Introduction: Unveiling the Secrets of SPX Options

In the vast and ever-evolving landscape of financial trading, SPX options stand out as a formidable force for discerning investors. Understanding the intricate workings of SPX options is paramount to unlocking their immense potential and navigating the dynamic market with confidence. This comprehensive guide will empower you with the knowledge and strategies necessary to master the SPX options arena, ensuring your triumph in the complex chess game of financial gain.

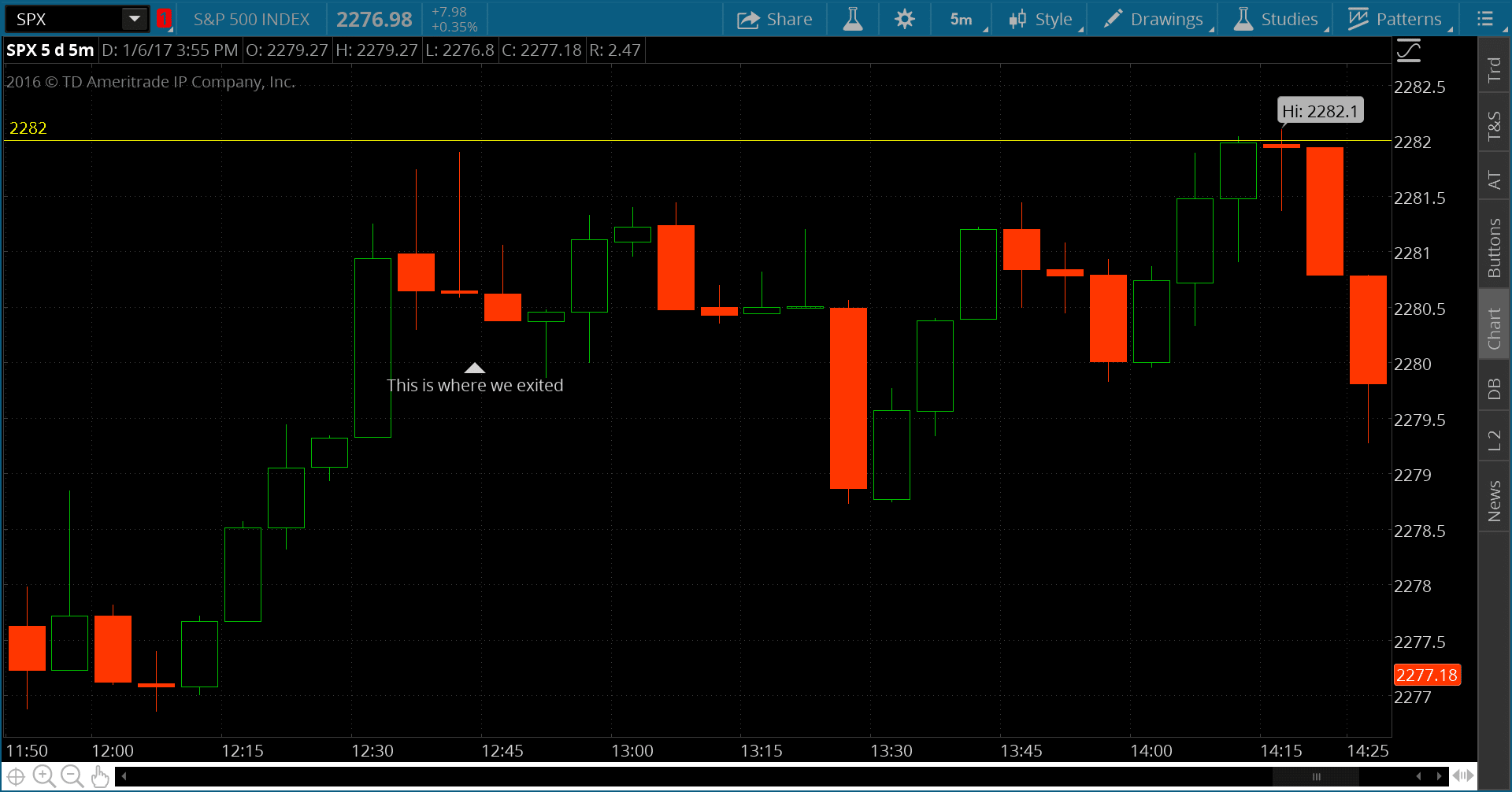

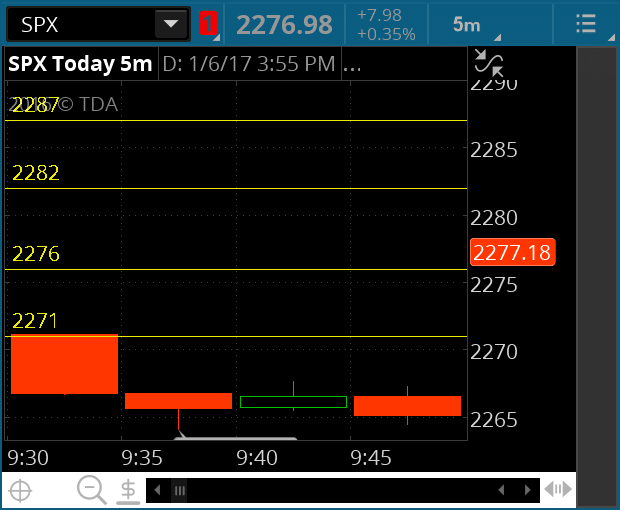

Image: www.spxoptiontrader.com

Demystifying SPX Options: A Definition

SPX options are financial instruments that derive their value from the Standard & Poor’s 500 index (S&P 500). They grant the holder the right, but not the obligation, to buy (call options) or sell (put options) a specific number of S&P 500 index shares at a predetermined price (strike price) on or before a set date (expiration date). This unique characteristic allows traders to speculate on the future direction of the S&P 500 index, potentially profiting from both rising and falling markets.

Understanding the Mechanics of SPX Options

-

Contracts and Premiums: The Cornerstones of SPX Options

SPX options are standardized contracts traded on the CBOE (Chicago Board Options Exchange). Each contract represents 100 shares of the S&P 500 index. When purchasing an SPX option, you pay a premium to the seller, which reflects the option’s current market value. This premium is calculated based on factors such as the stock price, time to expiration, volatility, and the strike price.

