Introduction:

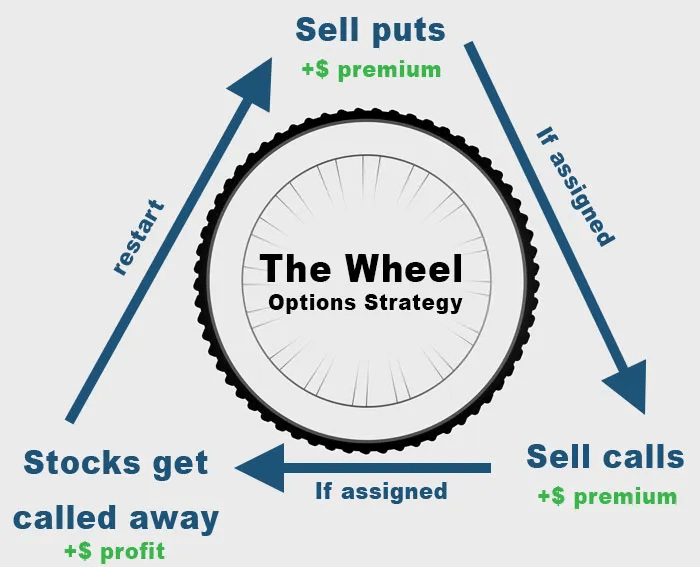

In the ever-evolving world of finance, option trading has emerged as a powerful tool for investors seeking to enhance their returns or manage risks. Among the various strategies employed, the Wheel Strategy stands out as a particularly captivating approach. This multifaceted strategy involves a combination of selling cash-secured put options and buying covered call options, offering multiple avenues for profit. In this comprehensive guide, we will delve into the intricacies of the Wheel Strategy, exploring its mechanics, advantages, and considerations.

Image: bullishbears.com

Unveiling the Wheel Strategy: A Circle of Opportunities

The Wheel Strategy derives its name from the cyclical nature of its execution. It encompasses selling a cash-secured put option with a strike price below the current stock price and simultaneously purchasing a covered call option with a strike price above the current stock price. This strategic positioning creates a “wheel” of possibilities, enabling investors to potentially profit from both bullish and bearish market movements.

Mechanics of the Wheel Strategy: Delving into the Process

Initiating the Wheel Strategy involves identifying an underlying stock with a desired price target. The cash-secured put option is sold with a strike price lower than the current stock price, while the covered call option is purchased with a strike price higher than the current stock price. As the stock price fluctuates, the options contracts generate premium income for the investor, while also potentially limiting potential losses.

Advantages of the Wheel Strategy: Embracing the Power of Flexibility

The Wheel Strategy offers a plethora of benefits for savvy investors. It provides an opportunity to generate income through options premiums, regardless of market direction. Additionally, it allows investors to potentially limit their risk by selling put options at a strike price below the stock price, ensuring a cushion against significant price declines. Furthermore, the strategy offers flexibility, enabling adjustments to strike prices and expiration dates as market conditions evolve.

Image: optionstradingiq.com

Considerations for Implementing the Wheel Strategy: Know the Risks

While the Wheel Strategy offers numerous advantages, it is crucial to acknowledge the inherent risks involved. These include the potential for assignment of sold put options, which could result in the investor being obligated to purchase shares of the underlying stock at the strike price. Moreover, the strategy requires careful selection of strike prices and expiration dates to optimize potential returns and manage risks effectively.

Tips and Expert Advice: Enhancing Your Wheel Strategy

Seasoned investors have accumulated valuable insights and advice for executing the Wheel Strategy successfully. One such tip involves selecting liquid underlying stocks with high trading volume to ensure option liquidity and favorable premiums. Additionally, traders are advised to monitor market conditions closely and make adjustments to their strategy as needed. Seeking guidance from experienced professionals can also enhance your understanding and execution of the Wheel Strategy.

Frequently Asked Questions: Unraveling the Intricacies

Q: Is the Wheel Strategy suitable for all investors?

A: While the Wheel Strategy can be a powerful tool, it is best suited for experienced traders with a solid understanding of options trading and risk management.

Q: What is the ideal holding period for options in the Wheel Strategy?

A: The optimal holding period depends on market conditions and personal preferences, but most traders hold options for several weeks to months.

Q: Can the Wheel Strategy generate income in both bullish and bearish markets?

A: Yes, the Wheel Strategy can generate income through premium collection regardless of market direction, making it a versatile option for various market conditions.

What Is The Wheel In Option Trading

Image: investgrail.com

Conclusion: Embracing the Wheel Strategy’s Versatility

The Wheel Strategy stands as a testament to the ingenuity and versatility of option trading. It offers investors a multifaceted approach to generating income and managing risks while providing the flexibility to adapt to changing market conditions. By understanding the mechanics, advantages, considerations, tips, and frequently asked questions discussed in this comprehensive guide, you can harness the power of the Wheel Strategy and potentially improve your trading outcomes.

Are you intrigued by the intricacies of the Wheel Strategy? Join the discussion and share your insights or experiences below. Let’s explore this captivating options strategy together and empower ourselves with the knowledge and tools to navigate the financial markets more effectively.