Binary Options: A Gateway to Financial Success

In the realm of financial trading, binary options have emerged as a captivating instrument offering the allure of both simplicity and profitability. These unique contracts grant traders the ability to speculate on the future direction of an underlying asset, compelling them to predict whether its value will rise or fall within a predetermined time frame. With the prevalence of binary options, discerning traders seek comprehensive strategies to maximize their chances of success, particularly in the realms of directional and volatility trading. This definitive guide unveils a treasure trove of knowledge, providing a roadmap for astute investors seeking to master these lucrative techniques.

Image: www.closeoption.com

Directional Trading: Betting on Market Movements

Directional trading, the art of profiting from the rise and fall of asset prices, presents a straightforward approach to binary options trading. Traders employ this strategy to capitalize on their predictions regarding the future direction of an asset’s value. For instance, a bullish sentiment may prompt a trader to purchase a “call” option, anticipating a price increase, while a bearish outlook would lead to the purchase of a “put” option, speculating on a price decline.

Volatility Trading: Navigating Market Swings

Volatility trading, on the other hand, revolves around the art of profiting from price fluctuations in underlying assets. Instead of focusing on directional movements, traders seek to exploit market volatility, placing their bets on whether an asset’s movements will exceed or fall short of a predefined range. This strategy aligns with the concept of implied volatility, a measure of the market’s expectation regarding the amplitude of future price movements.

Decoding the Landscape of Binary Options Strategies

The landscape of binary options strategies is vast and multifaceted, catering to varying risk appetites and market conditions. Some of the most widely employed techniques include:

- Moving Averages: This approach utilizes trend-following indicators to identify potential trading opportunities. By analyzing the average price of an asset over a specified period, traders can gauge market sentiment and capitalize on prevailing trends.

- Bollinger Bands: Similar to moving averages, Bollinger bands provide insights into market volatility by creating a dynamic band around an asset’s moving average. Traders can use this band to identify overbought or oversold conditions, which often signal potential reversal points.

- Relative Strength Index (RSI): The RSI is a momentum indicator that quantifies the magnitude of recent price changes to identify potential overbought or oversold conditions. Traders can use this metric to gauge the strength of a trend or predict potential reversals.

- Ichimoku Cloud: This comprehensive indicator encompasses multiple elements, including trend lines, support and resistance levels, and momentum indicators, offering a comprehensive view of the market. Traders can harness the Ichimoku Cloud to identify potential trading opportunities and manage risk.

- Fibonacci Retracement: Based on the Fibonacci sequence, this strategy identifies potential support and resistance levels where the price of an asset may retrace before continuing its dominant trend. Traders use these levels to place orders and set stop-loss parameters.

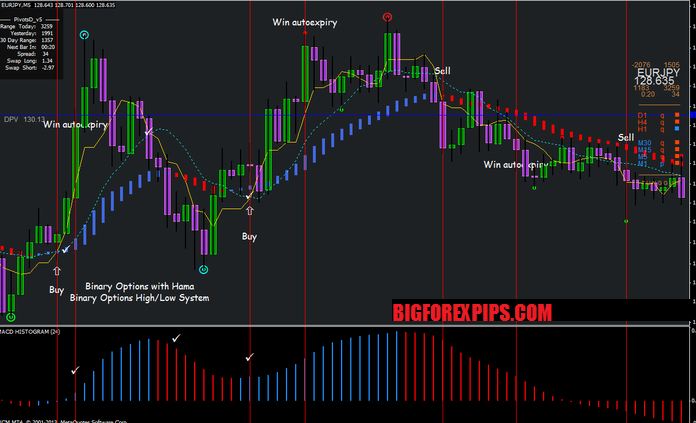

Image: forexmt4systems.com

Unveiling Expert Insights for Effective Binary Options Trading

Navigating the binary options market demands a judicious approach and adherence to proven strategies. Seasoned traders offer invaluable insights to enhance your trading acumen:

- Effective Risk Management: Never risk more than you are willing to lose, and allocate your capital wisely across multiple trades to mitigate risk.

- Technical Proficiency: Acquire a solid understanding of technical analysis concepts and utilize them to identify market trends and potential trading opportunities.

- Emotional Control: Remain disciplined and avoid letting emotions cloud your judgment, ensuring rational decision-making is prioritized.

- Continuous Learning: Stay updated on market trends, new strategies, and economic developments to adapt to the ever-changing trading environment.

- Demystifying Volatility Trading: Volatility trading requires traders to anticipate the magnitude of price fluctuations. Strategies like implied volatility and the Volatility Index (VIX) offer valuable insights.

Frequently Asked Questions

Q: How risky are binary options?

A: Binary options involve inherent risk and require a clear understanding of the potential losses. Employing risk management techniques and proceeding with caution is essential.

Q: Can binary options make me rich?

A: While binary options offer the potential for profit, they are not a guaranteed path to wealth. Consistent success requires a systematic approach and adherence to sound trading principles.

Q: Which binary options trading strategy is best?

A: The optimal strategy depends on individual risk tolerance and market conditions. Explore various approaches and refine your trading strategy based on personal preferences.

Binary Options Strategies For Directional And Volatility Trading Pdf Download

Image: forexpops.com

Call to Action

Are you ready to embark on a lucrative journey in the binary options market? Dive deeper into the strategies outlined in this article and equip yourself with knowledge and insights. Embrace the thrill of directional trading or master the art of volatility trading. The choice is yours. Embrace the empowering wisdom of expert advice and unleash your trading potential.