Introduction

Option trading offers a complex yet lucrative avenue for generating income and mitigating risk within financial markets. Among various option strategies, selling put options stands out as a particularly compelling approach for investors seeking a balanced combination of yield and downside protection. This comprehensive guide will delve into the intricacies of selling put options, guiding you through the basics, strategies, and market trends to help you master this valuable income-generating technique.

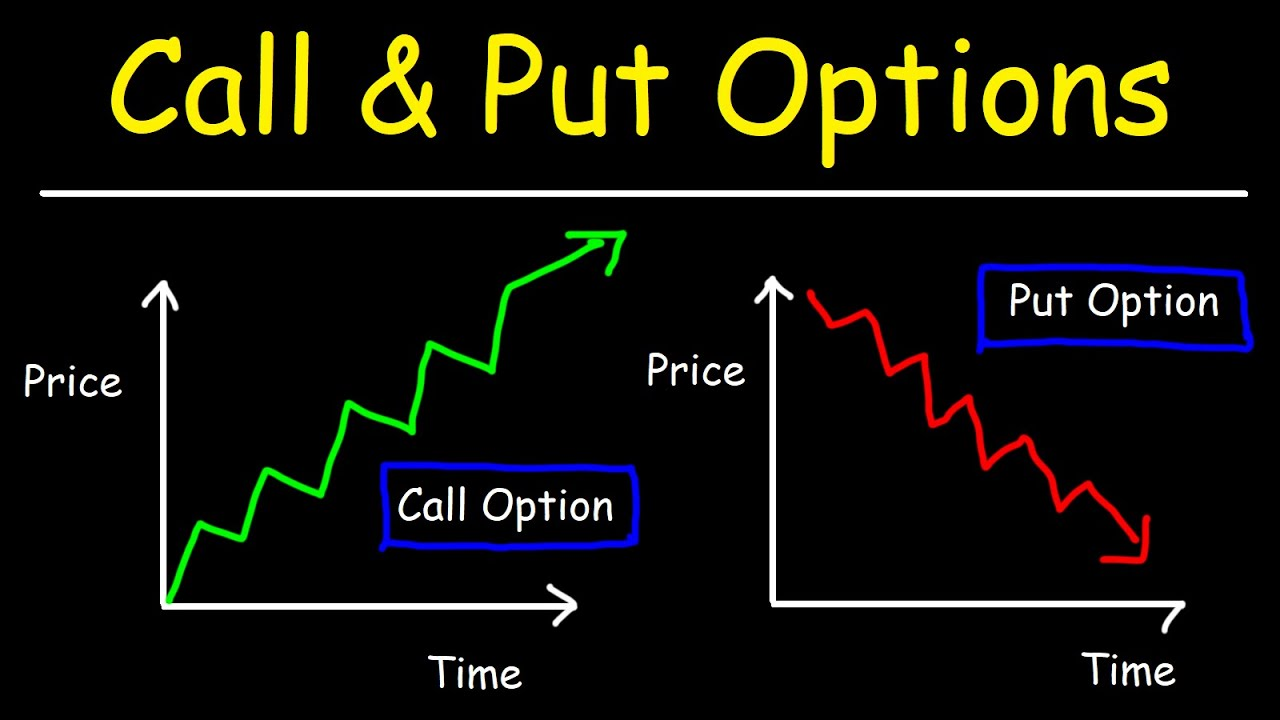

Image: tradewithmarketmoves.com

Understanding Selling Put Options

Selling a put option entails granting a buyer the right, but not the obligation, to sell a specific underlying asset to you at a predetermined strike price on or before a set expiration date. In exchange for granting this right, the option seller receives a premium from the option buyer. The seller is then obligated to purchase the underlying asset at the strike price if the buyer chooses to exercise the option before its expiration.

Advantages of Selling Put Options

-

Premium Income: The primary advantage of selling put options is the potential to generate income from the premium received from option buyers. This premium represents the upfront payment for assuming the potential obligation to purchase the underlying asset.

-

Downside Protection: By selling a put option, you’re effectively creating a downside cushion for yourself. If the price of the underlying asset falls below the strike price, you have the option to purchase it at a higher price than the market value, limit your potential loss.

-

Suitable for Both Neutral and Bullish Markets: Selling put options is particularly suitable for neutral or bullish market conditions where the expected price movement of the underlying asset is sideways or upward. In these scenarios, the probability of the option being exercised decreases, increasing the likelihood of profit from the premium received.

Basic Strategies for Selling Put Options

-

Straight Selling: This is the most straightforward strategy, where you sell a put option on an underlying asset you’re neutral or bullish on. The premium you receive compensates you for assuming the obligation to purchase the asset if it falls below the strike price.

-

Covered Selling: This strategy involves selling a put option while simultaneously owning the underlying asset below the strike price. This reduces the risk associated with selling a put option, as you already possess the underlying asset and cannot be forced to purchase it before expiration.

