Trading SPX Index Options: A Comprehensive Guide to Navigating Market Volatility

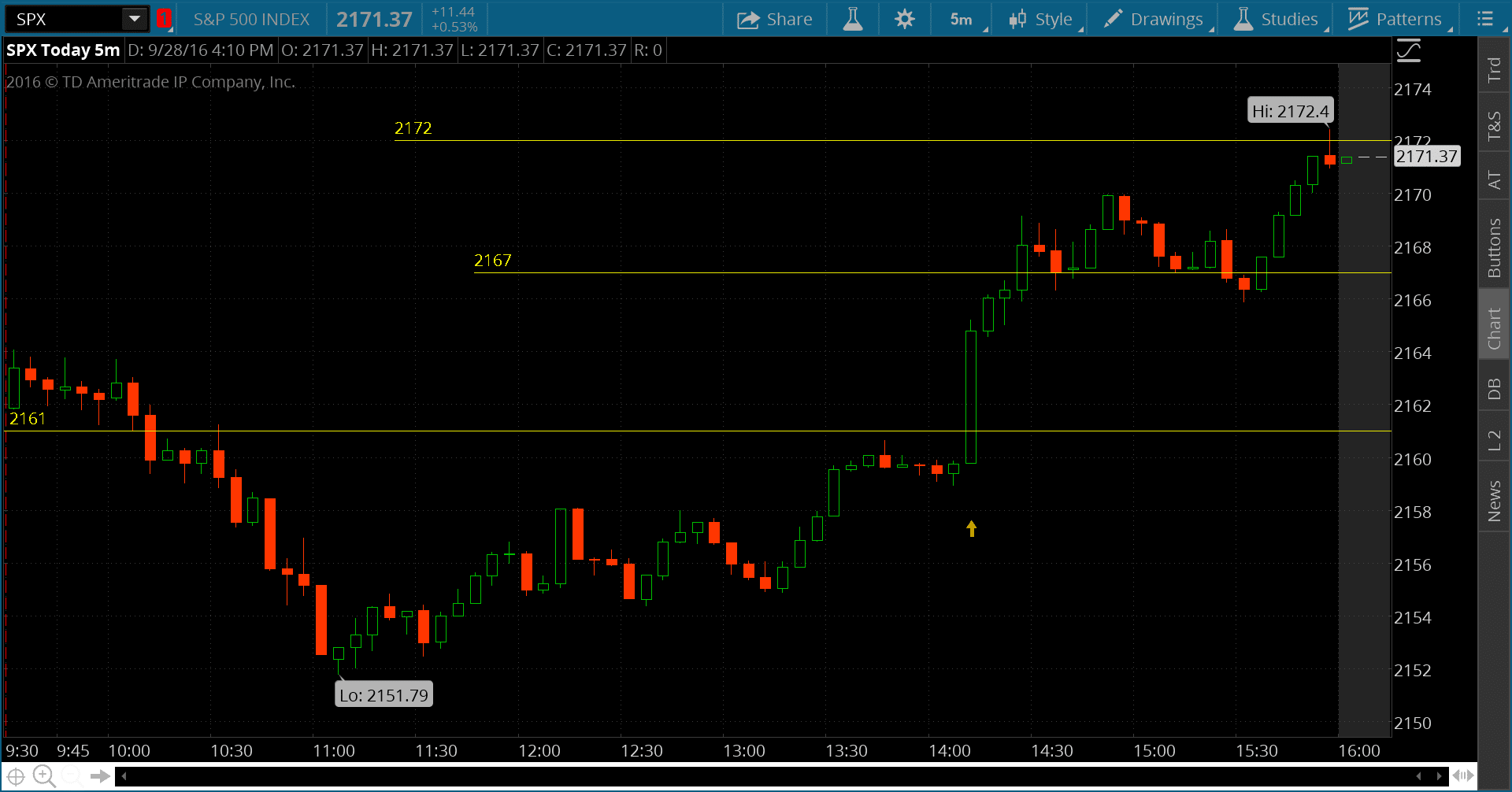

Image: www.spxoptiontrader.com

In today’s rapidly evolving financial landscape, the ability to effectively manage risk and capitalize on market opportunities is more critical than ever. Trading SPX index options has emerged as a powerful tool for investors seeking sophisticated exposure to the US stock market.

Understanding SPX Index Options

The SPX Index is a widely recognized barometer of the overall performance of the US large-cap stock market, comprising 500 of the most prominent companies. SPX index options grant traders the flexibility to capitalize on (or hedge against) potential movements in the index’s future value.

Benefits of Trading SPX Index Options

- Diversification: SPX index options offer a single instrument that provides broad exposure to the US stock market, effectively diversifying risk across multiple companies.

- Liquidity: The SPX Index is one of the most heavily traded financial instruments worldwide, ensuring high volume and liquidity for its corresponding options contracts.

- Versatility: SPX index options can be employed for both bullish and bearish market sentiments, allowing traders to tailor strategies to suit their individual risk appetite and market outlook.

Key Concepts

- Call Option: Grants the holder the right to buy the underlying asset (SPX Index) at a predetermined price (strike price) on or before a specified date (expiration date).

- Put Option: Grants the holder the right to sell the underlying asset (SPX Index) at a predetermined strike price on or before the expiration date.

- Delta: Measures the sensitivity of an option’s price to changes in the underlying asset’s price.

- Theta: Indicates the rate of decay in an option’s value as it approaches its expiration date.

Navigating Trading Strategies

- Bullish Call Strategy: Purchase a call option when anticipating a rise in the SPX Index. Potential profit is limited by the difference between the strike price and the higher index value at expiration.

- Bearish Put Strategy: Purchase a put option when anticipating a decline in the SPX Index. Potential profit is limited by the difference between the strike price and the lower index value at expiration.

- Spread Trading: Combines the purchase and sale of options with different strike prices and/or expiration dates to create customized risk-reward profiles.

Expert Insights and Actionable Tips

- “Proper risk management is paramount in SPX index options trading. Traders should carefully consider their risk tolerance and monitor their positions diligently,” advises market analyst Mark Armstrong.

- “Stay informed about major economic events and market trends that can influence the SPX Index. Monitor economic indicators such as GDP, unemployment, and consumer sentiment,” emphasizes financial expert Alina James.

Conclusion

Trading SPX index options offers investors a versatile and potentially lucrative way to tap into the dynamics of the US stock market. By understanding the key concepts, employing strategic approaches, and incorporating expert insights, traders can enhance their market navigation skills and potentially maximize their returns while effectively managing risk. Remember, investing involves inherent risks, and traders should exercise prudence and consult with qualified financial advisors before making any investment decisions.

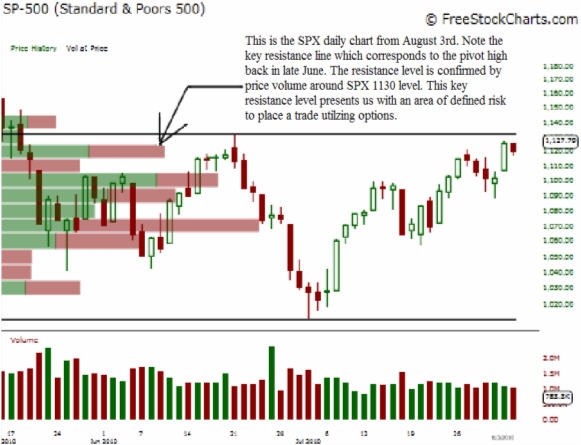

Image: www.youtube.com

Trading Spx Index Options

Image: www.thegoldandoilguy.com