In today’s rapidly evolving financial landscape, options trading has emerged as a powerful tool to enhance portfolio returns and mitigate risks. Among the diverse options available, SPX options leverage the Standard & Poor’s 500 index (S&P 500) as the underlying asset, offering boundless possibilities for savvy investors.

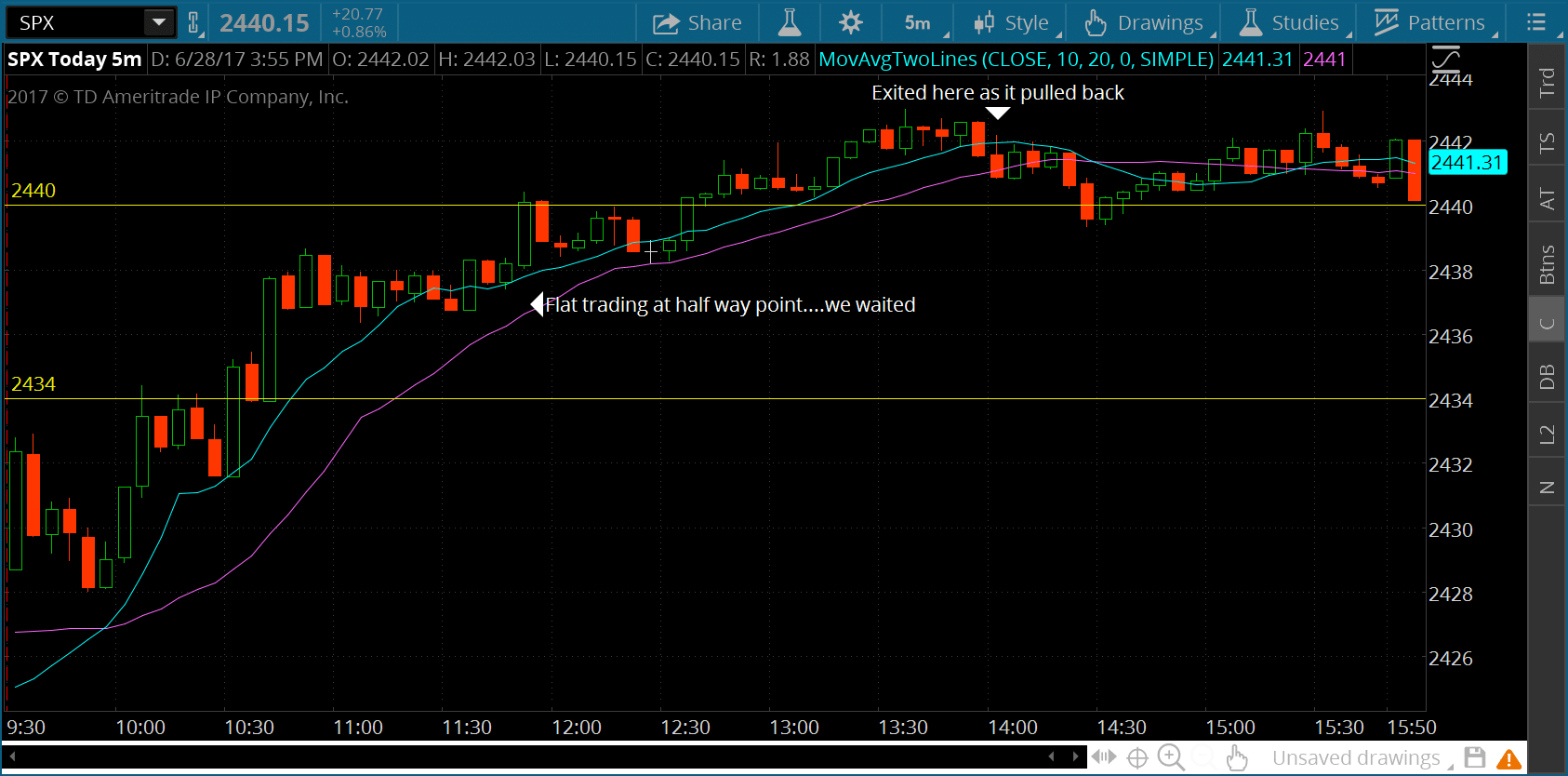

Image: www.spxoptiontrader.com

SPX options represent an enticing avenue for both experienced traders and those seeking a strategic edge. They empower traders to navigate market fluctuations with precision, enabling them to profit from both rising and falling prices. Given their multifaceted nature, a thorough exploration of SPX options trading strategies is warranted.

Navigating SPX Options Trading Terrain

To delve into the realm of SPX options trading, it is imperative to cultivate a foundational understanding of the underlying concepts. SPX options grant traders the right, but not the obligation, to buy (call options) or sell (put options) underlying S&P 500 futures contracts at a specific price (strike price) on a predetermined date (expiration date).

SPX options are traded on the CBOE Futures Exchange (CFE) and are available in both European and American versions. European options can only be exercised on the expiration date, while American options afford the flexibility to exercise anytime up to the expiration date.

Unleashing the Power of SPX Option Strategies

Traders who embrace SPX options trading strategies harness the potential to tailor their portfolio to specific market conditions and risk appetites. Among the most popular strategies are:

1. Covered Calls: This strategy involves owning the underlying S&P 500 futures contract and selling call options with a higher strike price. It is suitable for bullish investors seeking to generate income by collecting premiums.

2. Protective Puts: This strategy pairs a long position in the underlying S&P 500 futures contract with the purchase of put options with a lower strike price. It provides downside protection in volatile markets.

3. Iron Condor: This neutral strategy combines the sale of both call and put options with different strike prices. It aims to capitalize on quiet market movements with limited volatility.

Harnessing Expert Insights

Seasoned veterans in the arena of SPX options trading have gleaned invaluable insights over the years. Their wisdom can serve as a beacon for aspiring traders navigating the complexities of this market.

One of the key principles emphasized by experts is the importance of managing risk. Options trading carries inherent risks, and it is crucial to define clear risk parameters and strictly adhere to them.

Another valuable insight is to embrace a disciplined approach. Emotional decision-making can cloud judgment and lead to costly mistakes. By implementing a well-defined trading plan and sticking to it, traders can enhance their prospects of success.

Image: www.spxoptiontrader.com

Spx Options Trading Strategies

Empowering Conclusion

SPX options trading strategies unlock a world of possibilities for those seeking to maximize returns and mitigate risks in the ever-evolving financial markets. With a thorough understanding of the underlying concepts and by leveraging insights from experts, ambitious investors can harness the power of SPX options to navigate市場uncertainties with confidence and achieve their financial aspirations.

Remember, the journey to mastering SPX options trading is an ongoing one. Continuously seek knowledge, analyze市場trends, and adapt your strategies accordingly. With dedication and a thirst for excellence, you can unlock the transformative potential of SPX options and unleash your financial prowess.