Navigating the Trading Market: Basics of Options Trading

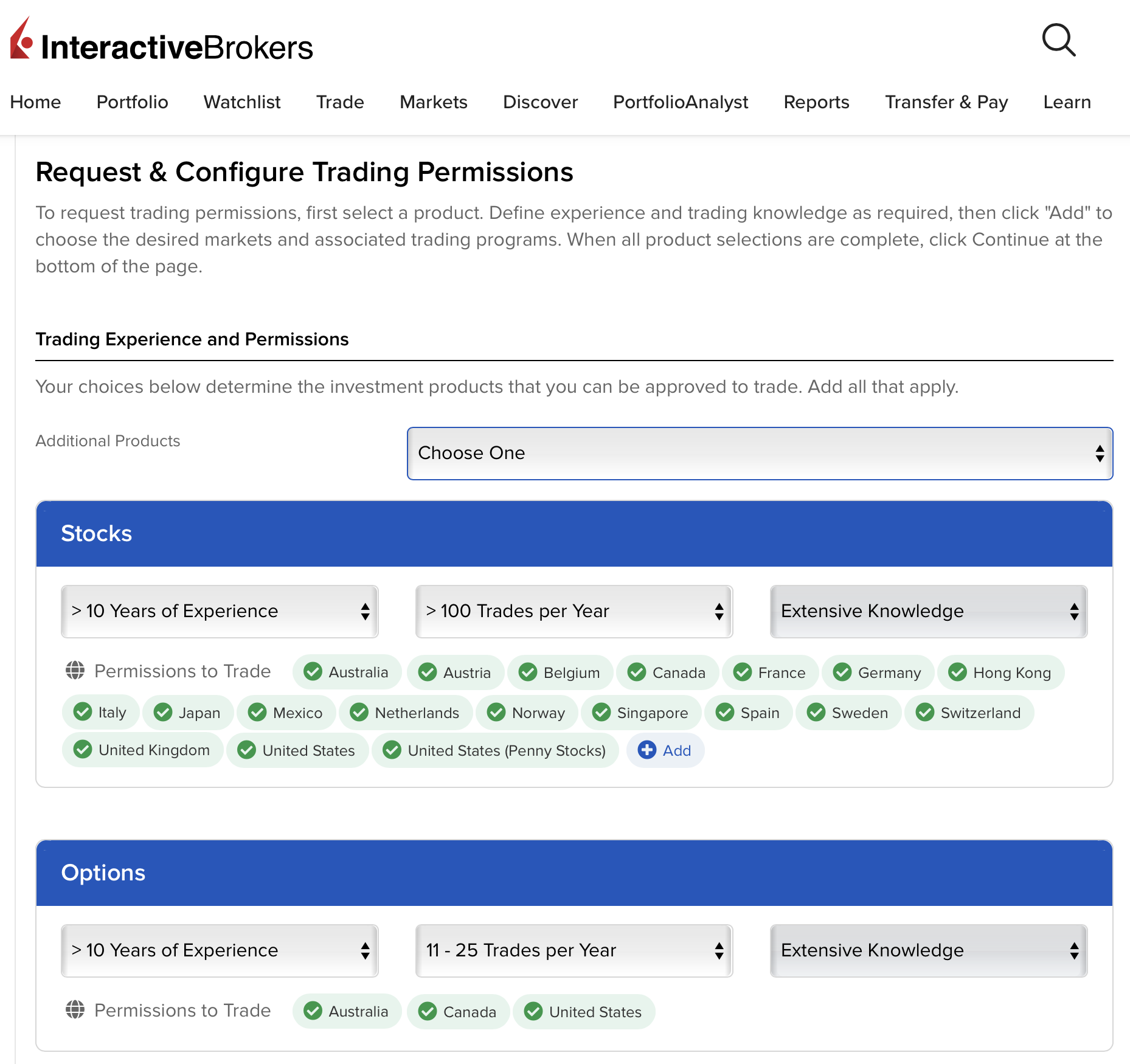

For aspiring stock market traders, understanding the nuances of options trading is crucial. Unlike a standard buy-and-hold approach, options trading involves purchasing contracts that give you the right, but not the obligation, to buy or sell an underlying asset at a specified price and date. This unique aspect necessitates a special type of trading account known as an options trading account.

Image: www.mstock.com

Types of Options Trading Accounts

To engage in options trading, you will need to establish an options trading account with a reputable brokerage firm. These accounts typically come in two forms:

- Margin Account: Margin accounts provide you with the ability to borrow funds from your broker, leveraging your capital. This allows you to control a larger amount of options contracts with a smaller amount of personal funds. However, it also exposes you to potential losses that could exceed the initial amount invested.

- Cash Account: Cash accounts limit you to trading with only the funds you have available in your account. This mitigates the risk of significant losses, as you can only lose up to the amount you have in your account.

Choosing the Right Options Trading Account for You

The choice between a margin and cash account depends on several factors, including your trading experience, risk tolerance, and capital availability.

- Experience and Risk Tolerance: If you are a novice trader or have a lower risk tolerance, a cash account is a safer option, as it limits your potential losses.

- Capital Availability: Margin accounts require more capital than cash accounts, as you must maintain a certain minimum balance to maintain your margin privileges.

- Trading Strategies: If you intend to employ complex trading strategies, such as writing options, a margin account may be more suitable as it provides greater flexibility.

Expert Advice for Options Trading

To enhance your options trading success, seasoned traders recommend the following strategies:

- Educate Yourself: Thoroughly understand the basics of options trading before diving in. This includes learning about contract types, expiration dates, and risk management.

- Start Small: Begin trading with a small amount of capital until you gain confidence in your abilities.

- Manage Your Risk: Use stop-loss orders to mitigate potential losses and never risk more than you can afford to lose.

- Consider Your Timeframe: Options have expiration dates, so you need to carefully consider when to exit your positions.

Image: gfmasset.com

Frequently Asked Questions

Q: Can I open an options trading account with any brokerage firm?

A: Not all brokerage firms offer options trading accounts. Choose a firm that specializes in options trading and has a strong reputation.

Q: Is options trading suitable for everyone?

A: Options trading involves significant risk and is not suitable for everyone. It is important to assess your financial situation, experience, and risk tolerance before considering options trading.

Q: How much money do I need to open an options trading account?

A: The initial deposit requirement varies among brokerage firms. Contact the firm you wish to open an account with for specific details.

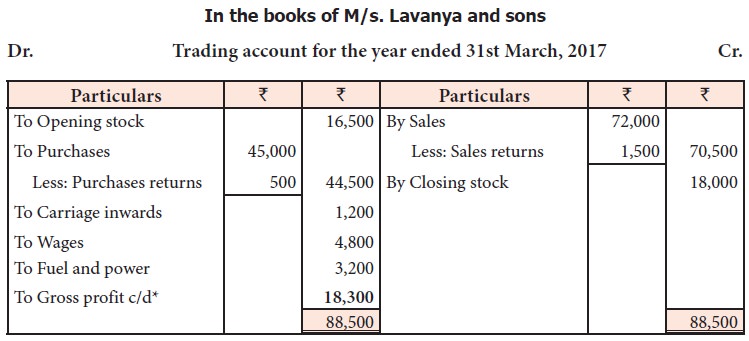

What Kind Of Account Required For Trading Options

Image: www.bank2home.com

Conclusion

Understanding the type of account required for trading options is essential for aspiring traders to navigate the options market effectively. By choosing the right account type, educating yourself, adhering to sound trading principles, and seeking expert advice, you can increase your chances of success in this dynamic and potentially lucrative trading arena. So, are you ready to explore the world of options trading?