Have you ever wondered how seasoned options traders seem to navigate the complex world of derivatives with such confidence? Their secret weapon isn’t some magical crystal ball, but a powerful concept known as delta. Delta, in the realm of options trading, is more than just a Greek letter; it’s a numerical representation of a derivative’s sensitivity to changes in the underlying asset’s price. It’s the key to understanding how much your option’s value will fluctuate with each dollar move of the underlying asset.

Image: tradersexclusive.com

Understanding delta is crucial for any options trader, regardless of their experience level. Whether you’re a seasoned veteran or just starting your options trading journey, this guide will demystify the significance of delta and how you can use it to make informed trading decisions. The journey will take us through its definition, how it’s calculated, its relationship with other Greeks, and practical applications in various trading strategies.

What is Delta?

At its core, delta represents the change in an option’s price for every $1 change in the underlying asset’s price. It’s a measurement of how much your option will gain or lose in value if the underlying stock increases or decreases by $1. Delta ranges from -1 to +1, depending on the type of option, its price, and time to expiration.

A delta of 1 means that the option price will move dollar-for-dollar with the underlying asset. For example, if a stock is trading at $100 and a call option with a delta of 1 is priced at $5, a $1 increase in the stock price to $101 would likely make the option price rise to $6. On the other hand, a delta of 0 means the option price won’t change with the underlying asset.

Understanding Delta’s Significance

Delta plays a key role in various aspects of options trading, making it a critical factor to consider when crafting your strategies:

1. Risk Management

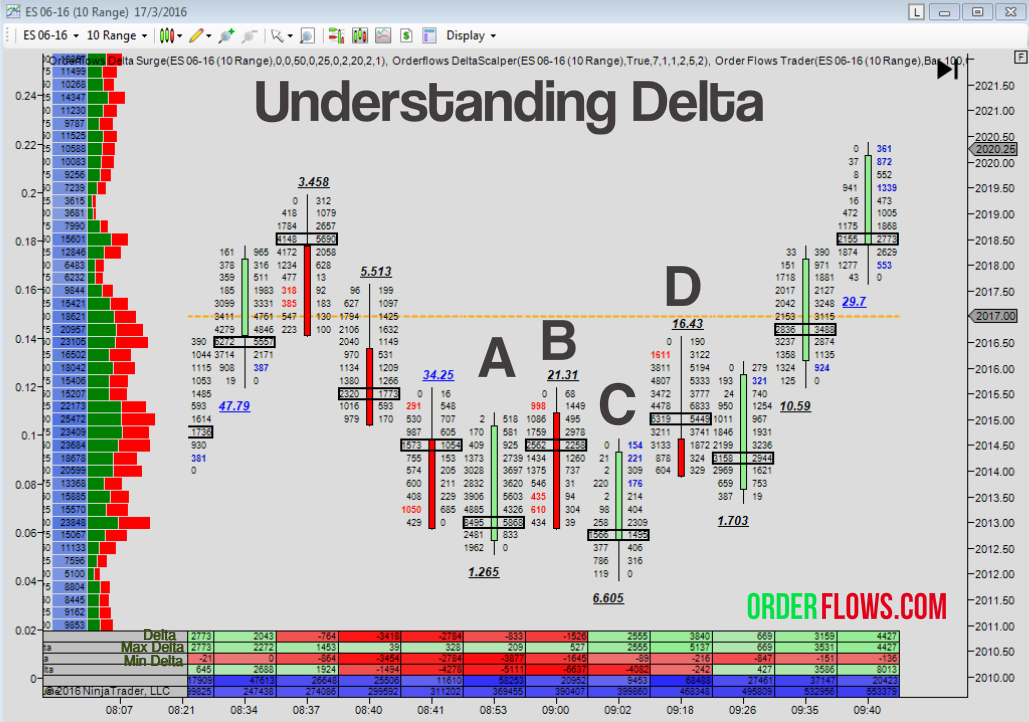

Delta is a fundamental tool for risk management. By understanding the delta of an option, you can anticipate the potential profit or loss with changes in the underlying asset’s price. High-delta options, with values closer to 1, are considered more “risky” but offer the potential for larger gains. Conversely, low-delta options, closer to 0, are considered less risky but carry the potential for smaller gains.

Image: www.orderflows.com

2. Hedging Strategies

Delta is often used in hedging strategies to mitigate risk. For instance, selling call options with a high delta can offset potential losses from a long stock position, as the call option will lose value if the stock price rises. Similarly, buying put options with a high delta can protect against losses if the stock price declines.

3. Directional Trading

Delta also plays a crucial role in directional trading strategies. Buying call options with a high delta is a bet that the underlying asset will increase in price. Conversely, buying put options with a high delta is a bet that the underlying asset will decline.

4. Volatility and Time Decay

Delta is influenced by other option Greeks, namely volatility and time decay. As an option approaches its expiration date, the delta generally moves towards either 0 or 1, becoming more sensitive to the underlying asset’s price movement. However, it is important to note that options lose value over time due to time decay, regardless of whether the price of the underlying asset goes up or down.

Types of Delta

You can’t talk about delta without understanding its different types:

1. Call Option Delta

Call option delta is positive and increases as the underlying asset’s price rises. It ranges from 0 to 1, with a closer value to 1 indicating a higher probability of the option finishing in the money.

2. Put Option Delta

Put option delta is negative and decreases as the underlying asset’s price rises. It ranges from -1 to 0, with a closer value to -1 indicating a higher probability of the option finishing in the money.

Calculating Delta

Although calculating delta involves complex mathematical formulas, you can readily access delta values through brokerage platforms, financial websites, and options pricing models.

Let’s illustrate how delta can be used in real-world trading scenarios. Suppose you are considering buying a call option on a stock trading at $100 with an exercise price of $105. If the call option has a delta of 0.6, you can anticipate that for every $1 increase in the stock price, the option price will likely increase by $0.60. If the stock price rises to $104, the option’s price is likely to rise around 0.60 * 4 = $2.40.

Delta in Options Trading Strategies

Various options trading strategies leverage delta for different purposes:

1. Covered Call Writing

Covered call writing involves selling a call option while holding the underlying stock. This strategy benefits from premium income from selling the call option, but limits potential upside gains of the stock. The trader aims for a stock price that stays flat or only slightly increases, as the delta of the call option will decrease, leading to a smaller loss in the value of the short call position.

2. Protective Put Buying

Protective put buying involves buying a put option on the underlying stock to protect against potential losses. This strategy offers downside protection for your stock investment. The trader aims for a stock price that stays flat or only slightly decreases, as the delta of the put option will decrease, leading to a smaller gain in the value of the long put position.

3. Straddle

A straddle involves buying both a call and a put option on the same underlying asset. This strategy can benefit from significant moves in the underlying asset’s price, both up and down. However, the maximum profit is limited to the amount of the premium paid, and the trader incurs losses if the underlying asset’s price remains relatively unchanged.

Delta In Trading Options

Conclusion

Delta is a powerful tool for options traders to understand and navigate the complexities of options trading. It allows for informed risk management, facilitates hedging strategies, and enables directional trading. Understanding how delta changes with time, volatility, and the asset’s price allows you to make more informed trading decisions. As you dive deeper into the world of options trading, remember that delta is your guide to unraveling the secrets of these derivatives. By embracing its role in your strategies, you can unlock the potential to maximize your profits while mitigating risks. So, get familiar with delta, and embark on a journey toward more profitable and successful options trading.