Introduction

In the exhilarating world of options trading, credit spreads have enticed countless traders seeking exponential returns with calculated risks. However, the allure of these strategies has often been juxtaposed with tales of catastrophic losses, a sobering reminder that even well-calculated trades can go awry. This article delves into the depths of option credit spreads, exploring their fundamentals, uncovering the pitfalls, and offering insights into mitigating risks and preventing account-busting scenarios.

Image: www.youtube.com

Understanding Credit Spreads

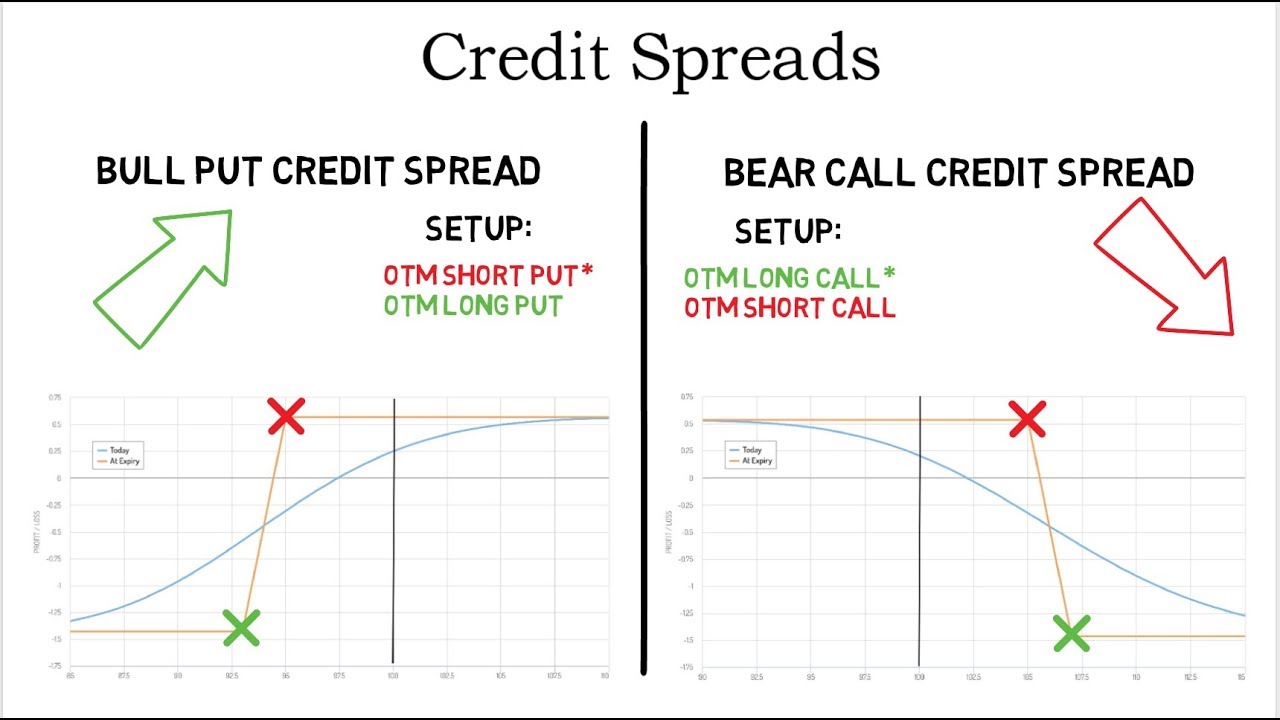

An option credit spread involves selling a higher-priced option (typically a call) and simultaneously buying a lower-priced option (typically a put) of the same underlying asset and expiration date. By selling the call, the trader receives an immediate premium, creating an initial credit. The goal is to profit from a range-bound market, where the underlying asset’s price remains within the “spread” between the strike prices of the two options. As long as the asset price stays within this range, the premiums collected from selling the call can offset any potential losses incurred from exercising the bought put.

Benefits and Risks

Credit spreads offer several advantages: they have a lower margin requirement compared to outright option purchases, can generate income in volatile markets, and provide limited risk compared to buying naked options. However, these benefits come with inherent risks that traders must be aware of. If the underlying asset’s price moves significantly outside the range, the losses can amplify rapidly. Unforeseen market events, such as earnings surprises or regulatory changes, can trigger abrupt price movements, invalidating the trader’s initial assumptions.

Pitfalls to Avoid

An abundance of enthusiasm and a lack of discipline can lead traders down a perilous path. Overtrading, fueled by the illusion of quick profits, is a common pitfall. Traders may find themselves entering multiple credit spreads without proper risk management, exposing their accounts to excessive losses. Margin trading, while amplifying potential profits, also magnifies risks and can lead to substantial losses if the market moves against their positions.

Image: www.youtube.com

Mitigating Risks

To prevent “blowing up” accounts, traders should implement prudent risk management strategies. Disciplined position sizing is crucial, ensuring that each trade represents only a small percentage of their account balance. Meticulous market analysis, incorporating both technical and fundamental factors, is essential to identify suitable candidates for credit spreads. Setting realistic profit targets and stop-loss orders provides a safety net, limiting potential losses in adverse market conditions.

Blew Up My Account Trading Option Credit Spreads

Image: knowmadicresearch.com

Conclusion

Option credit spreads can be a double-edged sword, offering both lucrative opportunities and substantial risks. Understanding the mechanics, pitfalls, and risk mitigation techniques is imperative for traders who wish to navigate this complex landscape successfully. By approaching credit spreads with prudence, humility, and well-defined risk management parameters, traders can minimize the odds of experiencing the dreaded “blown-up account” scenario and maximize their chances of consistent profitability in the ever-evolving world of options trading.