Options trading offers a wide array of potential opportunities for investors, but it also comes with inherent risks. One of the biggest pitfalls in options trading is unbalanced positions, which can lead to significant losses. Here, I will delve into the concept of unbalanced options trading, its risks, and how to avoid its pitfalls.

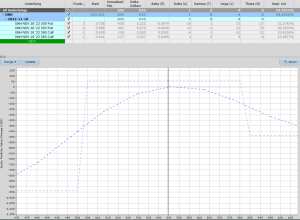

Image: www.youtube.com

**Understanding Unbalanced Options Trades**

An unbalanced options trade involves entering into a position without offsetting the risk with an opposite trade. For instance, buying a call option without also selling a put option, or vice versa, creates an unbalanced position. This can lead to substantial risk exposure should the underlying asset’s price move adversely.

**The Risks of Unbalanced Positions**

The most significant risk associated with an unbalanced options position is the unlimited loss potential. When you buy a call option, you have limited profit potential to the extent of the premium paid, but your potential loss is unlimited. Likewise, selling a put option exposes you to unlimited potential loss if the underlying asset’s price falls below the strike price.

Unbalanced positions can also hamper your flexibility. If the price of the underlying asset moves in a way that you hadn’t anticipated, you may be unable to adjust your position quickly. This can exacerbate losses and lead to substantial financial harm.

**Avoiding the Pitfalls of Unbalanced Options Trading**

The key to mitigating the risks of unbalanced options trading is to create balanced positions. This means that for every call option you buy, you must also sell a put option at the same strike price and expiration date. Similarly, if you sell a call option, you should buy a corresponding put option. This helps neutralize the potential losses from either side of the trade and limits your risk to the premium paid.

In addition to creating balanced positions, it’s important to manage your risk carefully. Set clear profit targets and stop-loss limits for each trade. This will help ensure that you don’t overextend yourself and avoid severe losses.

Image: optionstradingiq.com

**Conclusion**

Options trading can be a rewarding yet risky endeavor. Unbalanced positions, in particular, come with significant risks that can lead to substantial losses. By understanding the risks, creating balanced positions, and managing your risk wisely, you can mitigate the pitfalls of unbalanced options trading and increase your chances of success in this complex financial arena. Are you interested in reading more on the topic of options trading?

Unbalanced Options Trading

Image: optionstradingiq.com

**FAQ**

- What is an unbalanced options trade?

An unbalanced options trade involves entering into a position without offsetting the risk with an opposite trade.

- What are the risks associated with unbalanced positions?

An unbalanced position carries the risk of unlimited loss and reduced flexibility in managing your trade.

- How do I avoid the pitfalls of unbalanced options trading?

Create balanced positions and manage your risk carefully by setting profit targets and stop-loss limits, and avoid overextending yourself.