-

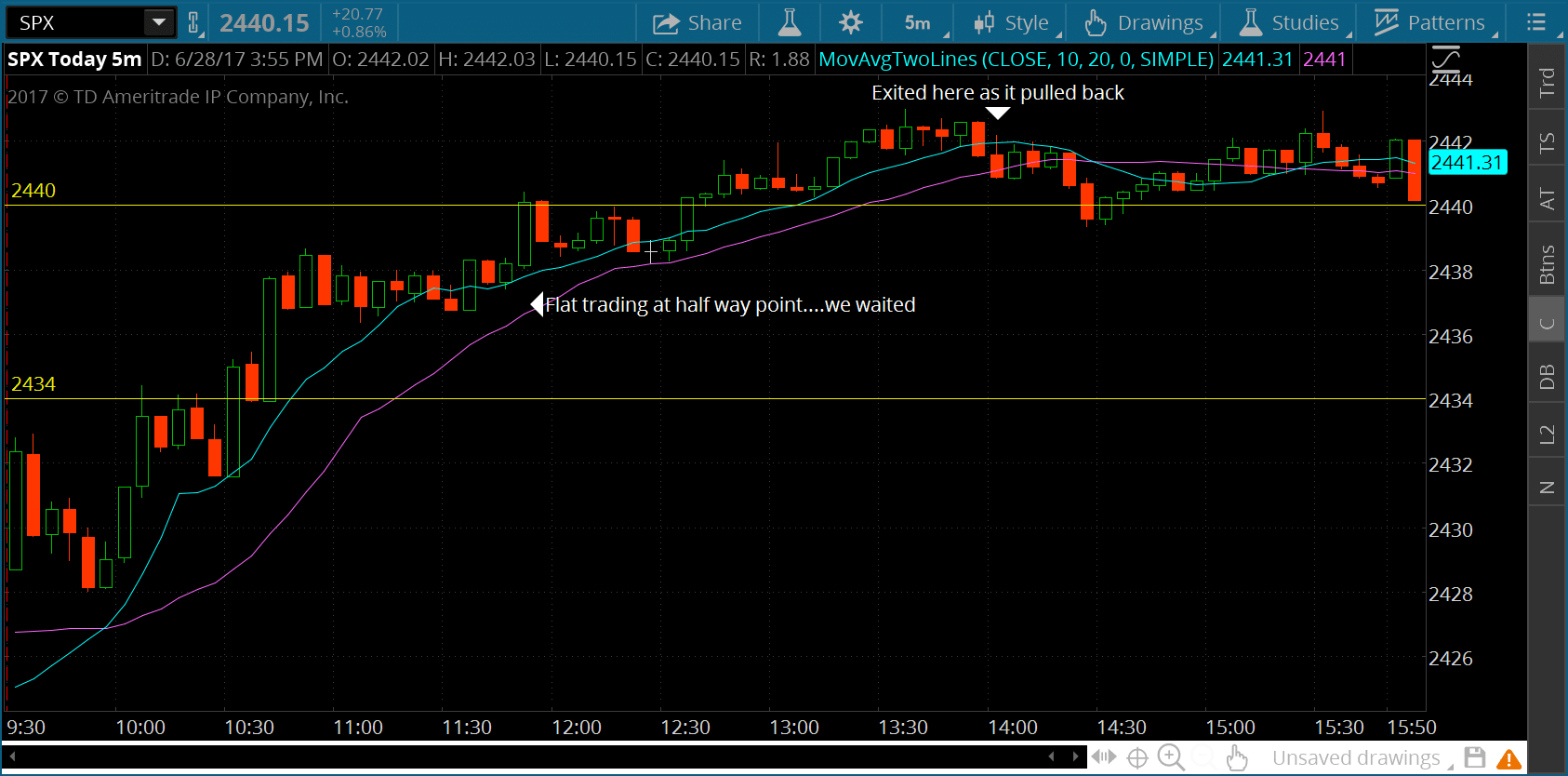

Image: www.spxoptiontrader.comCall Options: Betting on a Bullish Future

Call options convey the right to buy shares of the S&P 500 index at the strike price on or before the expiration date. If the S&P 500 index rises above the strike price, the call option holder can exercise the option and purchase the shares at a favorable price, realizing a profit.

-

Put Options: Capitalizing on a Bearish Outlook

Put options, on the other hand, give the holder the right to sell shares of the S&P 500 index at the strike price on or before the expiration date. When the S&P 500 index falls below the strike price, the put option holder can exercise the option and sell the shares at a higher price, securing a profit.

-

Expiration Dates: The Timeframe of Opportunity

SPX options have specific expiration dates, typically ranging from a few weeks to several months. The time remaining until expiration influences the option’s premium. Options with shorter expirations tend to have lower premiums, while longer-term options come with higher premiums.

Mastering the SPX Options Market: Strategies and Insights

-

Hedging with SPX Options: Shielding Your Portfolio from Risk

SPX options offer a powerful tool for risk management. By purchasing a put option, investors can protect their stock portfolio from potential market declines. If the market dips, the put option will increase in value, offsetting any losses in your stock positions.

-

Speculating on Market Trends with SPX Options

SPX options also present lucrative opportunities for speculators. By accurately predicting the direction of the S&P 500 index, traders can profit from both bullish and bearish markets. Call options can be employed when anticipating a market upswing, while put options are suitable for betting on downturns.

