Delve into the Realm of Options Trading with Confidence

In the world of finance, the allure of options trading beckons, promising lucrative returns to investors who possess the knowledge and acumen to navigate its intricacies. However, venturing into this realm requires a thorough understanding of its prerequisites, including the much-discussed options trading minimum balance. This article aims to dispel the fog surrounding this requirement, empowering you with a roadmap to success in options trading. Join us as we explore the depths of options trading minimum balance, demystifying the subject and equipping you with the expertise to unlock the full potential of this financial instrument.

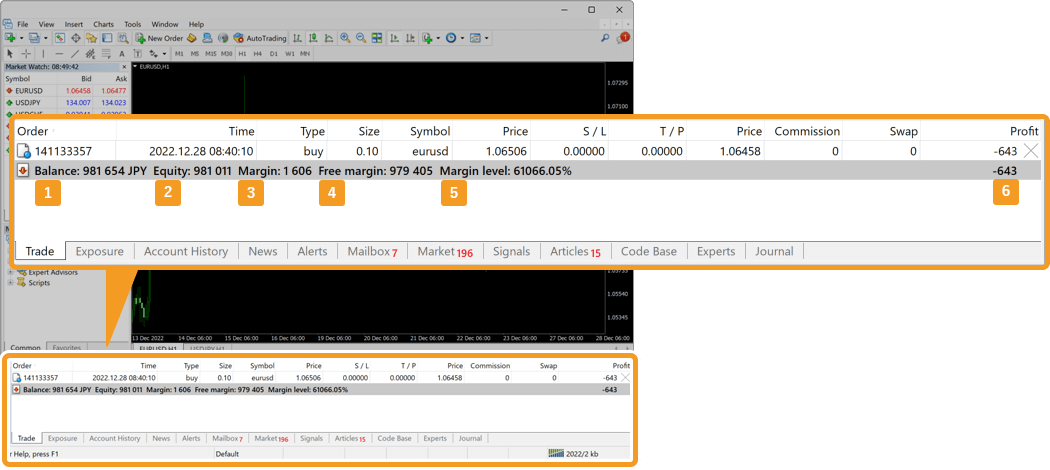

Image: myforex.com

What is Options Trading and Its Minimum Balance?

Options are derivative contracts that grant the holder the “option,” but not the obligation, to buy (in the case of call options) or sell (in the case of put options) a specific underlying asset at a predetermined price on a specific date. Unlike stocks or bonds, the purchase of options requires a margin account, which acts as collateral to cover potential losses. The minimum balance requirement for options trading varies depending on the brokerage firm and the type of options being traded. It is typically expressed as a percentage of the total value of the option contract. For example, a common minimum balance requirement is 25%, meaning you need to have at least 25% of the option contract’s value in your margin account.

Navigating the Maze of Options Trading Minimum Balance

Unveiling the intricacies of options trading minimum balance, we discover that it plays a pivotal role in risk management and account management. By setting a minimum balance requirement, brokerages ensure that traders possess sufficient funds to cover potential losses and maintain market stability. While some traders may lament this restriction, experienced veterans recognize its necessity in safeguarding the interests of both traders and the market. Understanding the purpose and nuances of the minimum balance requirement is paramount for aspiring options traders.

Breaking Down the Types of Options Trading Minimum Balance

Delving deeper into the options trading landscape, we encounter various types of minimum balance requirements, each tailored to the specific characteristics of different option strategies. For instance, “portfolio margining” allows traders to use the value of their entire portfolio as collateral, reducing the overall margin requirement. Conversely, “single-stock margining” requires a minimum balance for each individual option contract. Additionally, some brokerages implement a tiered system, adjusting the minimum balance requirement based on the trader’s account size and experience level. Understanding these nuances and selecting the most suitable margining strategy is crucial for effective options trading.

Image: marketxls.com

The Dynamics of Maintenance Margin in Options Trading

Complementing the minimum balance requirement, the concept of maintenance margin plays an equally critical role. Maintenance margin refers to the minimum equity that must be maintained in a margin account to prevent a margin call. If the equity falls below the maintenance margin, the brokerage firm may issue a margin call, requiring the trader to deposit additional funds or liquidate positions to meet the requirement. Understanding maintenance margin and managing it diligently is essential to avoid forced liquidations and potential losses.

Practical Tips and Expert Advice for Options Trading Success

Drawing upon the insights of experienced options traders and industry experts, we present invaluable tips and advice to enhance your options trading journey.

- Prudent Risk Management: Tread cautiously into the realm of options trading, ensuring that you fully comprehend the risks involved. Set realistic profit targets and never invest more than you can afford to lose.

- Diligent Research: Educate yourself thoroughly on options trading strategies, market dynamics, and underlying assets. Knowledge is your greatest ally in navigating the complex world of options.

Frequently Asked Questions on Options Trading Minimum Balance

To address common queries surrounding options trading minimum balance, we delve into a question-and-answer format, offering clear and concise responses.

- Q: How do I determine the minimum balance requirement for my options trading account?

A: Contact your brokerage firm or refer to their website for specific information on minimum balance requirements. - Q: Can I trade options without meeting the minimum balance requirement?

A: No, most brokerages will not allow you to trade options unless you have the necessary minimum balance in your margin account. - Q: What happens if my equity falls below the maintenance margin requirement?

A: Your brokerage firm may issue a margin call, requiring you to deposit additional funds or liquidate positions to meet the requirement.

Options Trading Minimum Balance

Conclusion: Unlocking the Potential of Options Trading

In conclusion, options trading minimum balance is not merely an arbitrary hurdle but a fundamental component of risk management and account maintenance. By understanding the rationale behind this requirement and embracing the practical tips and expert advice presented in this article, you can navigate the complexities of options trading with confidence and reap its potential rewards.

Whether you are a seasoned trader or a novice seeking to venture into the world of options, we invite you to explore our comprehensive suite of resources, including webinars, tutorials, and trading tools. Together, let us unlock the full potential of options trading and empower you to achieve your financial aspirations.