In the realm of investing, two prominent account types stand out: option trading accounts and cash accounts. Each offers distinct advantages and caters to different investor profiles. Whether you’re a seasoned trader or just starting out, understanding the nuances of these two account types is crucial for making informed decisions.

Image: ask.modifiyegaraj.com

To embark on this journey, I can’t help but recall my initial encounter with option trading. Back then, I was intrigued by the allure of potentially exponential returns, yet simultaneously apprehensive about the risks involved. It was then that I came across a seasoned trader who guided me through the complexities of this financial instrument.

What is an Option Trading Account?

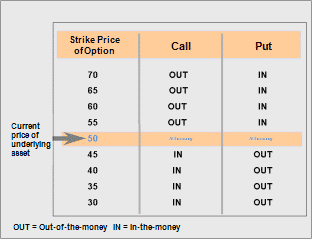

An option trading account grants you the privilege of trading options contracts, which are financial instruments that confer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified date. By speculating on the future price movements of the underlying asset, traders seek to profit from favorable market conditions.

What is a Cash Account?

A cash account, as its name implies, operates solely on the cash available in your brokerage account. With a cash account, you can buy and sell stocks, bonds, mutual funds, and ETFs using the settled funds in your account. Unlike option trading accounts, cash accounts do not allow you to engage in options trading.

Understanding the Key Differences

Before delving into the intricacies of option trading vs. cash account, it’s imperative to comprehend their fundamental differences:

- Trading Instruments: Option trading accounts empower traders to execute options contracts, while cash accounts limit trading to traditional financial instruments like stocks and bonds.

- Leverage and Risk: Options trading offers leverage, enabling you to control a substantial position with a relatively small initial investment. However, this leverage amplifies both potential gains and losses, elevating the risk factor.

- Trading Strategies: Option trading accounts unlock a vast array of trading strategies, allowing you to tailor your investments to specific market conditions and risk tolerance. These strategies often involve sophisticated techniques like spreads and combinations.

- Capital Requirements: Option trading accounts typically require a higher minimum balance than cash accounts, as the potential for losses necessitates a bigger financial cushion.

Image: ask.modifiyegaraj.com

Choosing the Right Account for You

The decision between an option trading account and a cash account hinges on several factors, including:

- Investment Objectives: If you seek the potential for substantial returns, albeit with elevated risk, an option trading account may be suitable. If preserving capital is your primary concern, a cash account is likely a better choice.

- Risk Tolerance: Option trading involves inherent risk, so it’s essential to assess your risk tolerance and invest accordingly. If you’re not comfortable with the potential for significant losses, a cash account is more appropriate.

- Trading Experience: Option trading demands a solid understanding of options strategies and market dynamics. If you’re new to investing or lack experience in options trading, a cash account provides a safer environment.

- Financial Situation: Option trading accounts often necessitate a higher minimum balance to mitigate potential losses. Ensure your financial situation aligns with the capital requirements of an option trading account.

Tips for Option Trading

If you opt for an option trading account, heed these expert tips:

- Educate Yourself: Before diving into option trading, equip yourself with comprehensive knowledge of options contracts, strategies, and risk management techniques.

- Start Small: Begin with small trades to gain experience and avoid substantial losses while refining your skills.

- Manage Risk: Utilize stop-loss orders and position sizing strategies to limit your potential losses and safeguard your capital.

- Monitor the Market: Stay abreast of market news, economic data, and industry trends to make informed trading decisions.

General FAQs on Option Trading vs. Cash Account

- Q: Which account type is safer?

A: Cash accounts are generally considered safer than option trading accounts due to their lower risk profile. - Q: Can I switch between option trading and cash accounts?

A: Yes, you can usually switch between account types with your brokerage firm. However, certain requirements and fees may apply. - Q: Is option trading profitable?

A: Option trading can be profitable, but it also carries significant risk. Success in option trading hinges on market knowledge, trading skills, and proper risk management.

Option Trading Vs Cash Account

Image: optionstradingiq.com

Conclusion

Option trading and cash accounts offer distinct avenues for investing, each with its advantages and risks. By comprehending the differences, assessing your personal circumstances, and following the expert tips provided, you can make an informed decision that aligns with your financial goals and risk tolerance. Embrace the world of investing with confidence, knowing that you have the knowledge to navigate these account types effectively.

Now, I’m curious to hear your thoughts. Which account type piques your interest more, option trading or cash account? Share your insights and let’s embark on this investment journey together.