-

Utilizing Greeks to Enhance Precision: Metrics for Informed Trading

Greeks are metrics that measure the sensitivity of an option’s price to changes in various factors, such as stock price, time to expiration, and volatility. Understanding and utilizing Greeks can significantly improve option trading strategies, enabling traders to make more informed decisions.

The Evolution of SPX Options: Emerging Trends and Techniques

-

The Rise of Electronic Trading: Streamlining the Options Market

Electronic trading platforms have revolutionized the SPX options market, providing traders with instant access to market data and execution capabilities. This enhanced efficiency reduces transaction costs and execution delays, empowering traders to seize opportunities in a rapidly evolving market environment.

-

Volatility Trading: Harnessing Market Fluctuations for Profit

Volatility is a crucial factor in option pricing. Traders who specialize in volatility trading seek to profit from fluctuations in the S&P 500 index’s volatility. By employing advanced strategies, such as straddles and strangles, volatility traders aim to capitalize on market uncertainty and market movements.

Spx Options Trading System

Image: www.spxoptiontrader.com

Conclusion: Embracing the Power of SPX Options

Harnessing the power of SPX options requires a deep understanding of their mechanics, strategies, and the latest market trends. By mastering the concepts outlined in this comprehensive guide, you will possess the knowledge and confidence to navigate the dynamic world of SPX options trading, unlocking its immense potential for both risk management and profit generation. Remember, knowledge is the cornerstone of success, and the insights provided here will serve as your compass in the exhilarating journey of SPX options trading.