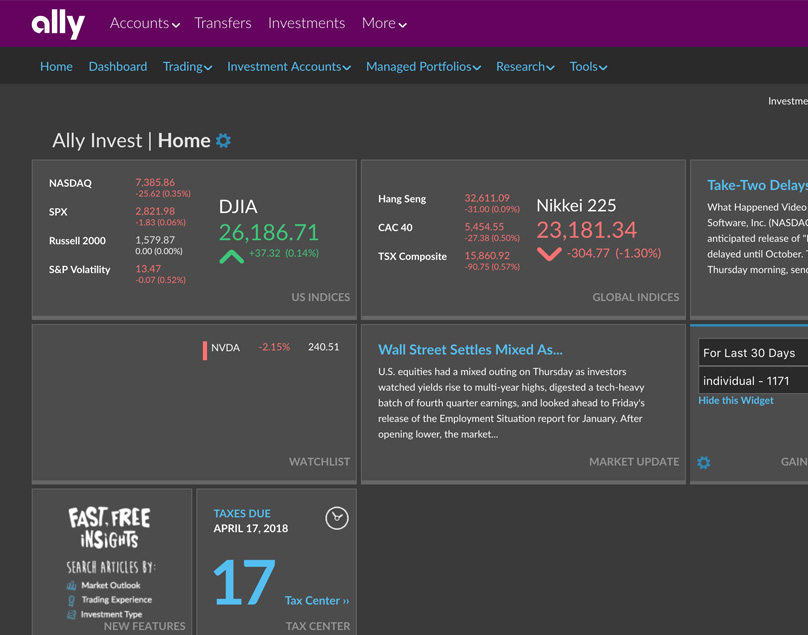

In the realm of investing, options trading stands out as a sophisticated strategy that offers both potential rewards and risks. As an investor, understanding the intricate nuances of option trading levels is paramount to navigating this complex landscape and making informed decisions. In this article, we endeavor to unravel the intricacies of Ally option trading levels, providing a comprehensive guide to empower you in your financial pursuits.

Ally option trading enables investors to speculate on the future price movements of underlying assets, such as stocks, indices, and commodities. By utilizing these contracts, traders can gain exposure to price fluctuations without the obligation to purchase or sell the underlying asset. Comprehension of option trading levels is thus essential to optimize strategies and mitigate potential losses.

Defining Option Trading Levels:

Options trading involves buying or selling contracts that confer the right, but not the obligation, to buy (in the case of call options) or sell (put options) the underlying asset at a specified price (strike price) on or before a pre-determined date (expiration date). The levels associated with option trading are interconnected and play a pivotal role in shaping trading strategies.

Key Level Components:

-

Underlying Price: The current market price of the underlying asset, which serves as the benchmark for option premiums and determines the intrinsic value of options.

-

Strike Price: The price at which the option holder can exercise their right to buy or sell the underlying asset.

-

Expiration Date: The date on which the option contract expires and the option holder’s rights cease to exist.

-

Option Premium: The price paid by the option buyer to the option seller for the option contract, which reflects the market’s assessment of the likelihood that the option will be exercised profitably.

-

Option Type: Whether it is a call option, giving the holder the right to buy, or a put option, granting the right to sell.

Understanding Option Premium Levels:

The option premium is a crucial aspect of option trading and is determined by several factors:

- The difference between the underlying price and the strike price (intrinsic value).

- The time remaining until the expiration date (time value).

- The implied volatility of the underlying asset (market’s expectation of future price fluctuations).

The relationship between underlying price, strike price, and time to expiration determines whether an option is in-the-money, at-the-money, or out-of-the-money. In-the-money options have positive intrinsic value, at-the-money options have negligible intrinsic value, and out-of-the-money options have no intrinsic value.

Trading Strategies and Level Considerations:

Traders can employ various strategies based on their market outlook and risk tolerance. Long calls and short puts are bullish strategies, while long puts and short calls are bearish strategies. Each strategy has its own considerations, and understanding the relevant levels is essential for successful execution.

Managing Option Trading Risks:

Option trading involves inherent risks, and proper risk management is paramount. Key factors to consider include:

-

Unlimited Potential Loss: Buying options involves unlimited potential loss, as the option holder is obligated to pay the full premium.

-

Time Decay: Time value erosion can significantly reduce the value of options, especially those with short expiration dates.

-

Implied Volatility: Market volatility can impact option premium and should be carefully considered when entering or exiting option positions.

Conclusion:

Mastering Ally option trading levels is a pivotal step for investors seeking to navigate the complex world of options. By understanding the key components and their interrelationships, traders can formulate informed strategies, mitigate risks, and unlock the potential for financial gains. It is imperative to approach option trading with a prudent mindset, seeking knowledge and guidance from reputable sources to embark on this challenging yet rewarding financial endeavor.

Image: www.youtube.com

Ally Option Trading Levels