When it comes to navigating the labyrinth of financial markets, CFD option trading stands out as a potent tool for unlocking profit potential. But amidst the myriad of concepts and strategies, getting started can feel like traversing uncharted territory. Fear not, fellow wealth seeker, for this comprehensive guide will illuminate the intricacies of CFD option trading, empowering you to take your financial journey to soaring heights.

Image: blog.iqoption.com

What’s the Buzz about CFD Option Trading?

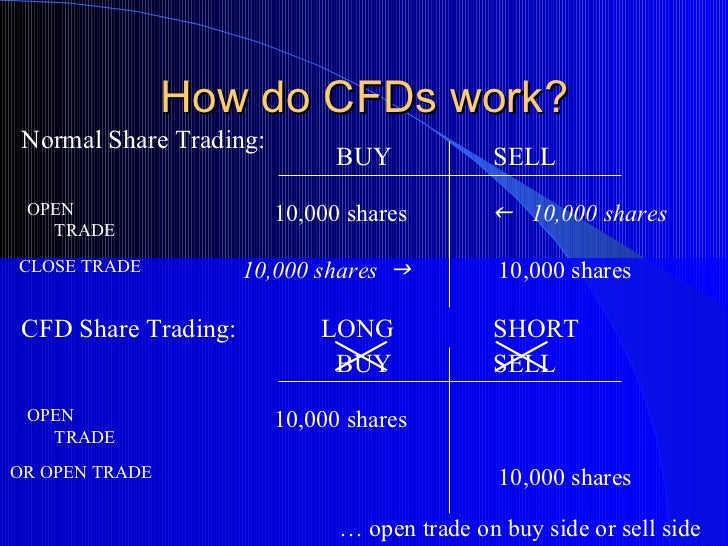

CFDs, or Contracts for Difference, are financial instruments that allow you to speculate on the price movements of various assets without physically owning them. CFD option trading takes this a step further, providing you with the flexibility to bet on whether an underlying asset’s price will rise or fall within a specified time frame at a predetermined price.

Think of it like betting on the outcome of a game. If you believe a stock’s price will soar, you can purchase a CFD option, effectively making a wager that it will indeed rise. If you’re wrong, you lose the premium you paid for the option. But if your prediction holds true, you can reap significant profits as the underlying asset’s price climbs.

How CFD Option Trading Works: A Simplified Journey

To better grasp the mechanics of CFD option trading, let’s delve into a simplified example. Suppose you’re eyeing a particular stock that’s currently trading at $50 per share. Using a CFD broker, you can purchase a call option, essentially placing a bet that the stock’s price will exceed $50 by a certain date (the option’s expiry date).

Now, let’s say you purchase a call option with a strike price of $52 (the price at which you’re betting the stock will rise above) and an expiry date of next month. If by the expiry date the stock’s price has climbed to $54, your bet has paid off, and you can exercise your option to buy the stock at the agreed-upon strike price of $52. You then sell the shares on the open market for $54, netting a tidy profit of $2 per share.

The Art of Crafting a Winning Strategy

CFD option trading, like any financial endeavor, requires a well-honed strategy to maximize your chances of success. Here are a few golden nuggets to guide you along the way:

-

Know Your Market: Immerse yourself in the world of the underlying asset you’re trading. Thoroughly research its historical price movements, economic factors influencing it, and any upcoming events that could impact its trajectory.

-

Master the Different Types: CFD options come in two main flavors: call options and put options. Call options bet on a price rise, while put options wager on a price decline. Understanding the nuances of each type is crucial for making informed decisions.

-

Manage Your Risk: Nothing ventured, nothing gained—but it’s essential to strike a balance between risk and reward. Thoughtfully consider your financial situation and risk tolerance before jumping into any trades.

-

Stay Informed and Adaptable: The financial markets are a living, breathing entity, constantly evolving. Stay abreast of the latest news, economic data, and market trends to make informed trading decisions.

-

Don’t Be Afraid to Seek Help: Don’t shy away from seeking guidance from experienced mentors, financial advisors, or reputable online resources. Learning from those who have blazed the trail can shorten your learning curve and accelerate your path to success.

Image: www.contracts-for-difference.com

Cfd Option Trading

Image: klfx.blogspot.com

CFD Option Trading: A Gateway to Financial Freedom

CFD option trading, when approached with a strategic mindset and a thirst for knowledge, can be a potent tool for building wealth. It empowers you to capitalize on market movements, diversify your portfolio, and potentially generate substantial returns.

Remember, every journey begins with a single step. Embrace the learning process, take calculated risks with unwavering confidence, and watch as CFD option trading unfolds as a transformative force in your quest for financial emancipation. The world of finance awaits, beckoning you to seize its boundless opportunities.