The VIX, also known as the fear gauge, is a widely followed measure of market volatility. It captures the market’s expectations of future volatility over the next 30 days. This data point makes it an invaluable tool for traders seeking to capitalize on periods of heightened market turbulence. One way to harness the potential of the VIX is through the trading of options based on the index. Understanding the intricacies of VIX options can help prepare you for trading in this dynamic and potentially rewarding market.

Image: www.makeupera.com

What are VIX Options?

VIX options are derivative securities that grant the holder the right, not the obligation, to buy or sell the VIX futures contract at a specified price on a specified date. By allowing traders the choice of speculative or hedging positions, VIX options offer a versatile instrument for navigating volatile market conditions.

Understanding VIX Options Trading

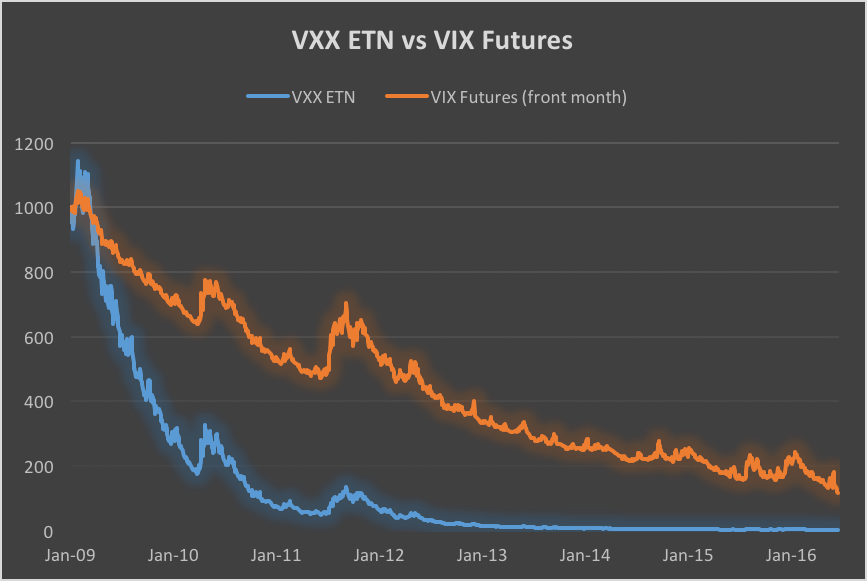

The VIX futures market serves as a basis for the VIX options market. Futures contracts represent agreements to buy or sell the VIX index at a predetermined price on a specific future date. The liquidity and price transparency of VIX futures underpin the viability of VIX options trading.

Types of VIX Options

There are two main types of VIX options: calls and puts. Calls confer the right to purchase the VIX futures contract, enabling traders to profit from an anticipated increase in volatility. Puts, on the other hand, provide the option to sell the futures contract, which benefits traders predicting a decrease in volatility.

Image: www.youtube.com

Strategies for Trading VIX Options

The volatility of the VIX index presents ample opportunities for various trading strategies. Speculative strategies, such as buying calls or selling puts, hinge on successful predictions of volatility movements. Hedging strategies, on the other hand, aim to offset potential losses in other instruments and portfolios, using VIX options as a risk-management tool.

Factors Influencing VIX Options Pricing

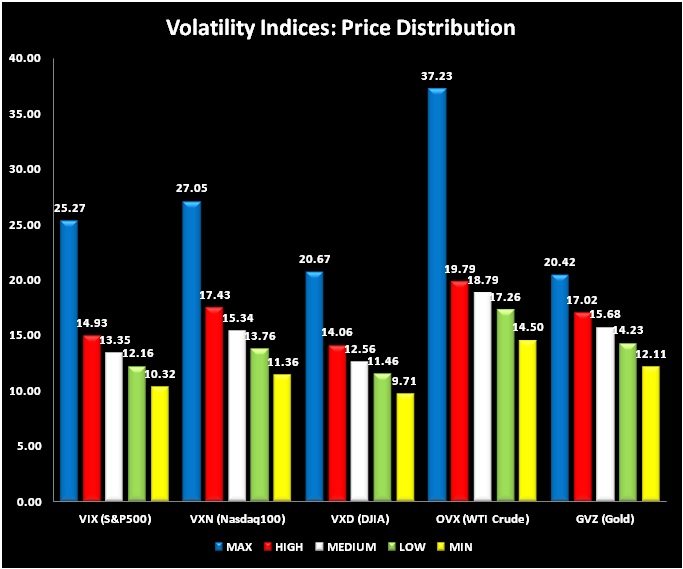

The pricing of VIX options is influenced by multiple factors. These include the current VIX level, historical and implied volatility, the time remaining until expiration, and the supply and demand for options. Understanding the impact of these factors is crucial for making informed trading decisions.

Risk Management in VIX Options Trading

Volatility itself is a risk factor, and as such, comprehensive risk management is essential in VIX options trading. Techniques such as position sizing, stop-loss orders, and delta hedging can mitigate potential losses and protect investments.

Benefits of Trading VIX Options

Trading VIX options offers several potential advantages:

- Exposure to volatility: VIX options provide traders with opportunities to profit from the positive correlation between volatility and option prices.

- Underlying market insights: VIX options provide insights into market sentiment and expectations, helping traders anticipate market behavior.

Challenges of Trading VIX Options

Volatility trading is not without its obstacles:

- Market timing challenges: Predicting the direction and magnitude of volatility can be difficult, especially in rapidly evolving market conditions.

- Liquidity risk: VIX options can experience reduced liquidity, making it challenging to execute trades promptly and efficiently.

- Information asymmetry: Active traders may enjoy an edge in accessing and interpreting information that impacts VIX options pricing.

Trading The Vix Options

Image: wirafiy.web.fc2.com

Conclusion

Trading VIX options can be a lucrative and dynamic trading strategy. With detailed descriptions of the basics, strategies, and profitable situations, this guide uncovers the workings of the VIX options market. However, a thorough market understanding, proper risk management, and realistic expectations are essential for investors to navigate the complexities of VIX options trading effectively.