Tired of predictable returns and yearn for the thrill of amplified gains? Join the realm of options trading, where calculated risks can soar your profits. Embark on a journey with Scottrade, a trusted brokerage offering seamless options trading capabilities.

Image: slickbucks.com

Options, financial instruments with inherent leverage, empower traders to multiply their gains exponentially. By speculating on price fluctuations and time decay, options provide traders with a versatile tool to navigate market volatility.

Unlimited Trading Opportunities

Scottrade allows you to trade options multiple times, opening doors to advanced trading strategies and maximizing profit potential. Multiple trading eliminates the constraints of traditional buy-and-hold approaches, allowing you to adapt to changing market conditions.

Leverage the flexibility of options trading to capitalize on price movements and volatility. Strategize by entering and exiting positions multiple times throughout a trading day, taking advantage of price swings and market dynamics.

Comprehensive Overview of Options Trading

Before delving into the complexities of multiple trading, let’s establish a solid foundation in options trading. Options contracts convey the right, not the obligation, to buy or sell an underlying asset—such as stocks, indices, currencies, or commodities—at a predetermined price on or before a specific date.

Traders purchase options based on their market forecasts. If their predictions align with market behavior, they can potentially reap substantial gains. However, options trading also carries risks, and traders must exercise caution and manage their exposure appropriately.

Capitalizing on Market Dynamics

Multiple trading on Scottrade allows you to adapt swiftly to evolving market conditions. By entering and exiting positions agilely, you can seize opportunities and mitigate potential losses. For instance, if you anticipate a stock to rise in value, you could purchase a call option.

If the stock surges as predicted, you can sell the option at a profit. However, if market sentiment shifts, you can exit the position by selling the option to limit losses. This flexibility enables you to capture price swings and maintain a proactive approach to options trading.

Image: surveyssay.com

Tips and Expert Advice for Success

Navigating the complexities of multiple options trading requires strategic planning and calculated decision-making. Here are some tips to guide your trading journey:

- Understand market dynamics: Continuously monitor market trends, news, and economic indicators to gauge market sentiment and anticipate price movements.

- Choose suitable options: Select options with strike prices and expiration dates that align with your trading strategy and risk tolerance.

- Manage risk effectively: Determine your acceptable risk level and set clear stop-loss and profit-taking points to protect your capital.

- Use technical analysis: Employ technical indicators and chart patterns to identify potential trading opportunities and price trends.

- Monitor positions regularly: Keep a watchful eye on your positions and make adjustments as needed to maximize profits and minimize losses.

FAQs on Options Trading Multiple Times

Q: Can I trade multiple options contracts simultaneously?

A: Yes, Scottrade allows you to enter and exit multiple options positions simultaneously, providing you with flexibility in managing your portfolio.

Q: Are there any restrictions on multiple trading?

A: Brokerage firms may impose certain restrictions on multiple trading, such as minimum account balances or position limits. It is advisable to check with Scottrade for their specific requirements.

Q: How do I calculate profit and loss in multiple options trading?

A: Profit or loss is determined by the difference between the premium paid to purchase the option and the premium received when selling it. The profit is capped at the option’s maximum gain potential, while the loss is limited to the premium paid.

Scottrade Option Trading Multiple Times

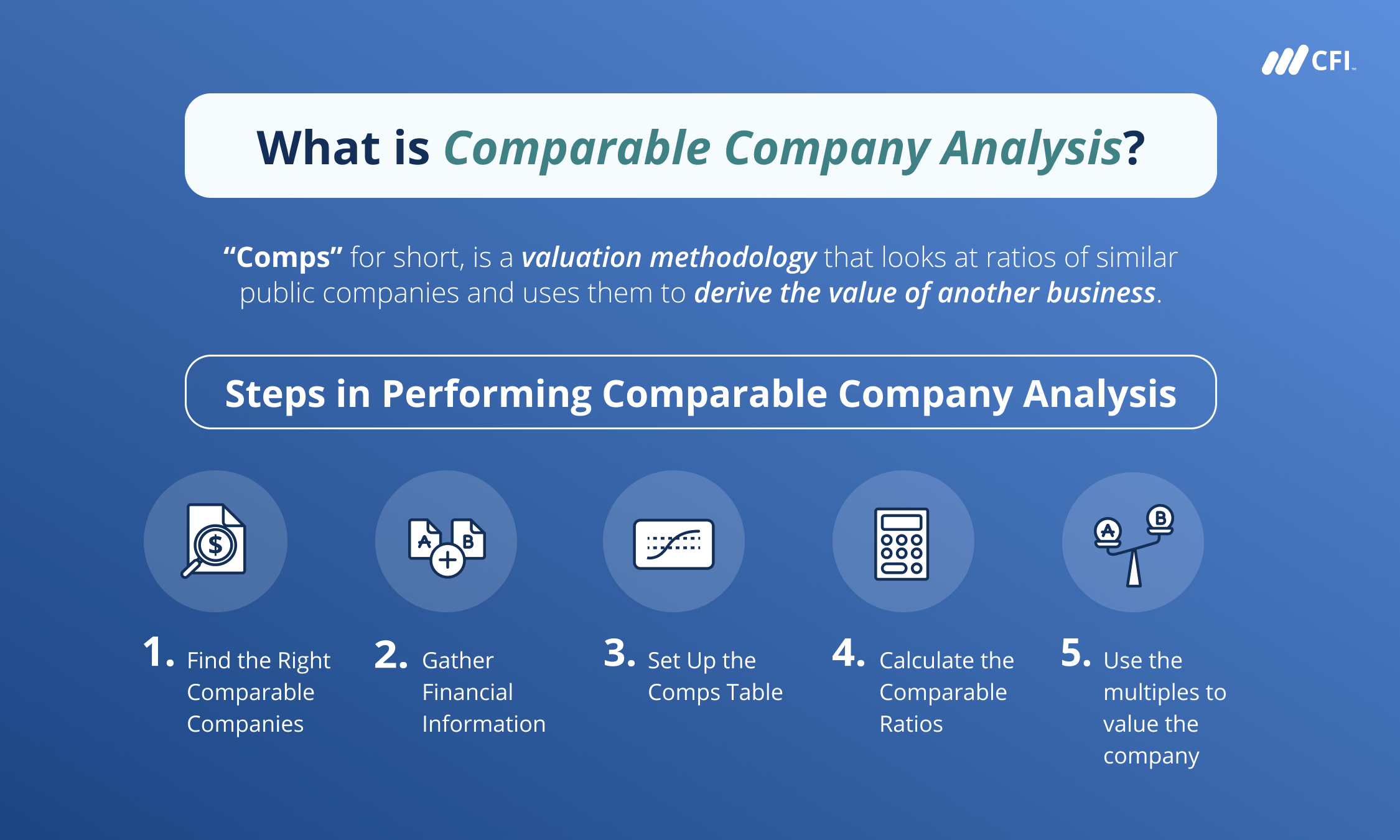

Image: corporatefinanceinstitute.com

Conclusion

Multiple options trading on Scottrade empowers you to unlock enhanced profit potential by capitalizing on market dynamics and executing precise trading strategies. By adhering to the principles outlined in this article and applying sound risk management practices, you can navigate the dynamic world of options trading with confidence. Remember, success in trading requires continuous learning, adaptation, and a commitment to excellence.

Are you ready to elevate your trading game with multiple options trading on Scottrade? Let us know in the comments below!