Empowering Traders: A Deep Dive into the World of Stock Volatility

Navigating the ever-evolving financial landscape, options trading has emerged as a lucrative yet adrenaline-pumping endeavor. At the heart of this thrilling pursuit lies stock volatility, a pivotal factor that separates the masters from the amateurs. Join us as we unlock the secrets of the most volatile stocks, providing you with the essential tools to reign supreme in the options trading arena.

Image: stardolllcoll-jasmin.blogspot.com

Stock volatility, in its essence, measures the magnitude of price fluctuations experienced by a stock over time. This dynamism presents both opportunities and risks, making it a crucial parameter for options traders. When volatility soars, options premiums surge, amplifying potential profits but also amplifying potential losses. Hence, identifying the most volatile stocks is paramount for harnessing the power of options trading.

Unveiling the Contenders: Stocks That Ignite the Options Market

The realm of volatile stocks is teeming with contenders, each boasting unique characteristics and risk-reward profiles. Let us delve into the most prominent candidates that have consistently set the options market ablaze:

-

Tesla (TSLA): As a pioneer in electric vehicle innovation and a constant disruptor in the automotive industry, Tesla’s stock has become synonymous with volatility. Its trailblazing spirit and ever-evolving product line attract a highly engaged and speculative investor base, contributing to its unpredictable price movements.

-

GameStop (GME): A veritable roller coaster of emotions, GameStop’s stock catapulted into the headlines during the infamous “meme stock” frenzy of early 2021. Its volatile nature persists, fueled by a dedicated and enthusiastic retail investor base that eagerly embraces sudden price swings.

-

AMC Entertainment (AMC): Another darling of the meme stock movement, AMC has captured the hearts of individual investors, propelling its stock price on an exhilarating ride. Its heavy reliance on box office revenue introduces an inherent volatility that appeals to traders seeking high-octane opportunities.

-

Nvidia (NVDA): A titan in the world of semiconductors and artificial intelligence, Nvidia’s stock often mirrors the pulsating heartbeat of the technology sector. Its cutting-edge advancements and strategic acquisitions generate waves of volatility that savvy traders exploit with precision.

-

Advanced Micro Devices (AMD): A formidable competitor to Nvidia, AMD’s stock mirrors the ebbs and flows of the semiconductor industry. Its relentless pursuit of innovation and battle for market share keep its volatility levels consistently elevated.

Harnessing the Power: Strategies for Mastering Volatile Stocks

Conquering the realm of volatile stocks in options trading demands a shrewd approach, balancing daring with discipline. Let us dissect the masterful strategies employed by seasoned traders:

-

Embrace Volatility: Volatility is not a curse but a blessing in disguise. Options traders thrive on price fluctuations, skillfully utilizing volatility to maximize potential gains.

-

Know Your Time Frames: Volatility manifests in varying time frames. Intraday volatility presents short-term trading opportunities, while longer time frames may yield substantial returns through strategic option positioning.

-

Target Trending Stocks: Volatile stocks often exhibit pronounced trends. Pinpointing these trending movements and aligning trades accordingly enhances the probability of success.

-

Control Risk with Options: Options offer the flexibility to limit risk while pursuing high rewards. Utilizing strategies such as covered calls and protective puts enables traders to safeguard capital while profiting from volatility.

-

Manage Emotions: The roller coaster ride of volatile stocks can evoke strong emotions. Discipline and rational decision-making are crucial to avoid being swept away by the fervor of the markets.

Expert Insights: Wisdom from the Masters

Inquiring minds seek enlightenment from those who have triumphed in the arena of options trading. Let us glean invaluable insights from seasoned experts:

“Volatility is the lifeblood of options trading. Embrace it, don’t fear it.” – George Soros, legendary hedge fund manager

“Risk management is paramount. Never bet more than you can afford to lose.” – Bill Gross, renowned bond investor

“Trade with conviction, but always remain adaptive to changing market conditions.” – Warren Buffett, iconic investor

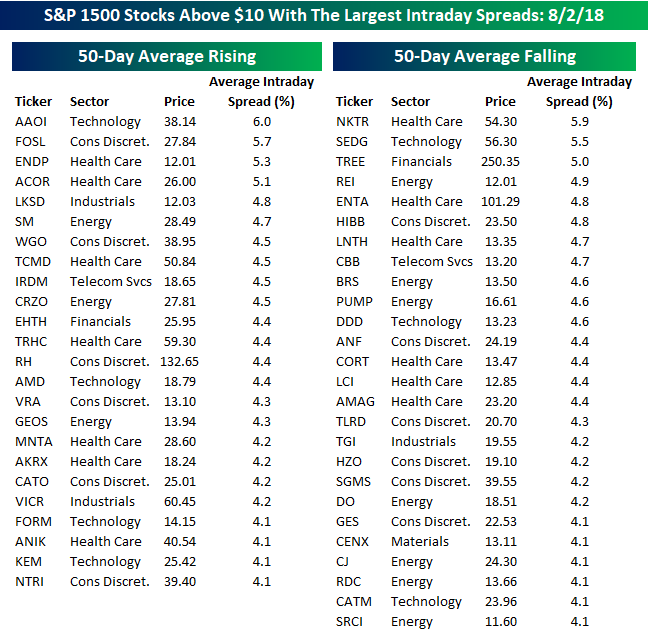

Image: www.bespokepremium.com

Most Volatile Stocks For Options Trading

Conclusion: Riding the Waves of Volatility with Confidence

The world of volatile stocks and options trading beckons the bold and the astute. By understanding the nature of volatility, wielding the right strategies, and tapping into the wisdom of experts, traders can harness this potent