Are you ready to dive into the exciting world of options trading, where you can amplify your returns and protect your investments like never before? If so, you’re in the right place! In this comprehensive guide, we’ll take you through the step-by-step process of setting up an options trading account, ensuring that you have everything you need to start trading options with confidence. So, grab your trading notepad and let’s get started!

Image: telegra.ph

Understanding Options Trading: A Gateway to Endless Possibilities

Options trading, a sophisticated yet lucrative financial strategy, allows you to harness the power of leverage to multiply your gains. Unlike stocks, where you directly own a portion of a company, options are contracts that grant you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. This flexibility empowers you to craft tailored trading strategies that align with your risk tolerance and financial goals.

Choosing the Right Broker: A Match Made in Trading Heaven

Navigating the labyrinth of online brokers can be daunting, but it’s crucial to select a reliable one that caters to your options trading needs. Consider factors such as platform usability, trading fees, product offerings, educational resources, and customer support. Once you’ve narrowed down your options, open an account and fund it with the capital you’re comfortable risking—remember, options trading carries inherent risks that can lead to financial losses.

Know Your Options: Navigating the Options Trading Landscape

The options market offers a tantalizing array of options contracts, each with unique characteristics. The two main types are call options, which provide the right to buy an underlying asset, and put options, which grant the right to sell. Understanding the Greek letters—delta, gamma, theta, vega, and rho—and their impact on options pricing is paramount for successful trading.

Image: www.twoinvesting.com

Trading Options: Mastering the Art of Calculated Risk

Now comes the exciting part—placing your first options trade! Determine whether you want to buy or sell an options contract based on your market outlook. Set the strike price, expiration date, and number of contracts to buy or sell. Use limit orders to specify your entry and exit points, ensuring you trade at your desired price.

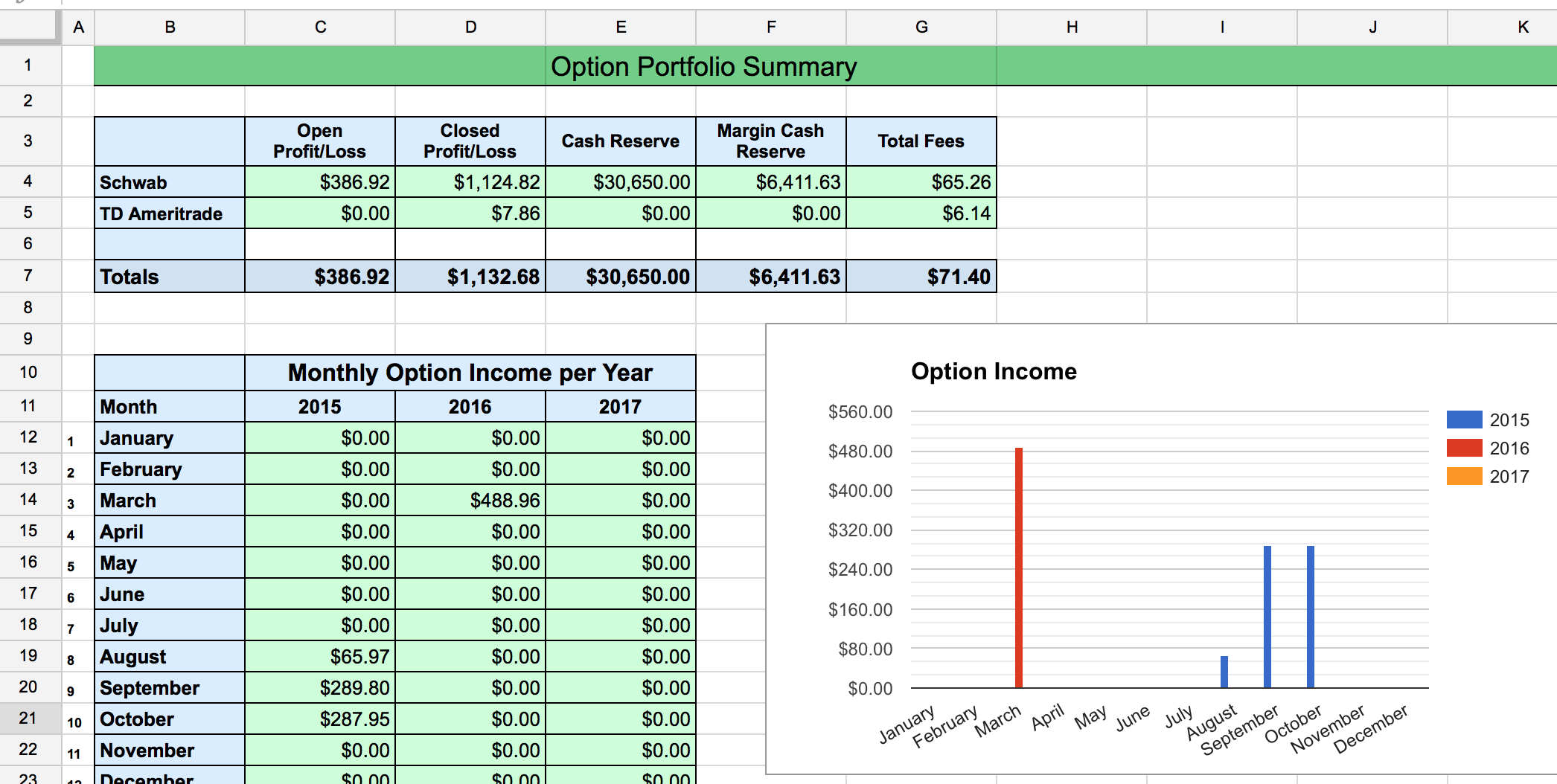

Monitoring Your Positions: Staying on Top of Your Trading Game

Once you’re in a trade, it’s essential to monitor your positions regularly. Track price movements, calculate profit and loss in real-time, and adjust your strategy as needed. Stay informed about market news and economic events that can impact your options trades.

How To Set Up An Options Trading Account

Image: finance.yahoo.com

Conclusion: Embarking on Your Options Trading Adventure

Setting up an options trading account is a significant step towards expanding your investment horizons. Remember, the key to successful options trading lies in meticulous research, prudent risk management, and continuous learning. Embrace the thrill of the options market, but always trade responsibly and seek professional advice if needed. As you gain experience and refine your strategies, you’ll unlock the full potential of options trading and elevate your financial pursuits to new heights.