-

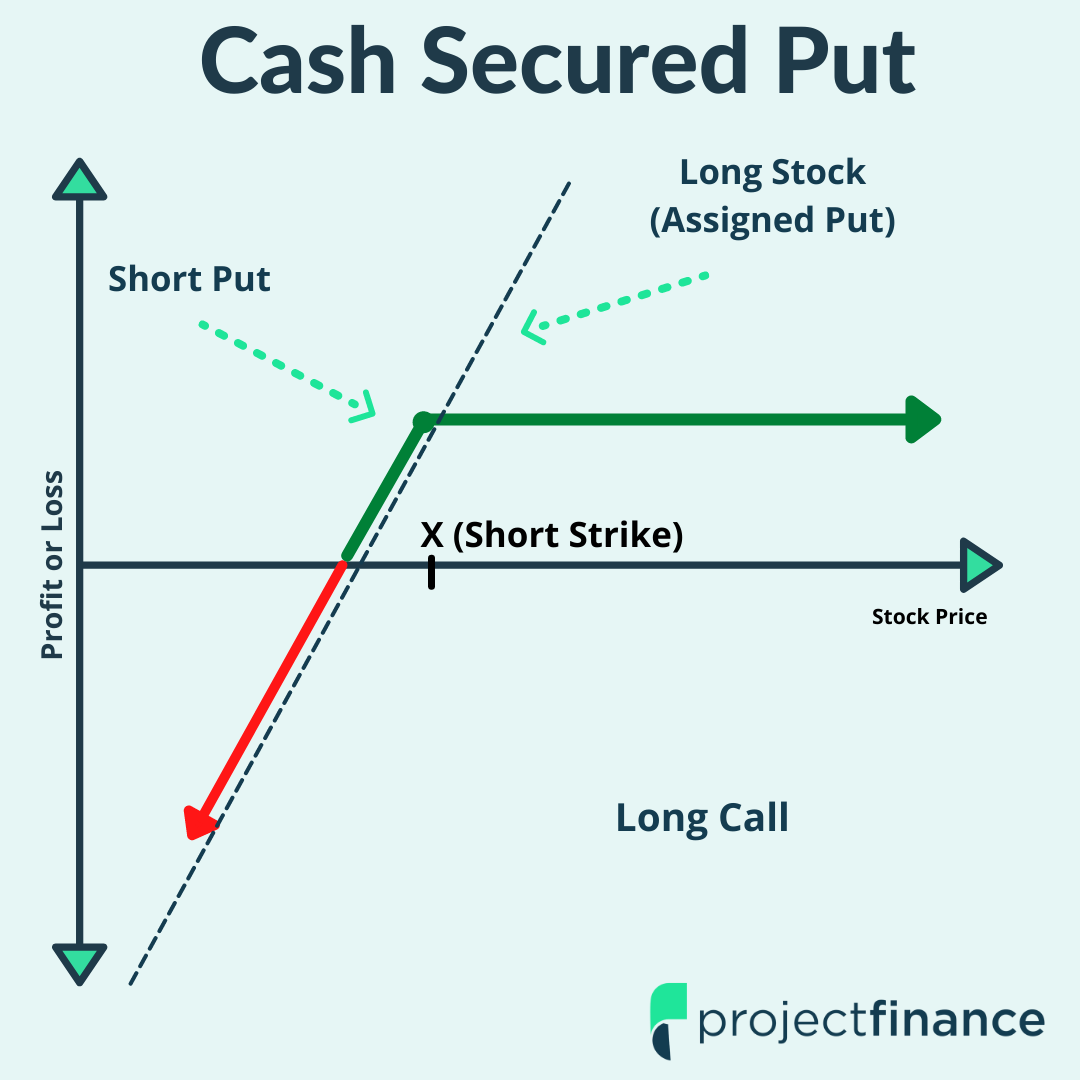

Cash-Secured Selling: Similar to covered selling, cash-secured selling also requires you to hold enough cash in your account to cover the purchase price of the underlying asset at the strike price. However, with this strategy, you don’t own the underlying asset until the option is exercised.

Image: www.projectfinance.com

Advanced Strategies for Experienced Traders

-

Naked Selling: This strategy involves selling a put option without owning the underlying asset or holding enough cash to cover the purchase price. This is a high-risk, high-return strategy that should only be considered by experienced traders.

-

Collar Strategy: This strategy combines selling a put option with buying a call option at a higher strike price. This limits both the downside and upside potential of the trade, reducing overall risk.

Market Trends in Option Trading

-

Growth of Retail Participation: Retail investors are increasingly participating in option trading, leading to increased liquidity and volatility in the options market.

-

Rise of Algorithmic Trading: Automated trading algorithms are being used by both retail and institutional traders, contributing to faster order execution and price discovery.

-

Regulation and Risk Management: Regulators are paying closer attention to option trading, introducing guidelines and requirements to manage risks associated with this complex market.

Option Trading Sell Put

Conclusion

Mastering the technique of selling put options can empower you to generate income, protect your portfolio from downside risks, and make the most of different market conditions. By understanding the nuances of this strategy, implementing suitable techniques, and keeping abreast of market trends, you can harness the full potential of option trading to meet your financial goals. Always remember to conduct thorough research, manage your risk carefully, and never invest more than you can afford to lose.