Imagine you’re an avid coffee enthusiast with an entrepreneurial spirit. Starbucks recently launched a new blend that’s generating buzz in the market. You speculate that its popularity will soar, driving up its stock price. However, you also acknowledge the inherent uncertainty in the stock market.

Image: www.simplertrading.com

Options: A Flexible Tool for Navigating Market Uncertainties

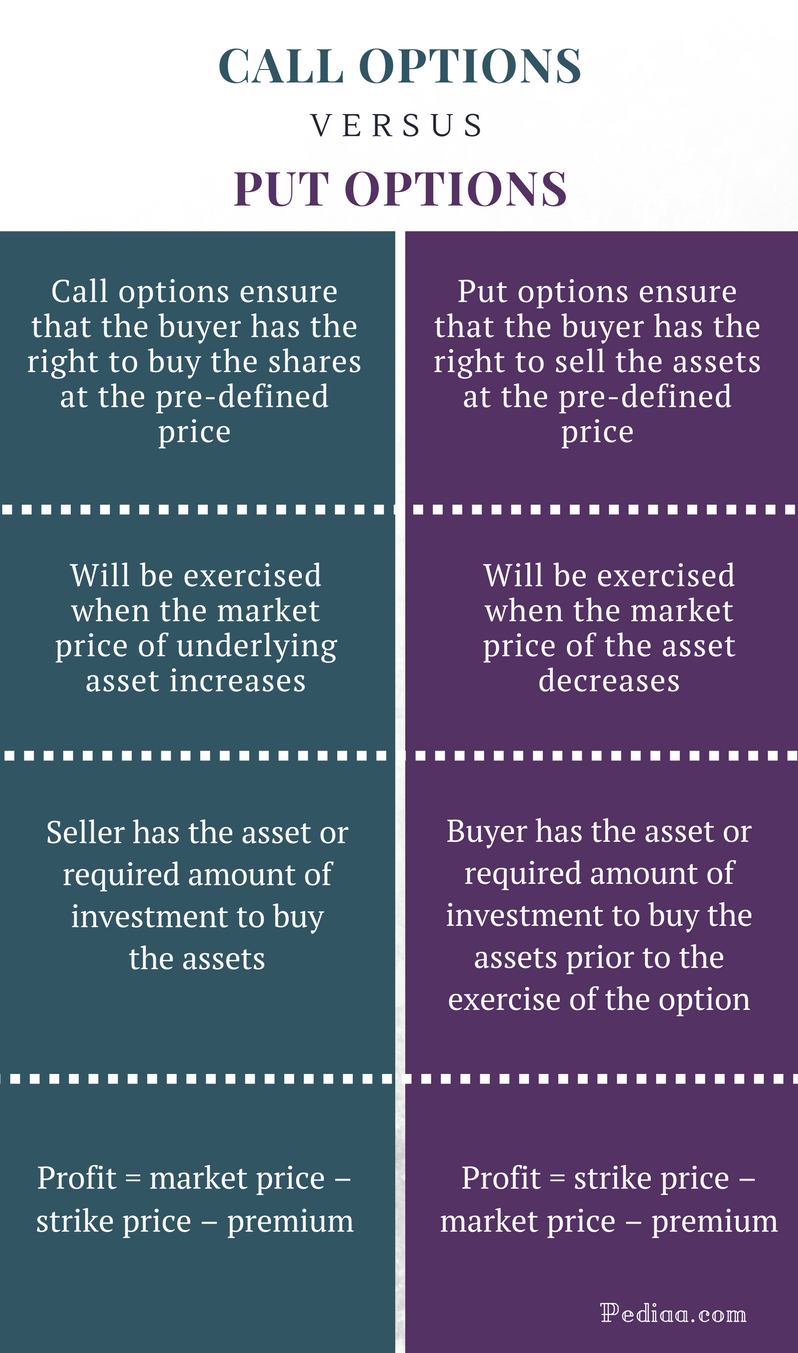

Enter options, a powerful tool that allows you to take calculated bets on an underlying asset, such as a stock. Options come in two flavors: calls and puts. Understanding the difference between these two options is crucial for navigating market uncertainties.

Call Options: Betting on Asset Appreciation

A call option gives you the right, but not the obligation, to buy an underlying asset at a predetermined price (the strike price) before a certain date (the expiration date). If the asset’s price rises above the strike price, you can exercise your call option and purchase the asset at a profit, potentially offsetting losses from the initial purchase of the call option.

Put Options: Hedging Against Asset Declines

A put option, on the other hand, grants you the right to sell an underlying asset at the strike price before the expiration date. If the asset’s price falls below the strike price, you can exercise your put option and sell the asset at a gain, mitigating potential losses from an initial purchase. This hedging mechanism is particularly valuable when the market outlook is uncertain, as it provides protection against asset value erosion.

Image: www.markettradersdaily.com

Key Differences Between Call and Put Options

To summarize the key differences between call and put options, refer to the following table:

| Call Option | Put Option |

|---|---|

| Gains from asset price increases | Gains from asset price decreases |

| Right to buy at strike price | Right to sell at strike price |

| Bullish betting strategy | Bearish betting strategy |

Latest Trends and Developments in Options Trading

The world of options trading is constantly evolving, and staying abreast of the latest trends and developments is essential for successful investing. Here are a few noteworthy observations:

- Volatility Index (VIX) Futures Contracts: Investors are increasingly using VIX futures contracts as a hedging tool against market volatility.

- Exchange-Traded Options (ETOs) on VIX: These ETOs provide exposure to VIX futures contracts, making it easier for investors to bet on market volatility.

- Spread Trading: Spread trading, which involves combining different options contracts, has gained popularity as a way to enhance profit potential while reducing risk.

Tips and Expert Advice for Budding Options Traders

Based on my experience as an options trader, I offer the following tips and advice to help you navigate this exciting and potentially lucrative market:

- Understand Your Risk Tolerance: Options trading involves risk, so it’s critical to assess your risk tolerance before making any trades.

- Research and Educate Yourself: Thoroughly research the underlying asset and the options you plan to trade. Knowledge is power.

- Start Small and Gradually Grow: Avoid jumping into the deep end with large sum. Start with small trades and gradually increase your investment as you gain experience.

Frequently Asked Questions (FAQs) About Call vs. Put Options

To provide a better understanding of call vs. put options, let’s address some common questions:

Q: What are the most common timeframes for options contracts?

A: Options contracts typically expire on specific dates, with the most common timeframes being monthly (monthly options) and quarterly (quarterly options).

Q: How do I calculate the profit or loss from an options trade?

A: The profit or loss from an options trade is calculated by subtracting the premium paid or received from the selling price or proceeds of the underlying asset.

What Is A Call Vs A Put In Options Trading

Image: pediaa.com

Conclusion

Understanding the difference between call and put options is fundamental to successful options trading. Call options allow for potential gains from asset value appreciation, while put options provide hedging protection against asset value declines. By incorporating the latest trends and developments, following expert advice, and carefully evaluating your risk tolerance, you can navigate the world of options trading with greater confidence and potentially enhance your investment returns.

Are you interested in delving further into the exciting world of call vs. put options? Share your thoughts and questions below!