Introduction

The Chicago Board of Trade (CBOT) is one of the world’s leading derivatives exchanges, and its grain options market is one of the most important in the world. CBOT grain options began trading in 1984, and they have since become an essential tool for managing risk in the grain industry.

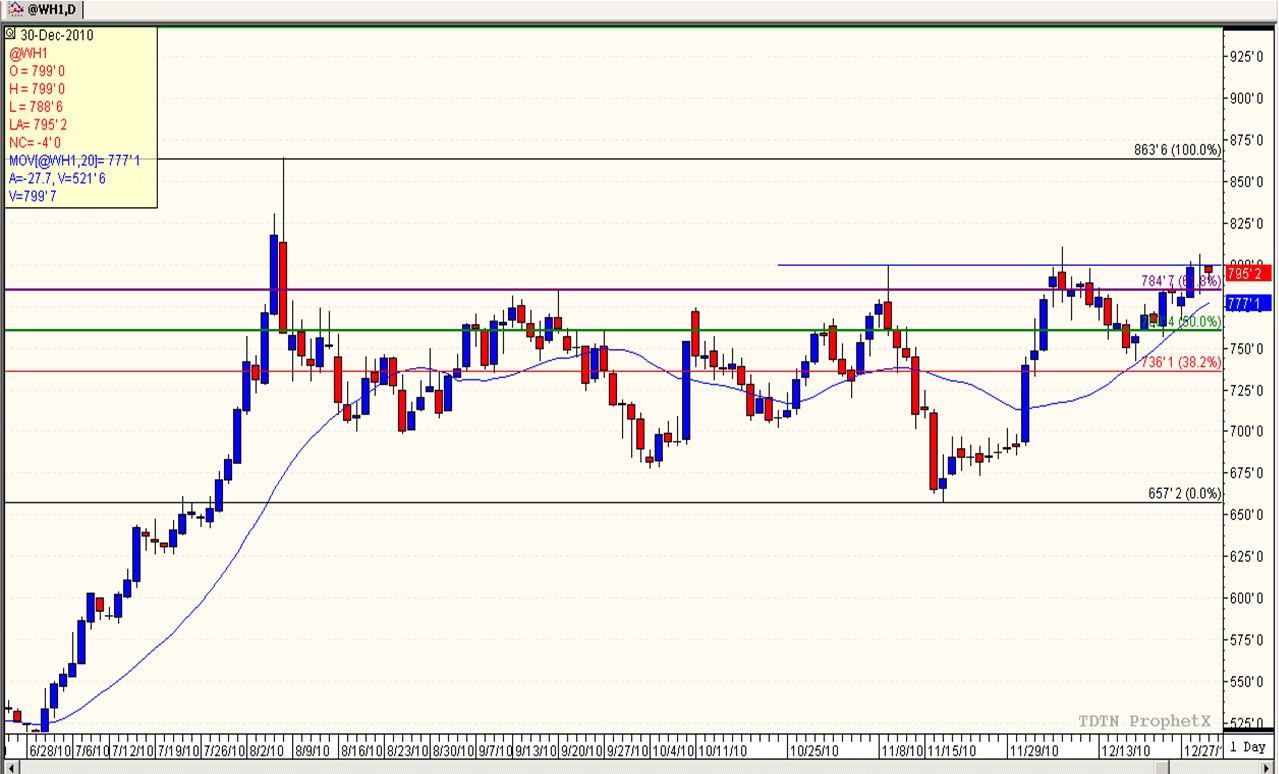

Image: grainmarketingplans.blogspot.com

History of CBOT grain options

The CBOT was founded in 1848, and it has a long history of trading agricultural commodities. In the early days, the CBOT traded only physical commodities, but it began trading futures contracts in 1865. Futures contracts are standardized contracts that obligate the buyer to purchase and the seller to deliver a certain quantity of a commodity at a set price on a future date.

CBOT grain options were introduced in 1984. Options are similar to futures contracts, but they give the buyer the right, but not the obligation, to buy or sell a certain quantity of a commodity at a set price on a future date. This flexibility makes options a valuable tool for managing risk, and they have become increasingly popular in recent years.

How CBOT grain options work

CBOT grain options are traded on the CBOT’s electronic trading platform. The minimum contract size is 5,000 bushels, and the contracts are traded in increments of 100 bushels. The trading unit for wheat, corn, and soybean options is one bushel.

CBOT grain options are available for a variety of delivery months, including the current month, the next month, and the following three months. The strike prices for CBOT grain options are set in increments of $0.25 per bushel.

Benefits of trading CBOT grain options

There are a number of benefits to trading CBOT grain options, including:

- Price risk management: CBOT grain options can be used to manage price risk in the grain industry. For example, a farmer who is expecting a large harvest can buy a put option to protect against a decline in prices.

- Income generation: CBOT grain options can be used to generate income. For example, an investor who believes that the price of corn is going to rise can buy a call option.

- Speculation: CBOT grain options can be used to speculate on the price of grain. For example, a trader who believes that the price of wheat is going to rise can buy a call option.

Image: www.tradingview.com

Risks of trading CBOT grain options

There are also a number of risks associated with trading CBOT grain options, including:

- Loss of principal: The value of CBOT grain options can fluctuate, and there is a risk of losing money when trading options.

- Time decay: The value of CBOT grain options decays over time, which means that the option buyer can lose money even if the price of the underlying commodity does not change.

- Margin requirements: Trading CBOT grain options requires margin, which is a deposit that is used to cover potential losses.

What Year Did Cbot Grain Options Begin Trading

Image: www.canadiancattlemen.ca

Conclusion

CBOT grain options are a valuable tool for managing risk in the grain industry. They offer a number of benefits, but there are also a number of risks associated with trading options. It is important to understand the risks and benefits before trading options.