Introduction

Image: broker-reviews.org

Unlocking the potential of the financial markets often involves navigating the complex world of options trading. Amidst the plethora of trading platforms available, Vanguard stands out as a reliable and accessible option for both seasoned investors and those new to the world of options trading. In this comprehensive guide, we embark on a journey to elucidate Vanguard’s options trading levels, empowering you with the knowledge and insights to make informed investment decisions.

Understanding Options Trading Levels

Options trading involves the purchase of contracts that grant the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset, such as a stock or ETF, at a predetermined price and date. Vanguard offers a tiered system of options trading levels, each tailored to different levels of experience and risk tolerance.

Level 1: Basic Options Trading

This entry-level tier allows investors to trade simple call and put options on select underlying assets. It is designed for those who are new to options trading or have limited experience. Trades are subject to review and approval, ensuring that investors have a basic understanding of options trading principles before executing trades.

Level 2: Intermediate Options Trading

As an intermediate level, Level 2 grants access to a broader range of options strategies, including covered calls, cash-secured puts, and multi-leg options. Investors must demonstrate a higher level of options trading knowledge and experience to qualify for this level.

Level 3: Advanced Options Trading

Catering to experienced options traders, Level 3 offers unrestricted access to all options strategies and underlying assets. This level requires a high degree of trading proficiency and a thorough understanding of options trading concepts. Traders must pass a comprehensive exam to qualify for Level 3.

Choosing the Right Options Trading Level

Selecting the appropriate options trading level is crucial for managing risk and maximizing potential returns. Beginners should consider starting with Level 1 to gain a solid foundation. As their knowledge and experience grow, they can gradually progress to higher levels. Seasoned investors who are comfortable with advanced strategies and are willing to assume higher risk may opt for Level 3.

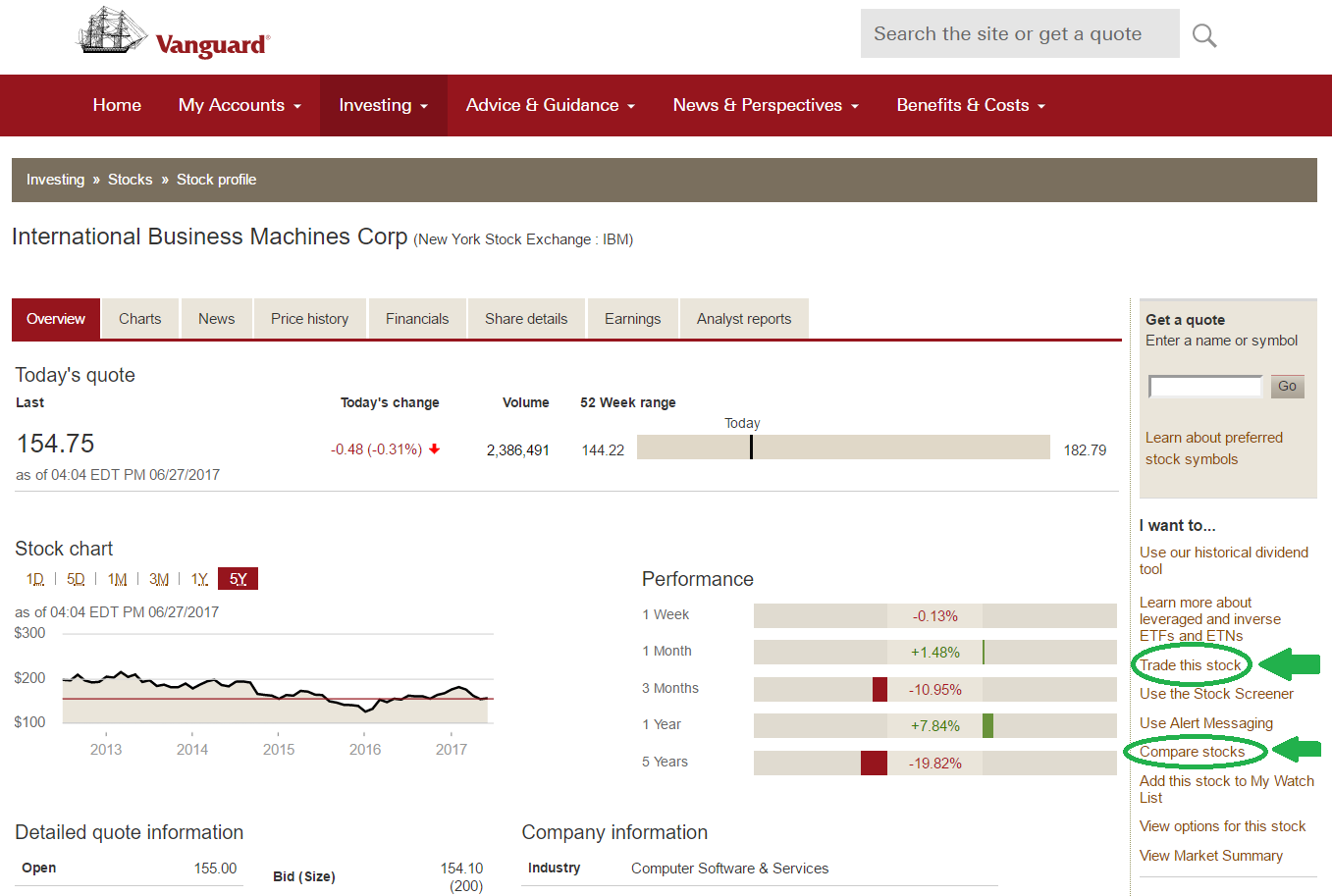

Vanguard’s User-Friendly Platform

Vanguard’s user-friendly options trading platform has been designed to facilitate seamless trading experiences for investors of all levels. The intuitive interface, comprehensive educational materials, and robust customer support make it an ideal choice for both novice and experienced traders.

Expert Insights and Actionable Tips

From Scott Cooley, CFA, Head of Options Trading at Vanguard:

- “Options trading can be a powerful tool for sophisticated investors seeking alternative income strategies or risk management techniques.”

- “It’s crucial to fully understand the mechanics and risks associated with options trading before entering into any contracts.”

Actionable Tips:

- Start small: Begin with a small amount of capital allocated to options trading to limit potential losses.

- Educate yourself: Continuously expand your knowledge through books, online courses, and webinars.

- Seek professional guidance: Consider consulting with a qualified financial advisor to help you navigate complex options trading strategies.

- Monitor your performance: Regularly review your options trades and make adjustments as needed.

Conclusion

Vanguard’s options trading levels provide a customizable framework that caters to investors of all experience levels. By understanding the features and nuances of each level, you can make informed decisions and navigate the world of options trading with confidence. Remember, investing involves inherent risks, and it’s essential to approach it with a well-informed and strategic mindset. Embrace the journey of investing and unlock the potential of the financial markets with Vanguard’s trusted guidance.

Image: www.ira-reviews.com

Vanguard Options Trading Levels

Image: thevideoink.com