Introduction

In the dynamic world of options trading, understanding and utilizing implied volatility (IV) is paramount for success. One powerful metric that incorporates IV into its calculations is IV Rank, a valuable tool that can provide insights into option pricing and potential trading opportunities. This comprehensive guide will delve into the concept of IV Rank, its significance, and practical strategies for leveraging it in your trading endeavors.

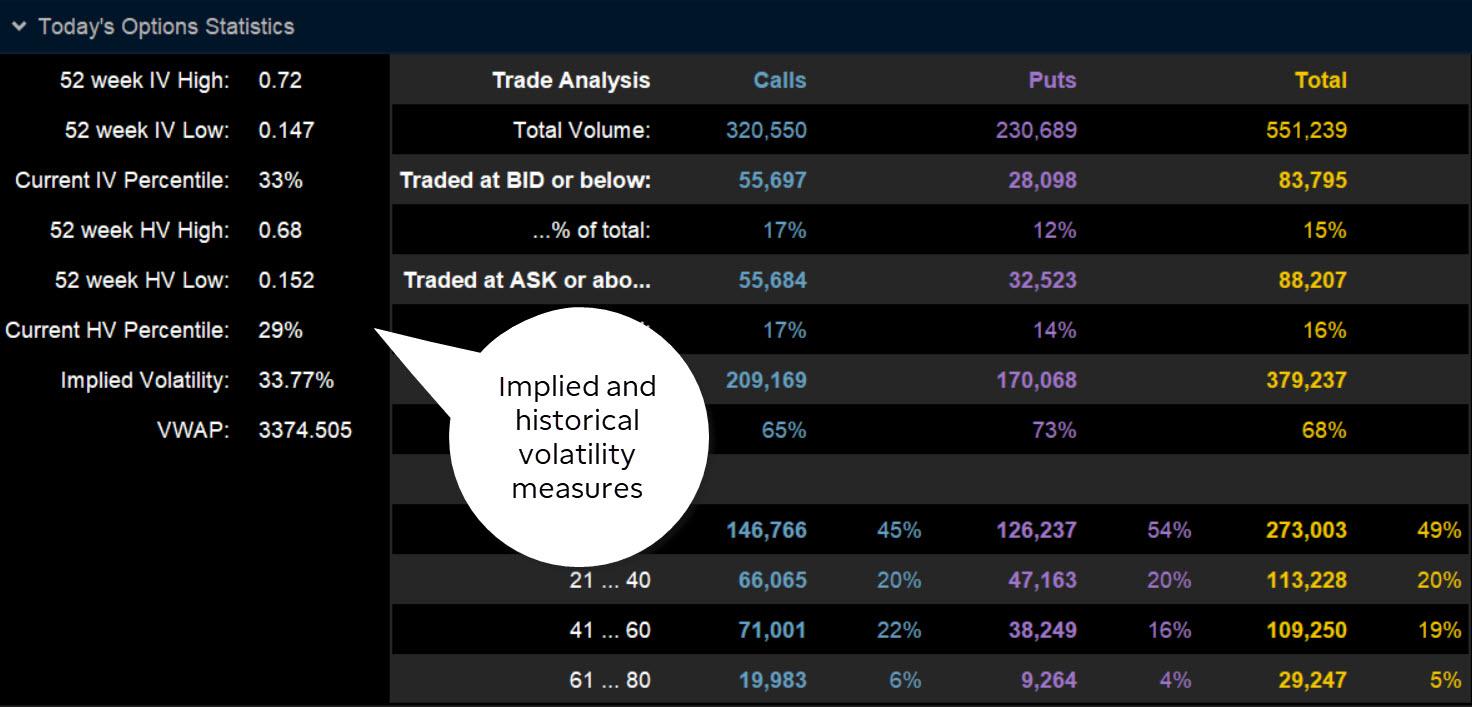

Image: www.stockmaniacs.net

Understanding IV Rank

Implied volatility is a crucial factor in determining the price of an option. It represents the market’s expectation of future price movements in the underlying asset. IV Rank, on the other hand, compares the current implied volatility of an option to its historical volatility. It provides traders with a standardized measure of volatility, making it easier to compare options and identify overvalued or undervalued contracts.

Significance of IV Rank

IV Rank plays a pivotal role in options trading for several reasons. Firstly, it can help identify options that are priced above or below their fair value. When an option’s IV Rank is significantly higher than its historical average, it may indicate that the market is overestimating future volatility, resulting in an overpriced option. Conversely, a low IV Rank suggests that the option may be undervalued.

Secondly, IV Rank can assist traders in anticipating future price movements. Options with high IV Ranks tend to have a greater potential for large price swings, while those with low IV Ranks exhibit more muted price fluctuations. By understanding IV Rank, traders can make informed decisions about option contracts that align with their risk tolerance and trading objectives.

Practical Applications of IV Rank in Trading

There are multiple ways to incorporate IV Rank into your trading strategies. One approach is to focus on options with high IV Ranks when volatility is expected to increase. These options have the potential to generate significant profits if the underlying asset’s price moves in the anticipated direction. Conversely, options with low IV Ranks can be considered in a low volatility environment to mitigate risk.

Another application involves identifying options with high IV Ranks that are nearing expiration. These contracts may offer opportunities for quick gains if the underlying asset’s price makes a sudden move. However, traders should exercise caution and carefully assess the risk-reward profile before entering such trades.

Image: tickertape.tdameritrade.com

Trading Options Using Iv Rank

Image: www.warriortrading.com

Conclusion

IV Rank is a powerful metric that can provide valuable insights into option pricing and future volatility. By understanding its significance and leveraging it effectively, traders can improve their success rate and maximize their returns. This comprehensive guide has outlined the basics of IV Rank, its applications, and practical strategies for incorporating it into your trading arsenal. Remember to conduct thorough research, exercise prudent risk management, and不断探索和学习to stay ahead in the ever-evolving options market.